By Constance GBEDZO

Corporate Governance and Enterprise Development

History has indicated that the ancient civilisations mined gold for its grandeur, diverse use and its convertibility into diverse forms.

Throughout history, gold has been used as a form of currency, and traded for goods and services. Egyptians were the first to use gold as a currency and medium of exchange.

The first gold coin was minted by the Kushan King Kanishka in India. Various other nations like Rome and Britain also used both gold and silver as currency and medium of exchange at some point. Gold has continually held immense historical significance; being used as currency, a symbol of wealth, and a hedge against economic uncertainties.

Civilization has prized this treasurable mineral for its rarity and enduring worth. Gold has retained its value. Investors have recognized its stability and potential to diversify their portfolios, especially during times of market volatility.

In 1792, the United States of America began the silver-gold standard monetary system, where dollar value was pegged to the value of gold and silver. Other world currencies also pegged the value of their currency in terms of gold value.

Indeed, the balance of payments in international trade transactions were made through exchange of gold.

The silver-gold standard economic system collapsed and the silver-gold stopped being a medium of exchange when the Bretton Woods Economic System was introduced.

In this era, while the value of US dollar was pegged to the value of gold, all other countries agreed to peg their currency value to the value of US dollar. Thus, US dollar assumed the role of world currency.

The Bretton Woods system was based on rules, the most important of which was to follow monetary and fiscal policies consistent with the US Dollar.

However, the Bretton Wood System also collapsed between 1971 and 1973 due, mainly, to the inflationary monetary policy that was inappropriate for the key currency country. This collapse led to the adoption of a managed floating exchange rate system by most countries.

Historically, in Ghana’s issuance of its jurisdictional currency in 1958, the original currency cover assets included gold, sterling, and call money in the United Kingdom, and British Treasury Bills with maturities not exceeding three months, among others.

In the 1960-61 financial year, the managers of the Ghanaian economy, decided to enhance the amount of gold to be held in the cover asset mix for the Cedi.

This decision saw a small amount of refined gold, valued at around US$3.7 million purchased abroad and transported to the Bank’s vault. However, a dip in the value of Gold in the 1960s saw a shift in policy direction from Gold as a cover asset to foreign currency and securities.

Subsequently, the foreign reserves of the Central Bank of Ghana has grown steadily over the last two (2) decades to the levels of almost US$11.00 billion in 2021.

Nonetheless, the portion of gold reserves has remained at 8.77 tonnes, with the average value of gold reserves held as a percentage of Gross International Reserves (GIR) at 6.14%.

The extraction of gold in Ghana dates back over a century. Between the 15th and 18th centuries, due to the wealth of mineral assets discovered, the early merchants named the country “Gold Coast”. Due to the abundance of gold minerals, mining became prevalent, with riverbanks being searched for gold grains.

Nevertheless, statistics show that in 2019, when Ghana was adjudged the largest producer of gold in Africa and the 7th largest in the world, other central banks acquired a record level of 670 tonnes of gold to boost their reserve.

Interestingly, Ghana’s gold is still exported in its raw state. Notwithstanding, Gold exports in 2022 accounted for about 7.5% of Ghana’s GDP. The mining sector, with gold as the dominant mineral, provides about 40% of Ghana’s foreign exchange earnings.

Despite the growth of Ghana’s oil industry, gold mining remains the mainstay of the country’s fiscal stability and economic growth. In 2023, gold mining added GH₵8.6 billion (US$580 million) to Ghana’s GDP.

Nonetheless, Ghana had added nothing to its gold reserves over the period. Data from the IMF and the World Gold Council indicate that major industrialized countries held the largest volume of gold reserves as at 2021.

This is followed by foremost emerging markets with major developing countries lagging behind the curve. Globally, Central Banks’ demand for Gold over the past decade, ranks third behind Jewellery, Technology and Investment sectors.

During the COVID pandemic period there was a marginal decline in central banks’ gold demand but, the number of central bank buyers outweigh the number of sellers over the period. Much of these buyers were from emerging market countries which had lower ratios of gold-to-total reserves.

For instance, Turkey was the largest annual gold net purchaser, adding 134.5 tonnes to its official gold reserves in 2020 alone. Other large net purchasers of gold during the pandemic year were, India, Russia, United Arab Emirate, Qatar, Colombia and Cambodia, among others.

It is worth noting that Ghana has yet not realised the maximum economic benefits of its Gold extraction, until 2021 when the Bank of Ghana’s (BOG) launched its Domestic Gold Purchase Programme (DGPP) on 21st June 2021to purchase gold to build its reserves.

