By Deborah Asantewaah SARFO

The Head of Governance and Inclusive Growth at the United Nations Development Programme (UNDP) Ghana, Edward Ampratwum, has charged institutions, development partners and private institutions to create specific financial mechanisms related to women-led businesses’ special needs.

He explained that access to finance and closing the gender financing gap are key pillars to women economic empowerment; and developing specific financial solutions that suit women entrepreneurs will unleash the full potential of women entrepreneurship.

“Development partners, national institutions and the private sector must work together to create a financial mechanism that recognises the unique realities of women-led businesses,” he emphasised.

In achieving this, he urged them to “rethink investment models of impact investing to blended financing”.

He noted that despite the strong payments records of women, they only experience a small fraction of investment capital compared to their male counterpart, stressing that in Africa, women-led businesses face a US$42billion financing gap.

Mr. Ampratwum added that across Africa, women make up nearly 60 percent of the self-employed; and lead over 40 percent of micro, small and medium enterprises (MSMEs), contributing approximately 13 percent of the continent’s GDP.

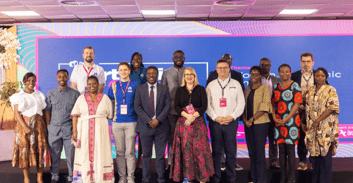

He said this at the ‘Partnering for Change’, an event hosted by Reach for Change in partnership with SCANIA, BMW Foundation and GIZ Widu.Africa project under the theme ‘Women, Economic Empowerment & Systems Change in West Africa’.

The Swedish Ambassador, Annika Hahn-Englund, emphasised that empowerment of women in West Africa is not only a human rights issue, but also a critical factor in unlocking the full potential of economies.

She added that women are the backbone of this region, contributing immensely to agriculture, trade and community life yet they face significant barriers to realising their economic rights, which undermines not only their potential but also the region’s collective prosperity.

In dismantling these barriers, she pointed out that education and skills development – financial literacy, entrepreneurship training and leadership are transformative tools for women’s economic empowerment.

For her part, Sofia Breitholtz, the Chief Executive Officer (CEO) of Reach for Change, explained that her organisation seeks to put entrepreneurs in front and at the centre by connecting them to the important value chains, investment capital, access to markets and resources.

She mentioned that they leverage their platform to tell stories of entrepreneurs and get other sectors involved to journey together, adding that “entrepreneurship has the power to lift and to create a more inclusive society”.

While access to finance remains a key barrier to women’s growth in entrepreneurship, some social entrepreneurs further indicated that the thought of not being capable, a mindset among some women, serves as a barrier to their growth.

“The biggest one is mindset because we have to paint a picture of the women of where they are going to, especially in communities where the women they see in spaces don’t use digital”, the Founder and CEO of Soronko, Regina Honu, said.

Reach for Change is a global non-profit organisation unleashing the power of local social entrepreneurs through a capacity and ecosystem development programme.