By Abdul-Jalil IBRAHIM(Dr)

Ghana’s economy has recently experienced a positive upturn, marked by a notable 16 percent appreciation of the cedi against the US dollar since January 2025. This encouraging development presents an opportunity to consolidate and sustain macroeconomic stability.

To build on these gains, it is essential to adopt innovative and strategic approaches to mobilising development finance.

With external borrowing for 2025 capped at US$250million as IMF conditionality, the government’s ability to fund critical infrastructure projects may be constrained. In this context, prioritising the mobilisation of concessionary financing emerges as a prudent and necessary strategy to bridge the funding gap and support inclusive growth.

Prioritising concessionary borrowing requires the government to expand its engagement with a diverse range of multilateral partners, among which the Islamic Development Bank (IsDB) is particularly well positioned.

As the development finance institution of the Organisation of Islamic Cooperation (OIC), the IsDB offers a robust financial infrastructure that can facilitate access to concessionary funding.

In addition to supporting government financing needs, the IsDB’s instruments can also enable private sector entities to mobilise capital—especially within the framework of the African Continental Free Trade Area (AfCFTA).

In its 2024 Manifesto, the National Democratic Congress (NDC) acknowledged the importance of joining the Islamic Development Bank (IsDB), articulating this as a commitment to “pursuing membership of the Islamic Development Bank to broaden opportunities for development financing.” As part of broader reforms aimed at achieving sustainable economic growth and currency stability, the NDC envisions positioning Ghana as the financial hub of West Africa.

Realising this vision requires the presence of a diversified mix of financial institutions to create a robust financial ecosystem. Membership in the IsDB would contribute to this objective by expanding the range of funding sources available to both the government and private sector, thereby enhancing Ghana’s competitiveness and financial resilience.

Concessionary financing: A smarter path for Ghana’s economic future

The passage of a controversial bill by Ghana’s Parliament to restrict LGBTQ+ rights has triggered strong responses from international stakeholders, including warnings from the U.S. and the UN that foreign aid could be curtailed.

Ghana’s Ministry of Finance at that time projected that the country could lose up to US$3.8billion in international financing over the next five to six years should this occur (Bonney, 2024).

This concern has been further compounded by the recent closure of USAID (which provides funding for 40 percent of global aid) operations in Ghana and around the world, creating a significant funding gap that threatens the continuity of critical development programmes.

In light of these developments, it is imperative for Ghana to adopt a proactive and pragmatic approach to diversifying its sources of concessionary financing. Exploring alternative partnerships is now a strategic necessity.

The IsDB, as a multilateral institution with a strong development finance mandate, presents a viable opportunity to help fill this gap. Its financial instruments could play a key role in stabilising Ghana’s financing landscape and supporting both public and private sector development, especially amid rising geopolitical sensitivities and shifts in traditional donor priorities.

The IsDB, established in 1974 and headquartered in Jeddah, promotes economic and social development in its 57 OIC member countries. Its mission focuses on poverty alleviation, health, education, governance and human development.

The IDB Group includes International Islamic Trade Finance Corporation (ITFC), Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) and Development of the Private Sector (ICD).

It holds a strong “AAA” credit rating from four major agencies, reflecting robust capitalisation, low leverage, sound liquidity and strong shareholder support. IsDB funding emphasises long-term development, with 34 percent of disbursements directed to transport and 15 percent to agriculture. Its financial infrastructure supports both public and private sector development across diverse regions.

Muslim-minority nations within West Africa at the Islamic Development Bank

The IsDB is an organisation that values inclusiveness in its dealing with member states. The Charter of the IsDB is fully aligned with the principles of the United Nations Charter and resonates strongly with Ghana’s democratic values.

It explicitly states that neither the organisation nor its organs are authorised to intervene in matters that fall within the domestic jurisdiction of any member state. Furthermore, the charter emphasises the commitment of member states to uphold good governance, democracy, the rule of law, human rights and fundamental freedoms—principles that are central to Ghana’s constitutional and political framework.

Importantly, the notion that the IsDB is exclusively for Muslim-majority countries is a misconception. Membership in the Organisation of Islamic Cooperation (OIC), under which the IsDB operates, is often pursued for strategic and economic reasons that serve a country’s national interest.

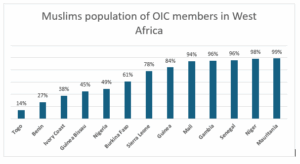

Of the sixteen ECOWAS member states, thirteen are members of the OIC, including countries such as Ivory Coast, Benin, Guinea-Bissau and Togo, all of which have Muslim-minority populations. Their membership underscores that affiliation with the OIC—and by extension, access to IsDB resources—is driven by pragmatic considerations related to development financing, trade and investment opportunities, rather than religious demographics.

Figure 1 Muslim population in OIC West African countries

Source: Pew Research, 2020

Joining the IsDB offers Muslim-minority nations a wide range of strategic and economic benefits that align with national development goals. One of the most significant advantages is access to concessionary financing.

Member countries can obtain long-term, low-interest loans to support projects in critical sectors such as infrastructure, health, education, agriculture and energy.

These funds are typically more affordable and flexible than those from commercial lenders, easing the debt burden while enabling countries to implement transformational development projects.

Membership also opens the door to enhanced trade opportunities through the ITFC, which supports import and export financing. This is particularly beneficial for nations seeking to industrialise or expand their manufacturing base, as it allows access to raw materials, machinery and market financing under favourable terms.

In the context of regional integration initiatives such as the African Continental Free Trade Area (AfCFTA), IsDB trade finance helps member states become more competitive in both regional and global markets.

Another key benefit is investment protection and export credit insurance through the ICIEC. This provides risk mitigation for both domestic and foreign investors, encouraging greater direct foreign investment (FDI) and enabling local businesses to confidently expand into international markets. For countries seeking to build investor confidence and diversify their economies, this protection is a vital tool.

The ICD plays a central role in private sector growth, offering equity financing, Shariah-compliant loans and advisory services. This support helps to stimulate entrepreneurship, strengthen small and medium-sized enterprises (SMEs) and create jobs—especially in underserved sectors. It also facilitates access to modern technology, financial tools and human capital development across various industries.

In addition to financial support, IsDB offers extensive technical assistance and capacity-building programmes to enhance national project implementation and public-sector efficiency.

Member countries benefit from knowledge sharing, training and advisory services in project design, financial management, Islamic finance and governance reform, thereby improving institutional capability and development outcomes.

Moreover, IsDB fosters South-South cooperation by promoting partnerships among its diverse membership of 57 countries.

This facilitates the exchange of best practices, technology transfer and the formation of joint ventures that help boost productivity and innovation. For Muslim-minority nations, this represents an opportunity to build strategic alliances beyond traditional development partners.

Lastly, membership in the IsDB strengthens a country’s position in international economic diplomacy. It demonstrates a commitment to broad-based development cooperation and allows countries to cultivate new relationships with economically influential members in the Middle East, Asia and Africa.

The IsDB’s focus on sustainable development—closely aligned with the UN Sustainable Development Goals—ensures that its interventions contribute not only to economic growth but also to long-term social and environmental resilience.