By Joshua Worlasi AMLANU & Ebenezer Chike Adjei NJOKU

Foreign corporate investors continued to be the dominant force in the domestic equity market – accounting for nearly 86 percent of total shares value sold between January and April 2025, according to a recent report from the Ghana Stock Exchange (GSE).

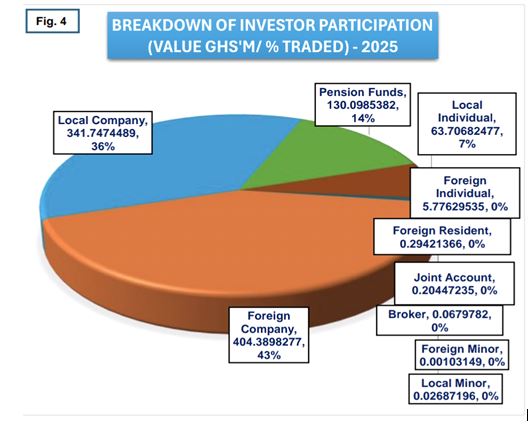

The data show that foreign companies sold GH¢531.71million in equities during the period out of GH¢618.06million total market value.

They also accounted for 48.02 million shares traded, which translates to 57 percent of market volume. This placed them as the highest investor segment ahead of the profit-taking season, which has coincided with rapid appreciation of the cedi.

Analysts attribute this activity to sustained interest in large-cap stocks and exchange-traded funds, particularly the NewGold ETF which remains an attractive vehicle for institutional hedging strategies amid a volatile global macroeconomic backdrop. Other preferred counters were financial stocks and market leader MTN.

Despite the dominance of foreign firms, domestic institutions – especially pension funds and local companies – have shown a measured but visible increase in equity participation. Pension funds accounted for GH¢156.55million in trades, or 14 percent of total market value – up from 10 percent over the same period in 2024.

The report attributes this growth to strategic asset reallocation from fixed income into equities as funds seek to improve portfolio returns in a gradually declining interest rate environment.

Local corporate investors also demonstrated significant engagement, trading GH¢343.17million on the buy side and GH¢62.48million on the sell side. Their combined volume of 52.5 million shares is nearly equivalent to that of their foreign corporate counterparts.

The activity, analysts say, points to a growing sophistication among Ghanaian corporates in Treasury management as equities increasingly form part of short- to medium-term investment strategies.

Meanwhile, local individual investors contributed GH¢69.80million in buy-side trades and GH¢ 23.18million on the sell side, totalling 38.61 million shares. Although this represents roughly 15 percent of market volume, their share of value remains low at around 11 percent.

This disparity indicates that local retail participation is skewed toward lower-priced equities or small-volume trades – an area market experts say has room for expansion, particularly with the application of technology to increase ease of trade.

These drove GSE’s Composite Index – a measure of the market’s performance – to a year-to-date gain of 24.69 percent and a year-on-year appreciation of 65.32 percent. The index began the final trading week of May 2025 at 29.8 percent.

Other investor categories – including foreign individuals, local and foreign minors, joint accounts and broker accounts – together accounted for less than one percent of total trades by value. Foreign individuals traded just GH¢5.55million, while activity from minors and residents was negligible.

Analysts have argued that the dominance of foreign corporates in the market is both a strength and a vulnerability. While they bring in needed liquidity and stability, they also introduce exposure to exogenous shocks.

The GSE data showed that ETFs, led by the NewGold fund, comprised 62.64 percent of total market value traded – equivalent to GH¢387.18million. Despite representing just over one percent of total volume, ETFs remain a preferred asset class for institutional investors seeking hedges against inflation and currency volatility, especially at a time when gold has rallied to record highs on account of global economic uncertainty.

The ICT sector meanwhile contributed 65 percent of total market volume – driven primarily by MTN, the largest listed company by market capitalisation. The financial sector followed with 30 percent of traded shares and 8.3 percent of value.

Other sectors including food and beverage, distribution and insurance accounted for marginal volumes, as market concentration remains around a few high-liquidity instruments with institutional appeal.

To broaden the base of participation and deepen the market, industry stakeholders have renewed calls for policy reforms and investor-friendly innovations; including fractional share trading, tax-advantaged equity investment accounts and targetted campaigns to attract young and first-time investors.