By Ebenezer Chike Adjei NJOKU

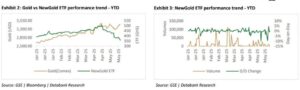

After weeks of lacklustre performance, the NewGold Exchange Traded Fund (ETF) listed on the Ghana Stock Exchange (GSE) is on course for a recovery, following a sharp rebound in global gold prices at the beginning of June 2025.

The rally in spot gold, triggered by a weakening US dollar and renewed geopolitical uncertainty, has lifted investor sentiment and could offer relief to holders of the gold-backed ETF which has endured a 20 percent decline since early May.

Gold surged by more than two percent in Monday’s session to US$3,372.13 an ounce, the highest in three weeks, as safe-haven demand intensified amid renewed tensions in the Middle East and mixed signals from US economic data. The rally helped reverse a 2.3 per cent week-on-week decline on the Commodity Exchange (COMEX) last week, when gold settled at US$3,312.10.

The NewGold ETF, which tracks the price of physical gold, reflected the late-May dip by falling 6.09 percent last week to close at GH¢350.86. The decline was exacerbated by thin volumes, with average daily trades dropping 16.78 percent to 4,750 units and total weekly turnover sliding 24.5 percent to GH¢8.25million.

“The disconnect between earlier safe-haven flows and late-week technical selling suggests domestic allocators remain tactically cautious, awaiting clearer signals on inflation and central-bank policy direction,” analysts at Databank Research said in a note at the beginning of the first trading week in June 2025.

gold

gold

The outlook for gold remains sensitive to inflation data and the trajectory of US Federal Reserve policy. Last week’s mixed Personal Consumption Expenditures (PCE) inflation data dampened expectations of imminent rate cuts. A stronger-than-expected core PCE reading sustained elevated real yields and suppressed gold’s appeal. Nevertheless, Monday’s decline in the US dollar, which fell 0.5 percent against other major currencies, has once again tilted the narrative.

Domestic investors have felt the impact of global moves acutely. The security began the year at GH¢390.5 and reached a high of 508.31 on Tuesday, April 22, 2025 – but the ETF has shed 10.2 percent in value since turn of the year and currently ranks in the bottom 20 percent on the GSE in terms of year-to-date performance. Yet despite the drawdown, NewGold remains the 17th most valuable stock on the exchange with a market capitalisation of GH¢1.02billion, accounting for roughly 0.76 percent of GSE’s total equity market.

The ETF is structured to provide investors with direct exposure to gold through units representing one-tenth of a gramme of the physical commodity. Backed by gold held in London Bullion Market Association-approved vaults, the fund offers a hedge against currency volatility, inflation and global financial instability — key considerations in the current macroeconomic environment.

The recent rally in gold comes against a backdrop of stronger local currency performance. The cedi (GH¢) was the best-performing currency on the interbank market last week, gaining 6.52 percent against the US dollar to close at a mid-rate of 10.95/US$. The cedi’s strength has in recent weeks dampened some of the upside potential of GH¢-denominated NewGold ETF.

“Should offshore investors continue to repatriate profits or if import demand accelerates, the cedi could face renewed depreciation pressure,” Databank Research noted.

“A weakening currency environment, especially above the GH¢11.30/US$ threshold, would make NewGold ETF more attractive as a hedge,” it added.

Investor attention will now turn to upcoming US macroeconomic releases and comments from Federal Reserve officials. Markets are particularly sensitive to indications that core PCE inflation – the Fed’s preferred gauge – may fall below 2.2 percent on an annualised basis, which could ease pressure on real yields and spark fresh interest in gold.

Meanwhile, physical demand from Asia – a key pillar of bullion support – has shown signs of weakening. In India, demand cooled with the traditional wedding season ending and rising local prices. Wholesale premiums fell from US$49 to US$31.

In China, premiums on the Shanghai Gold Exchange narrowed to US$15, reflecting local oversupply. While Asian demand dynamics may limit gold’s near-term upside, sentiment-driven flows and central bank purchases continue to play a stabilising role, aforementioned Databank Research showed in the note.

Locally, the Bank of Ghana’s gold reserves have grown significantly under its Domestic Gold Purchase Programme. As of end-April 2025, the central bank held 31.37 tonnes of gold – equivalent to roughly 1,008,837 ounces valued at approximately GH¢46.3 billion – a jump from 8.78 tonnes in 2023.

These come as GSE’s Composite Index began trading in June 2025 at 25.81 percent higher than beginning of the year.