- Introduction

Government deficit spending creates widespread economic distortions. It is the central policy that distorts, destabilizes, and impoverishes economies globally, particularly in Africa and other developing regions.

As economist Manuel Tecanho discusses in How Government Debt, Inflation, and Taxes Impoverish African Economies (Tecanho, 2022), “government deficit spending, monetary inflation, and high taxes are destructive policies that distort, destabilize, and impoverish economies in Africa and globally” (p. 45).

African policymakers are urged to prioritize solvency and fiscal independence by shifting away from the state-directed model, which has proven repressive and ruinous, and embracing a market-driven approach (Tecanho, 2022).

- The Burden of Unproductive Government Spending

The African continent stands at a critical economic crossroads, facing unprecedented challenges stemming from debt-funded government spending. This destructive policy framework has become the central force destabilizing and impoverishing African economies, creating widespread economic distortions that undermine economic development and prosperity. Over the past decade, Africa’s rising debt levels have had profound consequences for the region’s economic stability and growth.

For instance, according to recent data, African government debt has nearly doubled in the past decade, rising from 30% of GDP in 2013 to almost 60% by the end of 2022. This is evident in countries like Zambia, which defaulted on its debt in 2020, marking the first sovereign default in Africa in two decades. Zambia’s struggle to manage debt has led to severe fiscal and economic challenges, resulting in high inflation, unemployment, and reduced public investment in critical sectors such as healthcare and education (International Monetary Fund [IMF], 2022).

Similarly, in Ghana, debt levels surged to unsustainable levels in 2023, pushing the country into a debt crisis. The government was forced to restructure its debt, leading to significant austerity measures that hit the most vulnerable segments of the population, exacerbating inequality (World Bank, 2023).

More alarmingly, nine African countries are currently in debt distress, with twenty more at high risk, as reported by Afreximbank Research in 2024. These figures underscore the severity of the continent’s debt crisis. In countries like Mozambique, which was already facing a fiscal crisis after its “hidden debt” scandal in 2016, the mounting debt load continues to hinder economic recovery.

Mozambique’s inability to service its debt has delayed critical infrastructure projects and strained its social programs, leaving millions without adequate access to basic services (United Nations Economic Commission for Africa [UNECA], 2023).

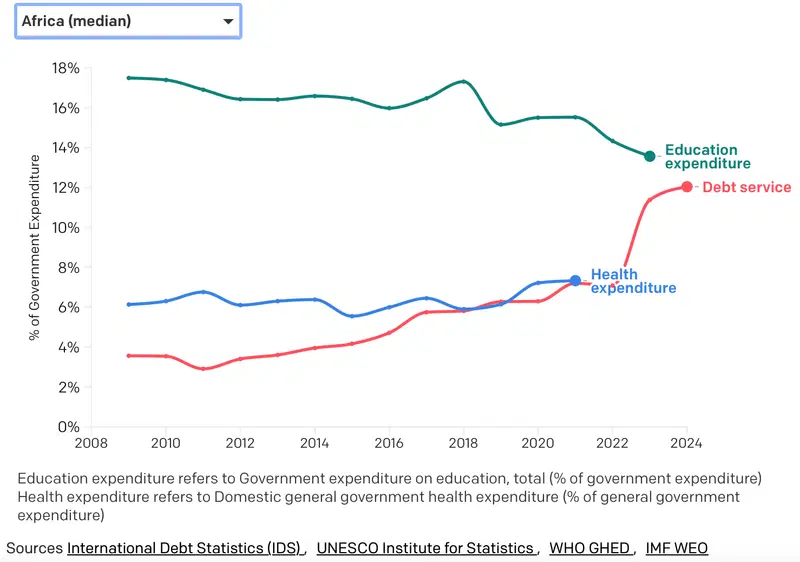

Debt servicing costs are increasingly consuming national budgets across the continent, crowding out vital investments in sectors that directly impact poverty alleviation. For example, in Nigeria, debt servicing has become one of the largest budgetary items, resulting in less funding for essential sectors such as education, healthcare, and infrastructure (Africa Development Bank [AfDB], 2023).

This has contributed to widespread poverty and underdevelopment despite the country’s vast natural resources.

In conclusion, the increasing reliance on debt to finance government expenditure is a double-edged sword for many African countries. While it provides short-term relief, it creates long-term economic challenges that undermine sustainable development. The continent’s ability to manage and restructure its debts will play a pivotal role in shaping its future economic trajectory.

3.0. The Silent Killers: How Debt, Inflation, and Taxation Undermine African Prosperity

The current economic model employed across Africa represents a cruel triple-barreled weapon against justice and prosperity. Economist Manuel Tacanho, in his work How Government Debt, Inflation, and Taxes Impoverish African Economies, discusses how government debt accumulation, monetary inflation, and heavy taxation create a devastating cycle that oppresses citizens, confiscates purchasing power, and drains economic well-being. Tacanho argues that these factors form a “triple trap” that strangles the potential of African economies and impedes growth.

As Tacanho (2019) notes, “Colonial and neocolonial statist models have caused and continue to cause severe economic, sociological, political, and moral harm to African societies. African leaders must prioritize African economic development and prosperity by abandoning Western economics and embracing Africonomics.” Tacanho’s call for a shift away from Western economic paradigms toward more contextually relevant African solutions is increasingly urgent as many African nations find themselves deep in economic crises.

