- Output and new orders increase at much sharper rates

- Employment rises for third month running

- Signs of inflationary pressures easing

Growth accelerated sharply in Ghana’s private sector as the second quarter of the year got underway.

Both output and new orders rose much more quickly than had been the case in March, with the former increasing to the largest extent in four-and-a-half years. In turn, companies took on extra staff and looked to build inventories. Business conditions were in part supported by a further easing of inflationary pressures.

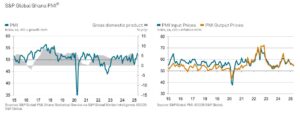

The S&P Global Ghana Purchasing Managers’ Index™ rose to 52.6 in April from 50.6 in March, signalling a solid improvement in the health of the private sector, and one that was the most pronounced since September 2021. Business conditions have now strengthened in three consecutive months.

Growth of business activity accelerated particularly sharply during April, quickening to the fastest in four-and-a-half years. Companies linked the marked expansion in output to higher new orders and improving economic conditions.

A stronger demand environment also helped lead to a third consecutive monthly increase in new orders. The rate of expansion was solid and the fastest since last November.

Growth of purchasing activity also hit a five-month high in April as companies responded to rising new orders by increasing their input buying solidly.

This helped firms in their efforts to build inventories, which rose modestly over the month. Some respondents indicated that they were looking to replenish stocks of purchases after inventories had run low, while others attempted to build reserves in anticipation of further increases in new orders in the months ahead.

Alongside growth of purchasing, companies also increased their employment levels in response to higher new orders. Workforce numbers rose for the third successive month, albeit at the slowest pace in this sequence.

Firms were again able to keep on top of workloads despite the sharper rise in new business. Backlogs of work decreased modestly, and to a larger degree than in March.

Inflationary pressures showed further signs of moderation in April. Both purchase prices and staff costs increased at a slower pace for the second month running, with rates of inflation at 14- and four-month lows respectively.

Where purchase prices rose, panellists linked this to currency weakness, although there had been an improvement in the strength of the cedi more recently. Higher employee expenses, meanwhile, were often linked to cost-of-living payments.

In line with the picture for input costs, the pace of output price inflation eased for the second month running. The latest increase was the slowest since February 2024.

Meanwhile, suppliers’ delivery times shortened further, with prompt ordering helping lead to quicker deliveries. The rate of improvement was broadly unchanged from that seen in March.

Hopes that economic conditions will continue to strengthen, and that exchange rates and prices will stabilize, supported confidence that output will rise over the coming 12 months. Sentiment eased slightly from that seen in March, but was still above the series average.

Andrew Harker, Economics Director S&P Global Market Intelligence commented “Growth in Ghana’s private sector stepped up a gear in April, suggesting some real momentum building as the second quarter of the year got underway.

The key now will be to see if this momentum can be maintained in the months ahead. A softening inflationary environment and generally optimistic outlook among firms suggest that this may well be the case.”