By: Benjamin Nathan Otchere

In today’s interconnected global economy, tariffs have become significant tools of economic policy that influence market dynamics and trade relations.

While their primary objective is to protect domestic industries and stimulate local economies, tariffs can also lead to unintended consequences, such as market volatility and retaliatory measures from trading partners.

Historical instances like the 1930 Smoot-Hawley Act, the U.S.–China trade war of 2018-2019, and Europe’s retaliatory tariffs during that same period, as well as the recent tariffs enacted by the POTUS, President Trump, illustrate this point.

These actions inevitably disrupt global supply chains and impact emerging markets. Consequently, the ramifications of tariffs extend beyond the nation imposing them, making it crucial for market participants to closely monitor these developments.

Financial Market Impacts and Dynamics

Empirical data from recent trade disputes clearly illustrate how tariffs influence financial markets. For instance, following the imposition of the U.S. steel and aluminium tariffs in 2018, the U.S. stock market experienced pronounced volatility.

Major indices like the Dow Jones Industrial Average saw steep declines on tariff announcement days, reflecting investors’ immediate concerns over rising production costs and potential disruptions to global trade.

Simultaneously, bond markets reacted differently: a flight to safety pushed investors towards U.S. Treasury bonds, driving yields downward, while riskier corporate bonds saw widening spreads as market uncertainty increased.

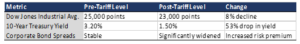

Table 1: U.S. Financial Market Responses to Tariff Announcements (2018–2019)

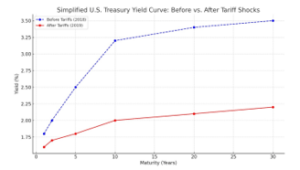

The table and chart discuss market responses to economic shifts, highlighting the duality between equity and bond markets. While equity markets often decline amid risk and uncertainty, bond markets may respond more subtly as investors seek safe-haven assets.

During the U.S.–China trade war, significant market volatility was noted, with the Shanghai Composite Index dropping about 32% while Chinese government bond yields decreased. Export-reliant corporate bonds faced widening spreads due to rising default risks.

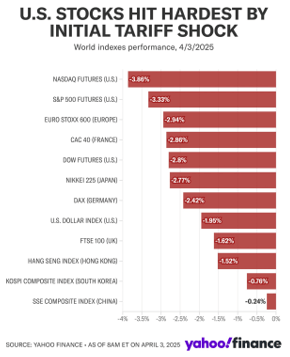

European markets also reacted, with counters to U.S. tariffs leading to declines in indices like Germany’s DAX and France’s CAC 40. Government bond yields in the EU fell to historic lows, indicating a flight to safety.

Overall, the text emphasises the sensitivity of financial markets to trade policy changes. As a result, with the recent tariff announcement by Trump, exchanges including the US Dollar Index are already feeling the impact (see graph below).

Global Spillover Effects on Emerging Markets

Beyond the immediate impacts in tariff-imposing and retaliatory countries, tariffs exert significant global spillover effects, particularly on emerging markets. In an interconnected financial system, emerging economies are especially vulnerable to shifts in global capital flows and trade dynamics.

When major economies impose tariffs, the resultant trade disruptions can have a profound effect on emerging markets, often acting as an early warning system for broader economic instability.

One of the key channels through which tariffs affect emerging markets is via trade disruptions. Emerging economies, which are often heavily integrated into global supply chains, can experience substantial export declines as tariff barriers reduce access to lucrative markets.

For example, countries like Vietnam, India, and Mexico have seen fluctuations in their export volumes as firms realign supply chains to mitigate tariff exposure. This can lead to lower industrial output and higher unemployment, further straining local economies.

Investor behaviour also plays a critical role in transmitting tariff shocks to emerging markets. In periods of heightened trade tension, global investors typically exhibit risk aversion, retreating from emerging market equities and bonds and shifting their capital towards safer assets in developed economies.

This capital flight leads to depreciations in local currencies, increased borrowing costs, and higher inflation, thereby deepening economic vulnerabilities. Data from the trade tensions of 2018–2019 reveal that emerging market currencies such as the Ghanaian cedi, Turkish lira and Argentine peso depreciated sharply, accompanied by a significant rise in bond yield spreads as investors demanded higher risk premiums.

Additionally, tariffs can trigger commodity price volatility—a factor that disproportionately affects emerging markets dependent on commodity exports. For nations such as Nigeria, Chile, and Indonesia, fluctuations in global commodity prices can lead to unpredictable revenue streams and fiscal instability.

When trade policies disrupt global demand, the ensuing price swings can create severe economic challenges for these countries, exacerbating existing vulnerabilities and impeding sustainable growth.

In conclusion

The intricate web of tariff-induced market dynamics underscores the multifaceted impacts of protectionist policies in the modern global economy. While tariffs are designed to bolster domestic industries and safeguard national interests, they inevitably create market turbulence—evidenced by sharp equity declines, bond market shifts, and widespread investor uncertainty.

Moreover, the ripple effects extend beyond the borders of tariff-imposing and retaliatory nations, significantly affecting emerging markets through disrupted trade, capital outflows, and commodity price volatility.

As global economic conditions continue to evolve, policymakers and investors must remain vigilant in assessing the trade-offs inherent in tariff policies. The coming months promise to reveal further insights into how these dynamics will shape financial markets and global capital flows.

Ultimately, a nuanced understanding of tariff impacts can help stakeholders navigate the complex interplay of protectionism, market stability, and economic growth in an era marked by unprecedented global interconnectivity.

Benjamin is a| Certified Financial Planner & Advisor