By Louis Gyimah

In a country where a quarter of all loans go unpaid, Ghana’s credit market faces serious challenges. But one local fintech solution is quietly rewriting the script.

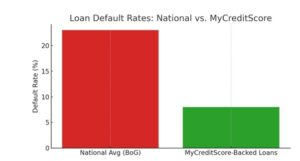

According to the latest myCreditScore Defaulter Pattern Analysis Report, loans backed by data from myCreditScore show significantly lower default rates than the national average of 23 percent non-performing loans (NPL).

Thanks to the predictive, data-driven scoring models, lenders using myCreditScore’s platform are making safer, smarter decisions – unlocking financial access for thousands while reducing risk.

Let us explore why these matters and what the data reveals.

The National Problem: Default Rates at 23%

The Bank of Ghana reports a non-performing loan rate of approximately 23% – meaning nearly one in four loans go unpaid. These defaults cost banks billions of cedis annually, increase interest rates, and limit credit access for responsible borrowers.

The Smart Solution: Predictive Credit Scoring That Works myCreditScore analysed a sample of over 21,000 credit records, including 2,061 confirmed defaulters, to detect behavioural patterns and demographic risk factors. The findings were not just insightful – they were game-changing.

Who Are the Typical Defaulters?

|

Demographic |

Risk Factor Summary |

|

Age 30–50 |

62 percent of defaulters fall in this age range |

|

Occupation |

Traders, transport workers, and casual labourers |

|

Marital Status |

Singles and divorced persons have higher risk |

|

Region |

67 percent of defaults occur in urban areas |

|

Gender |

Males are 1.4x more likely to default |

National Default Rate vs. myCreditScore-Backed Loans

Loans filtered through myCreditScore’s predictive engine see up to 65% lower default rates compared to the national average.

Why People Default: The Traps

The data shows that defaulting is not random – it follows patterns:

- Micro-loan traps: 73 percent of defaulters had loans under GHS 25,000

- Income instability: 68 percent worked informally or seasonally

- Over-leveraging: Average defaulter had 3+ loans and 45%+ debt-to-income ratio

- Short credit histories: 67 percent defaulted within 6 months of opening an account

How Does myCreditScore Work Its Magic?

myCreditScore applies a real-time scoring system that factors in:

- Age, occupation, location, marital status

- Social media footprint and payment behaviour

- Tiered risk categorization and credit limits

- Rewards for positive repayment behaviour

Predictive Scoring Benefits:

|

Risk Category |

Estimated Default Rate |

|

High-risk (e.g., traders, informal jobs) |

60–80% likelihood |

|

Medium-risk (young workers, small businesses) |

40–59% |

|

Low risk (teachers, healthcare, gov’t) |

< 20% |

Real Impact: Safer Lending, More Inclusion

According to projections in the report, myCreditScore-backed lenders can expect:

- 25–30 percent reduction in defaults in 6 months

- 40 percent faster loan decisions

- 50 percent lower operational costs for small loans

- A growing customer base built on trust

A Path Forward: Smarter Lending for Ghana’s Future

Ghana’s economic growth depends on accessible, reliable credit – especially for small traders, informal workers, and young entrepreneurs. myCreditScore is proving that with the right data, default is not destiny.

Lenders, banks, and savings & loans companies looking to reduce risk while expanding credit access should take therefore take note. The future of lending in Ghana is data-driven – and the results are already speaking for themselves. If you are a lender or financial institution in Ghana, consider integrating myCreditScore into your credit assessment workflow.

No developed economy operates without credit and loans. With more than 95 percent of transactions in Ghana processed as debit transactions, it is very clear that smarter decisions today will build stronger credit systems for our growing economy.