A News Desk Report

Modernisation of the Tema Oil Refinery (TOR), development of a national pipeline network and reassessment of taxation policies that contribute to high fuel costs are the top issues which must be addressed to stabilise the domestic petroleum sector.

A report by the Chamber of Oil Marketing Companies (COMAC) warns that without these structural reforms, the Gold for Oil (G4O) policy will fail to deliver the intended relief for consumers.

The policy, introduced in 2022 to ease foreign exchange (forex) demand by using gold for petroleum imports, has not been enough to counteract the underlying causes of high fuel prices.

At the time, it was projected that the country would trade 205,750 ounces of locally produced gold in exchange for 350,000 metric tonnes of fuel imports monthly.

The National Petroleum Authority (NPA) estimated the monthly fuel import cost under the programme at US$339.6million (GH¢4.4bn). Based on a gold price of US$1,650 per ounce at the time, 205,750 ounces of gold was calculated to adequately cover this monthly fuel import expense for retail distribution at fuel stations.

However, according to COMAC’s recent report, currency volatility, infrastructure deficits and regulatory inefficiencies were identified as major factors driving fuel costs.

It called for urgent action to modernise TOR, expand the nation’s fuel storage capacity and restructure distribution networks to improve efficiency and reduce costs.

This comes as the nation remains heavily dependent on imported refined petroleum due to insufficient domestic refining capacity. While Sentuo Oil Refinery has added some production, the report notes that the country still falls short of meeting local demand.

“Even with the recent introduction of Sentuo Oil Refinery, the gap between production and consumption persists,” the report stated.

To address this, COMAC recommends that government prioritises private-sector investment in TOR – describing the move as “long overdue”.

“Privatising and revamping critical assets such as TOR is long overdue. Modernisation efforts would reduce reliance on imports and improve domestic refining capabilities, ultimately contributing to a more resilient energy sector,” it said.

Fuel storage capacity is also a concern. The Bulk Oil Storage and Transportation Company (BOST), which manages strategic reserves, does not have adequate capacity to shield the market from supply disruptions.

“Without adequate strategic reserves, Ghana is increasingly vulnerable to supply disruptions which, in turn, contribute to price volatility,” a portion of the report stated.

The report also called for expanded storage infrastructure to ensure energy security.

High distribution costs, pipeline development

The country’s fuel distribution network is another major source of inefficiency, with Bulk Road Vehicles (BRVs) handling most transportation. This over-reliance on road transport increases logistics costs and puts additional pressure on fuel prices.

“The sector’s over-reliance on BRVs for fuel transportation leads to delays, increased logistical costs and significant strain on the Unified Petroleum Price Fund (UPPF). Developing a more robust pipeline network would not only enhance distribution efficiency but also help lower costs and reduce logistical challenges,” COMAC noted.

The report further recommended investment in a national pipeline system to reduce transport costs and improve fuel supply chain efficiency.

Taxation

In addition to infrastructure challenges, the report highlights taxation as a key factor inflating fuel prices. The Primary Distribution Margin (PDM) levy, which adds 26 pesewas per litre to consumer costs, is flagged as an unfair burden – particularly since more than 50 percent of petroleum products bypass designated depots.

“The PDM, initially introduced to cover inter-depot transportation costs, imposes a 26-pesewa-per-litre charge on consumers, regardless of whether the fuel passes through BOST facilities,” the Chamber noted.

It suggested reallocating these funds toward infrastructure projects, such as a national pipeline network, to reduce long-term costs.

“Instead of levying blanket charges, a more transparent allocation of funds to critical infrastructure improvements, such as a national pipeline network, could significantly reduce transportation costs and lower fuel prices,” it remarked.

Currency volatility

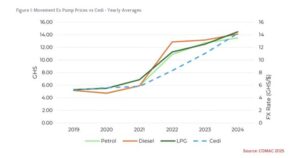

Unsurprisingly, depreciation of the cedi was also identified as a major driver of fuel price increases. While global crude oil prices fluctuate based on international benchmarks such as Platts and Argus, the nation’s dependence on fuel imports makes exchange rate instability a major concern.

“While global benchmarks like Platts and Argus remain relatively stable year-on-year, Ghana’s weak and volatile currency exacerbates fuel price fluctuations,” the report stated.

Analysts have observed a strong correlation between the cedi’s decline and fuel price hikes over the past five years. Last year alone, the cedi depreciated by 19 percent against its US counterpart. The report urged policymakers to implement strategies to support currency stability.

“Stabilising the cedi is not only an economic necessity but also a strategic imperative to mitigate fuel price volatility and curb inflation,” it said.

Furthermore, regulatory inefficiencies have also contributed to high fuel costs. The Zonalisation Policy, introduced in September 2023 to streamline fuel distribution, has instead created new constraints; leading to stock shortages and additional costs for oil marketing companies.

“Stock shortages at designated depots have led to supply disruptions, compelling oil marketing companies to seek cross-zonal authorisations. This process, mired in bureaucratic delays, introduces additional costs,” COMAC noted.

The report also highlighted technical failures in the Integrated Customs Management System (ICUMS) which have caused frequent delays in petroleum imports, increasing administrative costs and slowing supply chain operations.