… as global oil costs drop but currency pressures persist

A News Desk Story

Motorists and businesses dependent on petroleum products are likely to see a reprieve in liquid fuel prices from the middle of February 2025, on account of global cost reductions.

The price fall is however likely to be tempered by depreciation of the cedi, according to an analysis by the Institute for Energy Security (IES).

“Given the combined effects of global fuel price trends and the cedi’s depreciation, the second pricing-window of February is expected to bring mixed reactions on the local fuel market,” the IES said in its most recent statement.

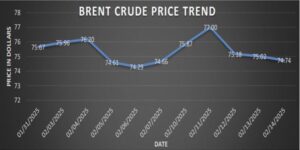

Brent crude drops over 5 percent

Brent crude oil, the global benchmark, saw a steady decline in early February, falling 5.65 percent from US$81.08 per barrel to US$74.74 per barrel by end of the first pricing window. The drop was driven by an increase in U.S. crude oil inventories and seasonal trends, according to market data analysed by IES.

In line with the crude oil price movement, refined petroleum products also registered declines. Data from Standard & Poor’s (S&P) Platts indicate that between the start and midpoint of February, gasoline prices fell by 1.26 percent to US$722.17 per metric tonne while gasoil (diesel) dropped 4.50 percent to US$708.67 per metric tonne.

Also, Liquefied Petroleum Gas (LPG) declined marginally by 0.22 percent to US$622.46 per metric tonne.

Cedi

Despite the decline in global fuel prices, the cedi weakened by 2.18 percent in the first pricing window – trading at GH¢15.42 per U.S. dollar compared to GH¢15.09 earlier in the month, resulting in an increase the cost of petroleum imports.

Projected price adjustments

With these opposing trends at play, IES forecasted a slight reduction in liquid fuel prices, while LPG prices are expected to remain unchanged.

“The Institute for Energy Security (IES) however anticipates a potential decrease in liquid fuel prices given the weight of price decreases on the world market, while LPG prices are likely to remain unchanged,” IES noted.

During the first pricing window of February, retail prices for petroleum products continued their upward trajectory. The national average price for gasoline stood at GH¢15.61 per litre, diesel at GH¢15.65 per litre and LPG was GH¢18.79 per kilogramme.

Given the anticipated downward adjustment in liquid fuel prices, consumers may see marginal relief in petrol and diesel costs. However, LPG – widely used by households and businesses – is unlikely to change.

Pump price

Any reduction will be welcome after consecutive price increases since beginning of the year. However, the impact will depend on how significantly Oil Marketing Companies (OMCs) adjust their prices in response to global market trends and forex pressures, IES noted.

IES identified Benab Oil, Star Oil and Zen Petroleum as offering some of the lowest fuel prices during the first pricing window.

“The OMCs will determine how they react to developments. Some might have much old stock, while others might be looking to gather market share. All of these and other factors will influence the actual pump prices,” Derick Xatse, a Research Analyst at IES, told B&FT.