…Advans Ghana, Turaco, Enterprise demonstrate power of microinsurance

In the aftermath of the devastating Kantamanto Market fire, Advans Ghana, Turaco Inclusive Ghana (T/A Turaco), and Enterprise Insurance LTD— three pioneering institutions in financial inclusion came together to provide a lifeline to hundreds of small business owners.

Through their longstanding microinsurance partnership, which began in 2010, Turaco and Advans Ghana, supported by underwriting partner Enterprise Insurance Company LTD, have provided financial protection to over 200,000 customers.

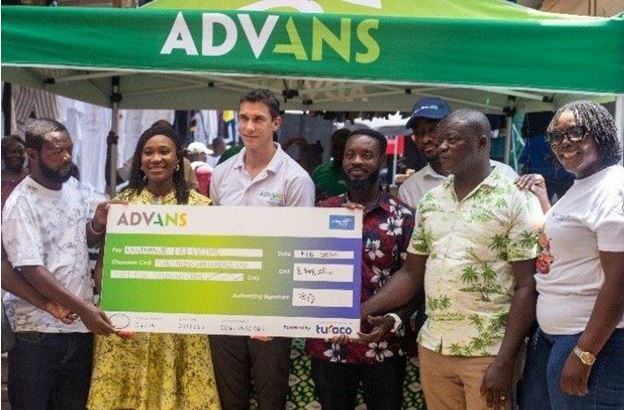

In response to the Kantamanto Market fire, the partnership proved invaluable once again, enabling 227 SME traders to receive over GH¢8.4 million, clearing outstanding loans and providing immediate cash support to rebuild their businesses and livelihoods.

The incident is a powerful real-world example of how embedded micro insurance can transform risk into resilience. The funds not only cover outstanding credit obligations with Advans Ghana but also offer critical working capital to help traders restart operations immediately.

“At Advans, we are intentional about embedding insurance into our services so our customers are protected in moments like these. Our partnership with Turaco and Enterprise Insurance is part of that proactive approach to safeguarding livelihoods, and this payout demonstrates the power of building financial resilience in advance,” said Guillaume Valence, Advans Ghana CEO.

Kantamanto Market, one of Accra’s largest trading markets, is home to thousands of traders who power Ghana’s informal economy. The fire that swept through the market left widespread destruction, but also revealed the untapped potential of micro insurance to protect Ghana’s most vulnerable business owners.

“Micro insurance is a customer-centric service that makes it possible for the most vulnerable people to access financial protection when they need it most. This is evident in our partnership with Advans Ghana and Enterprise Insurance, where insurance is embedded directly into financial services.

“Together, we have insured over 200,000 customers across Ghana, helping them bounce back from life’s unexpected shocks. The Kantamanto response shows that strategic partnerships and seamless delivery can turn risk into resilience,” said Leona Abban, General Manager, Turaco Ghana.

The product, underwritten by Enterprise Insurance LTD Ghana, highlights the importance of robust underwriting partnerships in delivering responsive and impactful micro insurance solutions.

“At Enterprise Insurance, we believe insurance is most impactful when it directly addresses the immediate needs of our customers and communities. Our underwriting support for the Advans-Turaco partnership reflects our commitment to protecting Ghana’s SMEs from unpredictable risks,” said Akosua Ansah-Antwi, Managing Director, Enterprise Insurance LTD.

Supporting Ghana’s economic backbone

The success of the Advans-Turaco response has been hailed as a blueprint for scaling financial protection for SMEs across Ghana, with the NIC Deputy Commissioner, Bernard Ohemeng-Baah, representing the Commissioner, praising the model and its impact.

“As a regulator, we see this payout as a demonstration of the role inclusive insurance can play in economic resilience. We will continue to foster regulatory support for innovations that protect small businesses and traders—the backbone of our economy,” he said.

SMEs employ millions of Ghanaians and form the backbone of the country’s economy. Yet, many remain one disaster away from financial ruin. The Kantamanto intervention is proof that with the right approach, recovery can be swift, dignified, and debt-free.

In addition to the insurance payouts, Advans Ghana has provided GH¢20,000 worth of building materials to support traders in rebuilding their stalls, reinforcing its commitment to their customers at Kantamanto. Advans Ghana also offered select clients a Restart Offer, which entailed a payment grace period and 10percent reduction in interest to help these clients get back on their feet. These initiatives were aimed at supporting their customers’ long-term recovery and stability.

About Advans Ghana

Advans Ghana Savings and Loans Ltd. is a subsidiary of the Advans Group, headquartered in Paris, France, with a presence in eight countries in Africa and Asia, and serving more than 1.3 million clients. In Ghana, Advans serves over 130,000 clients. It currently operates with 19 branches in eight regions – Greater Accra, Ashanti, Brong, Ahafo, Volta, Northern, Central, and Eastern – with its target markets mainly being micro, small, and medium-scale enterprises, not losing sight of individual clients.

About Turaco

Turaco Inclusive Ghana Ltd. T/A (Turaco) is an insurance and technology company transforming insurance financing in emerging markets with simple and affordable health and life insurance for low-income earners. Founded in 2018, Turaco is present in Kenya, Uganda, Ghana, and Nigeria. Turaco partners with leading mobile network operators (MNOs), technology companies, and financial institutions to distribute unique insurance products for their customers.

With Turaco, individuals can secure insurance coverage with premiums starting as low as US$1 per month. Using API integrations with their partners and AI to drive efficiency, Turaco activates policies, automates payments, and processes claims in a fraction of the time it takes traditional insurance companies. Turaco has insured over 3.5M people to date. For more information, visit Turaco’s website.

About Enterprise Insurance Ghana Limited

Enterprise Insurance, established in 1924, is Ghana’s oldest and leading insurance provider. The company offers a comprehensive range of insurance products and services, catering to the needs of individuals, businesses, and corporations.

Enterprise Insurance is rated AAA (the highest rating scale) for financial strength by the Global Credit Rating (GCR) of South Africa. Enterprise is renowned for its commitment to customer service, innovation, and social responsibility. Enterprise continues to lead the industry in underwriting partnerships that advance financial inclusion. The company is a subsidiary of the Enterprise Group PLC.