By David Alemzero (Dr.)

The significance of critical minerals (CRMs) in economic development, energy transition, and environmental sustainability has resulted in increased global attention.

Nonetheless, the issue of unsustainable production gives rise to both economic and ecological concerns. Studies indicate that the Pareto principle is applicable to the correlation between mineral rents and CRM value; nations with lower mineral rents as a percentage of GDP derive greater economic benefit from CRMs than those with substantial mineral revenue as a percentage of GDP.

Diversified economies derive greater benefits from critical mineral development, unlike resource-dependent economies which struggle to maximize critical mineral value. The optimization of critical mineral benefits in resource-rich nations requires a balanced strategy encompassing sustainable production, economic diversification, and robust regulatory frameworks.

The mining and minerals sector, a historically and economically significant industry, underpins development and supports diverse sectors including construction, electronics, and renewable energy. Essential minerals, such as lithium, cobalt, and copper, are crucial components in technologies including electric vehicles, wind turbines, and solar panels.

The environmental consequences of mining, including but not limited to carbon emissions, necessitate a transition towards sustainable practices. Based on European Union projections, global CRM demand is expected to increase twofold by 2060, indicating substantial growth in lithium and cobalt markets driven by the increasing demand for electric vehicles and batteries. Although mining is economically significant, its contribution to global CO2 emissions is only 8%, a figure lower than that of the energy and agricultural sectors.

This policy brief assesses the economic, environmental, and regulatory performance of leading CRM-supplying nations, offering an empirical analysis of factors influencing CRM development.

The triplet objective of economic, environmental, and regulatory performance must be pursued concurrently for these countries to derive maximum economic value, achieve ecological quality, and have better regulatory settings. The energy transition critically depends on these minerals, whose importance is defined by their economic value and the risk to their supply.

Global Drivers of Critical Minerals

It is estimated that the energy transition will be a $100 trillion market, a significant portion of which relies on the availability of critical minerals. According to the European Union, global CRM demand is projected to reach 167 million tons by 2060, representing a twofold increase.

Escalating demand will lead to significant environmental consequences, notably for critical minerals like cobalt and lithium, as inputs to the production of batteries, wind turbines, and other clean energy technologies. The markets for lithium and cobalt are poised for exponential expansion, with battery-grade lithium consumption predicted to double from 2010 to 2030 to meet the escalating needs of the electric vehicle sector.

While contributing significantly to the economy, mining activities generate approximately 8% of global carbon dioxide emissions; a figure comparatively modest when juxtaposed against the energy and agricultural sectors.

Nevertheless, the environmental impact of extracting these critical minerals necessitates regulation to mitigate carbon dioxide emissions. Studies suggest that the critical minerals sector facilitates carbon abatement, with these minerals playing a key role in decreasing overall economic emissions.

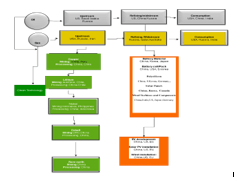

Figure 1: Hydrocarbon and Selected Critical Mineral Supply Chains

Note: DRC= Democratic Republic of Congo. EV=Electric Vehicle. PV=Photovoltaic Source. IEA

Figure 1 presents a systematic depiction of the global supply chains pertaining to energy resources and technologies, categorized into extraction (upstream), processing (midstream/refining), and consumption (downstream) phases. A summary of the core components is provided below:

Oil:

-Upstream operations: Crude oil extraction is predominantly conducted within the United States, Saudi Arabia, and the Russian Federation.

– Refining/Midstream Processing is undertaken in the United States, China, and Russia.

– Consumption: The principal consumers are the United States, China, and India.

Gas:

– Upstream: The extraction is carried out in the USA, Russia, and Iran.

– Refining/Midstream**: Processing activities are conducted in the Russian Federation, the State of Qatar, and Australia.

– Consumption: The United States, Russia, and India are the principal consumers.

Copper:

– Mining operations: Primarily located in Chile and Peru.

– Processing predominantly occurs in China and Chile.

Lithium:

Australia and Chile represent primary sources in the mining of lithium.

– Processing: China and Chile are the primary locations for processing activities.

Battery Materials and Production:

– Battery Materials: The dominant producers are China, Korea, and Japan.

– Battery Cell/Pack Production: Manufacturing is primarily situated in China, the United States, and South Korea.

Polysilicon and Solar Panels:

– Polysilicon: Sources of production include China, South Korea, and Germany.

– Solar Panels: Leading manufacturers of solar panels are based in China, Korea, and Canada.

Wind Turbines and Components:

– Production is spread across China, India, the US, Japan, and Germany. Spain

Clean Technology:

– Nickel:

– Mining Operations: Indonesia and the Philippines.

– The processing is done mainly in China and Indonesia.

– Cobalt:

– Mineral Extraction: The Democratic Republic of Congo and the People’s Republic of China are the key miners of cobalt.

– Processing: Primarily done in China.

– Development of Electric Vehicles: China, the USA, and the EU are at the forefront of this technological advancement.

– Solar Photovoltaic (PV) System Deployment: Key markets include China, the United States, and the European Union.

– Wind Turbine Installation: China, the United States, and the European Union are leading economies.

Rare Earth:

-Mining and Processing: China holds a dominant position.

Figure 1 depicts the global distribution of resource extraction, processing, and consumption, highlighting the significant contributions of China and the United States to the energy and technology sectors.

This also emphasizes the intricate relationships within the global supply chains supporting these crucial industries. China’s dominance in the critical minerals sector has superseded that of the United States. China’s role in the processing of key critical minerals is substantial, exceeding 88%, with some domestic mining operations.

