By Ernest Bako WUBONTO

The Automobile Assemblers Association of Ghana (AAAG) has urged the government to implement a vehicle financing scheme with reduced interest rates to make new cars more affordable and stimulate demand for locally assembled vehicles.

The association, which includes leading industry players such as Volkswagen (VW) Ghana, identified key barriers currently hindering market demand.

These include prohibitive commercial interest rates exceeding 27 percent, excessive collateral requirements and the capital-intensive nature of vehicle purchases—rendering the prevalent ‘cash-and-carry’ model increasingly impractical.

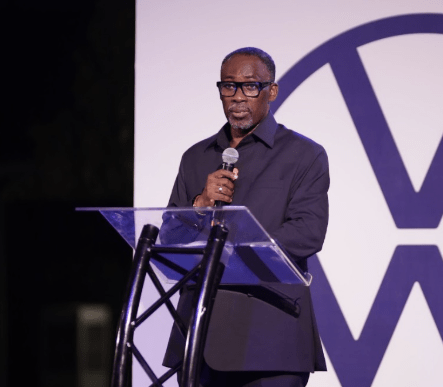

President of the AAAG and Chief Executive Officer of VW Ghana, Jeffrey Oppong Peprah, in an exclusive interview with the Business and Financial Times, revealed that discussions have already begun with the Ministry of Finance (MoF) to develop a national auto financing policy.

The goal is to enable financial institutions to offer loans at interest rates ranging between 10 and 15 percent—far below current commercial rates of nearly 30 percent.

“We need a robust vehicle financing policy with favourable interest rates. If we aim to grow this industry without a structured auto financing model, the goal will remain out of reach,” Mr. Peprah said.

He proposed that an incentivised financing rate, applicable exclusively to the purchase of locally assembled vehicles, be benchmarked by the Bank of Ghana (BoG) and adopted by commercial banks. “Such a policy would boost consumer confidence and drive vehicle sales volumes,” he added.

According to Mr. Peprah, early discussions with the Ministry of Finance have been encouraging, with the government expressing commitment to establishing a supportive framework that promotes sector growth.

Additional multi-stakeholder engagements are expected to involve the Bank of Ghana, commercial banks and automobile dealers.

Breaking the cash-and-carry barrier

Mr. Peprah stressed that the dominant cash-based vehicle purchasing system in Ghana is outdated and unsustainable. “It limits market growth significantly,” he said, advocating for a shift toward structured vehicle financing—mirroring successful models in more mature markets.

The Ghana Automotive Development Policy (GADP), introduced in 2019, has opened the space for domestic auto assembly. To date, nine major assembly plants have been established. However, while production capacity continues to grow, consumer-level uptake remains sluggish due to financing challenges.

The AAAG’s proposed financing model recommends preferential interest rates of 10–15 percent for new vehicle purchases, more flexible loan terms, reduced collateral requirements and strategic partnerships between banks, manufacturers and government. The focus would be on boosting purchases of locally assembled vehicles.

“With the right financing structures, we can fundamentally transform vehicle ownership, stimulate local manufacturing and establish Ghana as an automotive hub for West Africa,” Mr. Peprah stated.

Industry potential

He further noted that in South Africa, the automotive industry is the second-largest contributor to gross domestic product (GDP) after mining, playing a pivotal role in job creation and industrial activity.

“Ghana has the potential to be the first West African economy to mirror this success—if the necessary policies and support mechanisms are put in place,” he asserted.

Mr. Peprah, however, warned that other regional players, particularly Côte d’Ivoire, are moving aggressively to position themselves as the automotive hub of West Africa.

He called on the Ghanaian Government to expedite policy implementation to secure the country’s competitive edge and attract the full investment potential of global auto brands.