…2024 Old Mutual Financial Services Monitor report

By Ebenezer Chike Adjei NJOKU

The financial burden on working Ghanaians continues to intensify as more individuals channel their resources toward supporting family and dependents.

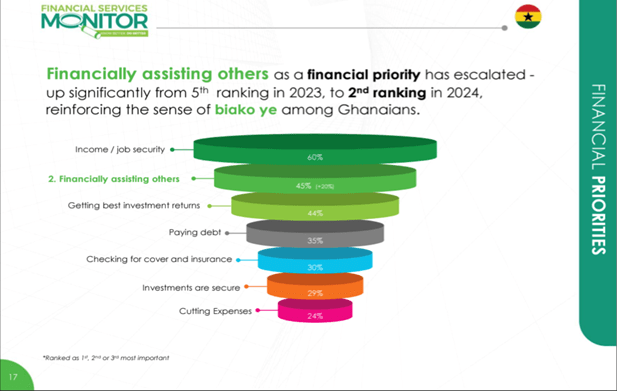

According to the 2024 Old Mutual Financial Services Monitor, financially assisting others has risen sharply as a priority, moving from the fifth position in 2023 to second place in 2024.

This, Old Mutual said, highlights the deepening reliance on communal support systems, encapsulated in the Akan concept of biakoye—the belief that an individual’s well-being is intrinsically linked to that of their community.

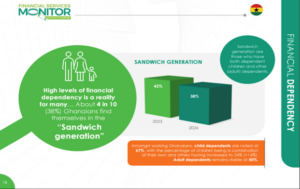

The second edition of the report surveyed 650 working adults earning a minimum of GH¢1,000 per month, and highlighted a significant trend of financial interdependence. “High levels of financial dependency is a reality for many… About 4 in 10 (38 percent) Ghanaians find themselves in the Sandwich Generation,” the report noted.

These individuals are ‘sandwiched’ between two generations—supporting younger dependents (such as their own or relatives’ children) while also providing financial assistance to ageing parents or other older family members. The development exacerbates financial pressures at a time of stagnant incomes and rising living costs.

Declining income, rising commitments

The findings indicate that 69 percent of respondents reported lower or unchanged income compared to the previous year. Despite this, financial obligations toward family members have expanded, with 67 percent of working respondents supporting children and 50 percent assisting adult dependents.

While the government has negotiated a 10 percent rise with organised labour, the disparities in the private sector are widening. Major firms in banking, technology and energy have been able to raise salaries to keep at pace with inflation but the same cannot be said of other segments.

The proportion of individuals providing financial care for both groups increased to 24 percent, marking a 14-percentage-point rise from the previous year.

At the same time, fears over job and income security have intensified. Nearly half of respondents (46 percent) said they constantly worry about losing their income, up from 40 percent in 2023. “Income security remains the top priority for Ghanaians. This is followed by financially assisting others, getting the best investment returns and debt management,” the report stated.

Shift in borrowing and savings behaviour

The growing financial burden has led to changes in borrowing and saving habits. More individuals are turning to informal lending sources, particularly family and ‘Susu’ schemes, to meet financial obligations. The proportion of respondents borrowing from family and friends doubled from 11 percent in 2023 to 23 percent in 2024, while loans from Susu groups rose from 10 percent to 15 percent. Mobile money emerged as a key source of loans, increasing from 12 percent last year to 22 percent this year.

Despite the rise in borrowing, the report suggests an increased emphasis on maintaining savings. “Ghanaians are significantly less inclined to dip into their savings to make ends meet, relative to 2023,” it noted, pointing to a decline in withdrawals from savings accounts from 61 percent last year to 18 percent in 2024.

Presenting the report, Vuyokazi Mabude, Old Mutual’s Group Head in charge of Knowledge and Insights, said while the development could point to a growing awareness of the need to preserve financial reserves amid ongoing economic uncertainty, it was in part due to reliance on family for support.

“The growth in financial reserves signals greater awareness of the need for savings in challenging times, but it also underscores continued reliance on family assistance,” she said.

Side hustlers

Entrepreneurial activity remained a key financial strategy for many respondents. The survey found that 49 percent of them own or part-own a business, with self-employment particularly prevalent in the informal sector. “This, in addition to the 1 in 2 who own or part-own a business, points to an entrepreneurial interest among Ghanaians.”

However, access to formal credit remains limited. Only 9 percent of business owners finance their operations through financial institutions, while 70 percent rely on self-generated funds. Informal lending sources such as Susu groups (19 percent) and loans from family and friends (15 percent) continue to play a critical role in sustaining small enterprises.

This comes as average lending rate for bank-loaned facilities stood at 30.25 percent at the end of 2024.

Retirement planning remains low priority

Despite the focus on financial assistance and investment returns, retirement planning remains a lower priority. The report indicates that only 33 percent of workers are actively saving for retirement, with the category ranking eighth among financial goals. Confidence in retirement preparedness has also declined, with only nine percent expressing confidence in their retirement savings, down from 18 percent in 2023.

The low prioritisation of retirement savings is particularly pronounced among lower-income earners and younger respondents. “Potentially driving the lack of action to save for retirement is the more urgent short-to-medium-term savings goals noted in their top set,” the report stated.

Financial advice gap

Despite the complexity of financial decision-making, most respondents said they navigate these challenges without professional guidance. The survey found that 90 percent of respondents do not have a financial advisor, and half do not know whom to turn to for financial planning.

“Only 21 percent are very confident in their savings and investment decisions, flagging a key area for advice and further support,” the report highlighted.