The intention was to double the Central Bank’s gold holdings to bring a significant change to the Bank’s foreign exchange reserves management operations.

DGPP was to serve as a channel to support reforms within the Artisanal and Small-Scale Gold Mining sector (ASGM), and to establish responsible supply chains for ASGM gold from Ghana.

The Bank thought that the exploitation of this precious metal is to be done responsibly to ensure that the full benefits are derived without undue harm to the environment.

Then, Government also introduced the Gold-for-Oil program (G4O) in 2024; leveraging gold to pay for oil imports, thereby stabilizing fuel prices and easing pressure on foreign exchange reserves.

The implementation of the DGPP and its G4O component were with an inappropriate ‘tone at the top’. Therefore, although these programmes were well intended, they lacked the needed well-thought legal regime to anchor programmes objectives.

Eventually, those objectives were not actualized. We were told that Bank of Ghana incurred losses as result.

Bank of Ghana also introduced alternate gold-based investment schemes, dubbed, ‘the Ghana Gold Coin’, under the domestic gold program in 2021.

This product, together with other Gold based investment assets, including investments into equities and mutual funds were not aggressively promoted by the bank as asset classes that have the potential to provide better returns than traditional investments like bank deposits and treasury bills.

Having witnessed the haphazard implementation of the DGPP and its G4O component, the NDC government led by His Excellency John Mahama quickly took steps to implement its manifesto promise of establishing the Ghana Gold Board.

Within 90 days in office, the Ghana Gold Board Act (ACT1140), 2025 was accented in April 2025. This Regulatory Body by the Act is responsible for the following:

- Overseeing the buying, assaying, selling and export of Gold and other minerals

- Formalize gold trading within the small-scale mining sector

- Support responsible mining

- Promote value addition to the gold and other minerals

- Enhance traceability and boost Ghana’s efforts to secure London Bullion Market Association (LBMA) certification

- Generate foreign exchange and other related matters

- Support accumulation of gold reserve by the BOG

The Ghana Gold Board appears to be the game changer and a masterstroke that can transform Ghana’s Gold from a mere commodities or medium of exchange to an economic instrument that the Ministry of Finance and the Central Bank of Ghana can deploy in managing both the fiscal and monetary policies.

When implemented well, it has the potential to enhance earnings and curb smuggling, increase gold purchases from small-scale miners and reducing illicit activities, and to streamline the gold value chain, from extraction to marketing, thereby ensuring ethical sourcing and maximizing revenue.

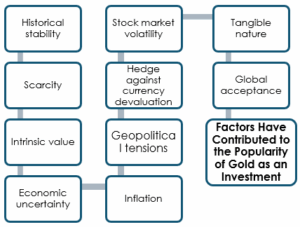

Historically, the evolution of gold as an investment instrument has been remarkable. The future performance of gold as an investment is highly anticipated.

The potential of gold as an investment appears bright, with growing demand from emerging markets and geopolitical uncertainties. Gold’s inherent value and limited availability makes it a safeguard against inflation and devaluation of the cedi.

Ghana can take advantage of the several financial instruments inherent in Gold to attain macro-economic stability.

Indeed, the Security and Exchange Commission in collaboration with the Central Bank of Ghana, and Private Sector Financial Institutions must take the advantage of the opportunities being created by the GoldBOD to design financial assets for private sector individuals and institutional investors.

This is likely to cause reduction in excessive demand for the US-Dollar as a means for store of value.

Indeed, adding Gold Exchange Traded Funds (gold ETFs) or gold-based mutual funds or Sovereign Gold bonds or physical gold to the known investment portfolios can help mitigate risks and offer stability in the long run.

To take advantage of this potential, investors should consider diversifying their portfolios and staying up-to-date on global economic trends.

This needs to be backed by altruistic collaboration from key actors in the financial services industry and aggressive advocacy for these products as alternative to the already known investment assets.

About the Author

With a diverse professional background spanning various sectors in Ghana, including roles in the audit service, Ernst and Young Ghana, international NGOs, audit/compliance and enterprise risk management in banking, academia, and consultancy, I have acquired extensive experience in finance, corporate governance, business strategy, and enterprise-all risk.

My journey through these organizations has provided me with insights into the challenges and shortcomings prevalent in Ghana’s socio-economic development.

Over the past few years, some reforms have been promulgated in the mining sector to ensure Ghana attains macro-economic stability. However, the Ghana Gold Board appears to be the masterstroke and the game changer.