- As GNPC, GSF propel country to 78% score on governance index

As the world gradually moves away from conventional to cleaner energy sources, Ghana will need to make bold policies and choices to ensure the continued viability of the oil and gas industry, a new report by the Natural Resource Governance Institute (NRGI) has said.

In its latest Resource Governance Index (RGI) on Ghana, it said the Ministry of Energy and the Ghana National Petroleum Corporation (GNPC) must acknowledge the need for such bold policies and choices in the current global energy transition debate, in order to safeguard the long-term future of the industry and that “All stakeholders across the Ghanaian oil and gas sector must be cognizant of the role that hydrocarbons play in the climate crisis.”

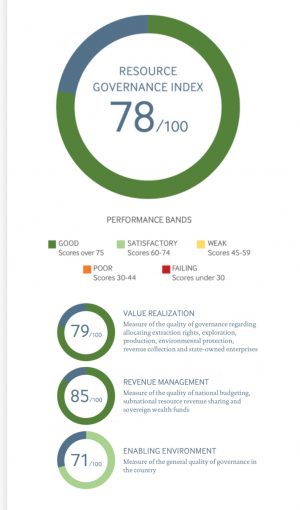

The 2021 RGI assesses how 18 resource-rich countries govern their oil, gas and mineral wealth. The index composite score is made up of three components. Two measure key characteristics of the extractives sector – value realization and revenue management – and a third captures the broader context of governance — the enabling environment. These three overarching dimensions of governance consist of 14 subcomponents, which comprise 51 indicators, which are calculated by aggregating 136 questions.

In all, the country’s oil and gas sector scored 78 out of 100 points in the 2021 index improving by 11 points since the 2017 RGI. Strengthened resource governance is underpinned by improvements across both the index’s value realization and revenue management components, it said.

“Ghana’s oil and gas sector’s move into the ‘good’ performance band in the 2021 RGI is driven by improvements in the governance of licensing and national budgeting along with continued improvements of the state-owned Ghana National Petroleum Company and the Ghana Stabilization Fund (GSF), the country’s sovereign wealth fund,” the report read.

It added that the adoption of new laws regarding licensing and national budgeting strengthened Ghana’s extractives legal framework and helped drive the 2021 RGI score increase. “Both law and practice scores increased, but the difference between them widens from -7 to -22, signaling a worrying implementation gap.”

It also credited the improvement to GNPC improving its performance through commodity sales disclosures but noted that areas for future improvement include the timeliness of disclosures and aspects of corporate governance.

It further scored the Ghana Stabilization Fund a full 100 points on governance, owing to new disclosures of assets and asset classes. “Ghana’s oil and gas sector outperformed the older gold mining sector owing to enhanced transparency and accountability in the oil and gas sector legislative framework,” it commended.

Recommendations

To sustain and improve on the gains made so far, the report recommended that the Ministry of Energy and the Petroleum Commission push for enhanced disclosures with regard to licensing, beneficial ownership, environmental and social impact assessments as well as asset declaration by public officials.

Enhanced monitoring and compliance by these state agencies in collaboration with civil society organizations, it explains, are needed to ensure adherence to established laws.

It also believes various governmental agencies and ministries should adhere to open data principles in line with commitments made through Ghana’s Open Government Partnership National Action Plan and that the GNPC should immediately restart the publication and disclosures of its annual reports and consolidated financial statements, to ensure transparency and accountability of its management of the country’s oil and gas resources.

“The Ministries of Finance and Energy along with other key governmental actors should collaborate with civil society organizations, and the Ghana EITI to ensure that Ghana meets the standard requirements of the Extractive Industries Transparency Initiative,” it further added.