By Dela AGBO

Since the beginning of 2025, Ghana’s treasury market has experienced a notable downward trend in interest rates.

Under the new Mahama administration, which assumed office on January 7th, treasury bill yields have been falling despite persistent oversubscriptions in the weekly auction process.

This paradox raises critical questions about the state of government borrowing, investor confidence, and the overall economic strategy.

Understanding Treasury Instruments: Bills vs. Bonds & Notes

Treasury securities are categorized into:

- Treasury Bills (T-Bills): Short-term securities with maturities of 91, 182, and 364 days. They are considered risk-free and highly liquid.

- Treasury Bonds & Notes: Long-term instruments (2 years or more) offering periodic interest payments. These instruments typically attract institutional investors and foreign capital.

While T-Bills continue to see strong demand, government bonds and notes have faced defaults, eroding investor confidence in longer-term debt instruments.

Why Are T-Bill Rates Declining Despite Oversubscriptions?

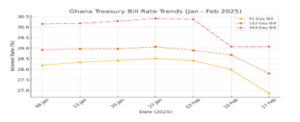

Analysis of the recent treasury auction data shows a consistent decline in interest rates across all tenors. The 91-day bill, for instance, fell from 28.19% on January 6th to 26.86% on February 17th. The 182-day and 364-day bills exhibit similar declines.

Several factors could explain this trend:

- Government’s Debt Management Strategy: The administration may be deliberately lowering rates to reduce borrowing costs, despite the urgent need for funds.

- Limited Alternative Investments: Due to defaults in bonds and notes, investors are shifting towards T-Bills, increasing demand and enabling the government to lower rates.

- Market Confidence in Short-Term Debt: Investors may prefer short-term securities, anticipating an economic recovery or better investment opportunities in the near future.

Investor Behavior: Why Oversubscriptions Persist?

Despite the falling yields, investors continue to flock to T-Bills. The primary reasons include:

- Risk Aversion: Following the default on bonds and notes, investors perceive T-Bills as a safer option.

- Lack of Alternative Investment Channels: The financial sector may not be offering attractive alternative instruments.

- Institutional Mandates: Pension funds and banks are mandated to invest in secure assets like government securities.

What Is the Government Doing?

The administration is employing several strategies to navigate the treasury market dynamics:

- Improving Debt Management: The government may be seeking alternative funding sources to reduce reliance on expensive domestic borrowing.

- Enhancing Investor Confidence: Policy measures aimed at stabilizing the economy could lead to more sustainable borrowing.

- Fiscal Consolidation Efforts: Managing expenditure to reduce the budget deficit and avoid excessive reliance on short-term debt.

- Exploring External Financing: Seeking concessional loans and foreign direct investments to ease pressure on domestic borrowing.

Government’s Next Steps

The government must strike a balance between reducing borrowing costs and maintaining investor confidence. Possible actions include:

- Restoring Credibility in Bonds: Implementing measures to regain confidence in longer-term securities.

- Diversifying Borrowing Sources: Exploring external financing or engaging development partners but the limitation is the IMF program Ghana has currently signed up for.

- Enhancing Market Transparency: Ensuring clear communication on economic policies and debt management strategies.

Conclusion

While the treasury market remains active, the declining rates signal a shifting investment landscape. Investors should monitor government policies closely, while policymakers must address the root causes of market distortions. For deeper insights into portfolio allocation and fixed-income investments, EcoCapital Investment Management Limited offers expert guidance.