This situation is particularly evident in countries like Zambia, Ghana, and Ethiopia. Zambia, for example, struggled with an unsustainable debt burden, leading to a default on Eurobond payments in 2020. Ghana’s heavy reliance on borrowing from international markets and its subsequent debt service payments have constrained the government’s ability to invest in critical sectors such as education and healthcare, leaving the population vulnerable to economic shocks. In 2021, Ghana’s public debt exceeded 80% of GDP (International Monetary Fund, 2021). In Ethiopia, the country faced a significant challenge of high debt levels, which led to a default on Eurobonds in 2022, exacerbating inflationary pressures and straining public services (Ethiopian Economic Association, 2022).

This economic crisis extends beyond mere financial metrics—it manifests in deteriorating living standards, rampant inflation, and increasing social unrest. For instance, inflation in Zambia surged to over 20% in 2021, leading to an increase in the cost of basic goods and a decrease in purchasing power for ordinary citizens (World Bank, 2021). Similarly, Ghana has experienced widespread protests due to rising prices, with inflation reaching 37.2% in 2022 (World Bank, 2022). Ethiopia’s crisis has similarly led to food insecurity, as the economic instability drives up prices for basic staples, contributing to a rising hunger crisis in the country (World Food Programme, 2022).

The ramifications of these economic challenges are felt not only in the wallets of African citizens but also in the growing social unrest and the erosion of political stability. The austerity measures imposed by international financial institutions often fail to address the structural issues of poverty and inequality, leaving the most vulnerable populations in further despair.

Taxation in Africa has become a tool of oppression rather than development. With an average corporate tax rate of 27.5% – the highest of any region globally – Africa’s tax policies are stifling growth and innovation.

4.0. Conclusion

It’s time for a fundamental change in economic policy choices. African leaders must prioritize economic integration and development by abandoning Western statist economic models that have proven repressive and ruinous. Africonomics, with its focus on the nilar, a transformative economic model, offers a path forward. The model fosters integrated, stable, and thriving African economies by advocating for market-driven development, sound money, and minimal taxation (Bantu, 2021). This conceptual economic model that emphasizes the unique needs and conditions of African nations, proposing an alternative to Western economic frameworks that have historically been used in the continent. It advocates for a market-driven, decentralized approach to economic development, focusing on self-reliance, regional integration, and minimizing external debt reliance.This demands a shift from state-led development to a market-driven approach, from fiat currencies to sound money, and from confiscatory taxation to minimal taxes.

As seen in the cases of Rwanda and Botswana, where economic reforms focused on promoting private sector growth, reducing corruption, and stabilizing macroeconomic fundamentals, there has been notable success in fostering growth and improving the standard of living for citizens (Bertelsmann Stiftung, 2020). Rwanda’s GDP growth consistently exceeds 7% annually, and Botswana’s stable economy has seen rising foreign direct investment since adopting sound fiscal policies in the early 2000s.

Africa’s economic transformation depends on these crucial economic reforms. It is time to break free from the chains of debt, inflation, and over-taxation, and pave the way for a prosperous, independent, and dignified Africa. As the examples from Rwanda and Botswana show, a focus on sound economic policies can lead to sustained growth and increased prosperity for African nations.

Reference

AfDB. (2023). African economic outlook 2023: Debt and development in Africa. African

Development Bank Group. https://www.afdb.org/en/knowledge/publications/african-economic-outlook

Afreximbank Research. (2024). Africa’s debt dynamics: Risks and opportunities. African Export-

Import Bank. https://www.afreximbank.com

Bantu, M. (2021). Africonomics: A new model for African prosperity. African Press.

Bertelsmann Stiftung. (2020). BTI 2020 – Botswana country report. Retrieved from

Ethiopian Economic Association. (2022). Ethiopia’s debt crisis: A critical analysis. Retrieved

from http://www.ethiopian-economists.org

IMF. (2022). Zambia: Economic developments and outlook. International Monetary Fund.

https://www.imf.org/en/Countries/ZMB

International Monetary Fund. (2021). Ghana: 2021 Article IV Consultation-Press Release; Staff

Report; and Statement by the Executive Director for Ghana. IMF Country Report No. 21/155. https://www.imf.org/en/Publications/CR/Issues/2021/06/04/Ghana-2021-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-Executive-465453

Mlambo, V. (2004). The dynamics of Zimbabwe’s hyperinflation. Journal of African Economies,

13(2), 215-238.

Odhiambo, N. M. (2020). The tax burden in Africa: A case study of Kenya. African Development

Review, 32(1), 120-132.

Tacanho, M. (2019). How government debt, inflation, and taxes impoverish African economies.

Journal of African Economics, 25(1), 25-40.

Tecanho, M. (2022). How government debt, inflation, and taxes impoverish African economies.

Economic Publishing House.

UNECA. (2023). Debt distress in Africa: Trends and impacts on sustainable development.

United Nations Economic Commission for Africa. https://www.uneca.org

World Bank. (2023). Ghana’s debt restructuring: The way forward. World Bank Group.

https://www.worldbank.org/en/country/ghana

World Bank. (2022). Ghana: Inflation and its economic consequences. Retrieved from

https://www.worldbank.org/en/country/ghana

World Bank. (2020). Zambia’s debt burden. Retrieved from

https://www.worldbank.org/en/country/zambia

World Bank. (2021). Zambia: Economic update and debt sustainability analysis. Retrieved from

http://www.worldbank.org/en/country/zambia