An analysis of the top three critical mineral (CM) producing countries in 2020, focusing on cobalt, copper, and lithium, is provided below. Moreover, it details each country’s contribution to the global production of these minerals. A detailed explanation is provided below:

Cobalt Production

– Top Producers:

The Democratic Republic of Congo (DRC) is the leading global producer of cobalt, accounting for 69% of the world’s output. The Russian Federation’s contribution is 6.3%. Australia accounts for 4%. Other significant producers include Cuba (2.7%), Canada (2.6%), and New Caledonia (France) (1.2%). The Remainder of the World (RoW) collectively contributes 14.2%.

Copper Production

– Top Producers:

Chile is the leading global producer of copper, accounting for 27.8% of global output. Peru provides a contribution of 10.4%. China constitutes 8.3% of the total. Other significant producers include the Democratic Republic of Congo (7.8%), the United States (5.8%), Australia (4.3%), Zambia (4.1%), the Russian Federation (3.9%), Mexico (3.6%), Indonesia (2.5%), and Poland (1.9%). The remainder of the world (RoW) collectively accounts for 19.5%.

Lithium Production

– Top Producers:

Australia is the leading producer of lithium, accounting for 54.2% of global output. Chile contributes 16.3%. China accounts for 12.6% of the aggregate. Argentina constitutes another significant producing economy, contributing 7.3%. The remaining global markets comprise 9.6% of the aggregate total.

The following key Observations are made.

Cobalt:

The Democratic Republic of Congo’s preeminent role as a cobalt producer highlights its substantial contribution to the global battery and electronics industries. Russia and Australia follow, holding the second and third positions respectively.

Copper:

Production is highest in Chile, followed by Peru and China. In contrast to cobalt, copper production is geographically more dispersed, with considerable output from a variety of countries.

Lithium:

Australia holds the leading position, with Chile and China following. Lithium production is essential to the manufacturing of batteries, particularly for electric vehicles and renewable energy storage systems.

Geopolitical Implications:

Global supply chain vulnerabilities are highlighted by the concentrated production of key materials in a small number of countries such as the Democratic Republic of Congo (cobalt), Chile (copper), and Australia (lithium). The production and processing of these crucial minerals are significantly influenced by countries like China, granting them strategic leverage in the international marketplace.

This analysis highlights the critical role of these minerals in contemporary technologies and the geopolitical complexities of their production and distribution.

Conclusions and Policy Implications

The study concludes that all minerals are essential, their significance being contingent upon availability, supply constraints, and utilization. The insignificant carbon footprint of CRM development yields a net positive impact on economic growth and environmental sustainability.

Foreign direct investment (FDI) is directly correlated with the development of customer relationship management (CRM), particularly within developing economies where investment is crucial for resource exploration and development. The implementation of suitable macroeconomic policies ensures that GDP positively influences mineral rent development, promoting both economic advancement and equitable growth.

The development of renewable energy sources is crucial for both economic and environmental reasons, given the essential role of critical raw materials in solar photovoltaic and wind energy infrastructure. Policies that incentivize renewable energy deployment, such as tax rebates and permitting easing, are crucial for scaling up renewable energy technologies.

The policy brief underscores the critical need for efficient mineral resource management, with middle- to high-income nations exhibiting superior resource management practices compared to low-income nations. The Pareto principle is demonstrably applicable; nations exhibiting lower mineral rent proportions of GDP generally realize superior economic gains from CRM development, whereas those with mineral rents as a greater percentage of GDP derive less value from the critical minerals.

Policy Recommendations

Research and Development Investment: National investment in research and development is crucial for comprehensive mineral deposit data acquisition and subsequent dissemination to facilitate development. This will contribute to the diversification of CRM supply, thus reducing the associated risks.

Strategies for private sector-driven growth are essential in developing nations. A supportive environment must be cultivated to attract foreign direct investment (FDI) for CRM development.

Enhanced regulatory structures are crucial for sustainable CRM development, especially in developing economies, necessitating improvements in regulatory quality and anti-corruption measures.

Accelerating Renewable Energy Adoption: The implementation of supportive policies, such as tax rebates and expedited permitting procedures, will facilitate the integration of CRMs into clean energy technologies.

Strategic Mineral Reserves: National stockpiling of critical minerals is recommended to address escalating demand and guarantee supply chain resilience.

The recycling of critical minerals mitigated the depletion of mineral resources, thus enhancing their availability. This approach may mitigate the demand for new materials, although its effectiveness is limited to the short term.

This policy brief offers substantial insights into the economic and regulatory performance of leading CRM-supplying nations, thus providing guidance for sustainable CRM development essential to the global energy transition.

References

- Gielen, D., & Lyons, M. (2022). Critical materials for the energy transition: Rare earth elements.

IEA (2022) Securing Supplies for an Electric Future. Paris: OECD. https://doi.org/10.1787/c83f815c-en.

- Shi, J., Hu, X., Dou, S., Alemzero, D., & Alhassan, E. A. (2022). Evaluating technological innovation impact: an empirical analysis of the offshore wind sector. Environmental Science and Pollution Research, 1-16. https://doi.org/10.1007/s11356-022-23521-8

- Drexhage, J., La Porta, D., Hund, K., McCormick, M., & Ningthoujam, J. (2017). The growing role of minerals and metals for a low carbon future. World Bank, Washington, DC. https://doi.org/10.1596/28312

- IEA (International Energy Agency). 2021a. The Role of Critical Minerals in Clean Energy

Transition. Paris. Available at https://www.iea.org/reports/the-role-of-critical-mineralsin-clean-energy-transition.

The author is a researcher and lecturer at Southwest University of Science and Technology, Mianyang, China.