By Surv. Prof. Forster SARPONG

On January 7, 2025, John Dramani Mahama returned to power with a singular promise to reset Ghana’s battered economy through data-driven governance, bold reforms, and inclusion.

After years of economic volatility, rising inflation, unsustainable debt, and fiscal deficits, the new administration launched what it termed the “Ghana Reset Agenda”, a comprehensive strategy aimed at restoring macroeconomic stability, revitalizing the productive sectors, and ensuring shared prosperity.

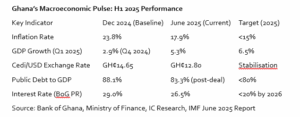

Now, six months into the new administration, green shoots of recovery are emerging. Inflation is slowing, GDP is growing, and fiscal discipline is being restored, thanks, in no small measure, to the application of financial science and the critical role of Ghana’s financial scientists. These are the economists, data analysts, policy modelers, actuaries, and investment strategists working behind the scenes to engineer this turnaround.

This feature explores Ghana’s economic performance from January to June 2025, assesses the policies and reforms under the Reset Agenda, and examines the pivotal role played by financial science in shaping outcomes.

Ghana’s Macroeconomic Pulse: H1 2025 Performance

The Reset Agenda: Policy Pillars in Practice

Debt Restructuring and Relief

On June 25, 2025, Parliament approved a historic $2.8 billion debt relief agreement with bilateral creditors, deferring repayment obligations from 2022–2026 and extending maturities to 2043. The move has freed fiscal space and restored investor confidence, reducing Ghana’s debt-to-GDP ratio by 4.8 percentage points.

Inflation Targeting and Monetary Recalibration

BoG, with input from financial scientists, adjusted the policy rate twice within the first six months, using advanced forecasting models and inflation expectations data to guide rate cuts while keeping inflation under check.

Revitalising Growth through 24-Hour Economy

The government is piloting its 24-Hour Economy initiative across the ports of Tema and Takoradi and in public health and manufacturing hubs. Using financial modeling tools, the initiative forecasts a 2.1% increase in national output by year-end.

Fiscal Transparency and Scientific Budgeting

For the first time, Ghana’s 2025 budget was developed using performance-based budgeting techniques and scenario-based forecasts—direct contributions of financial scientists working in the Ministry of Finance and supported by development partners like the IMF and World Bank.

The Rise of Financial Science in Ghana’s Recovery

Predictive Analytics and Real-Time Modeling

Financial scientists are leveraging big data and AI-driven tools to monitor inflation dynamics, FX movements, and credit conditions in real-time. The Bank of Ghana’s use of Vector Autoregressive (VAR) models helped accurately predict price shocks and allowed pre-emptive action in February 2025.

Sovereign Debt Optimization

Quantitative finance experts played a critical role in the IMF-backed debt deal by preparing cash flow forecasts, stress testing repayment options, and modeling sustainability metrics under various global economic scenarios.

Capital Market Innovation

The Reset Agenda aims to raise GH¢10 billion through domestic bonds over 18 months. Financial engineers at the Ghana Fixed Income Market (GFIM) are developing instruments such as Diaspora Bonds, ESG-linked securities, and inflation-indexed notes to deepen capital market access.

Public Sector Financial Management Reforms

Through reforms in Integrated Financial Management Information Systems (IFMIS) and treasury forecasting tools, Ghana is improving liquidity management, expenditure controls, and public procurement efficiency.

Impact on Citizens and Businesses

Conclusion

Conclusion

Ghana’s journey toward economic renewal under President Mahama’s Reset Agenda has taken a promising turn. In just six months, the government has stabilized inflation, improved investor confidence, and laid a foundation for inclusive growth. But beyond policies and programs lies a more transformative force: financial science.

The active involvement of financial scientists armed with models, simulations, and empirical tools has elevated the sophistication of economic governance. Their relevance has never been more apparent in fiscal planning, debt sustainability, market development, and public sector reforms.

As Ghana looks toward exiting the IMF program by 2026 and embarking on full-fledged growth, the continued deployment of financial science will be essential not just for recovery, but for resilience and prosperity. Financial scientists must now be empowered as strategic national assets, embedded within ministries, think tanks, academia, and industry to co-pilot Ghana’s development in the digital and global age.