By Juliet ETEFE ([email protected])

The inflation rate for January 2025 stands at 23.5 percent, marking a slight decrease from 23.8 percent recorded in December 2024 according to the latest Consumer Price Index (CPI) report released by Ghana Statistical Service (GSS).

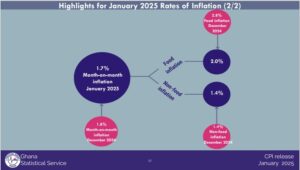

The report also indicates that month-on-month inflation between December 2024 and January 2025 was 1.7 percent, indicating continued price pressures.

Food inflation remained a dominant factor, standing at 28.3 percent compared to 27.8 percent in December while non-food inflation was recorded at 19.2 percent compared to 20.3 percent in December.

Inflation for locally produced items declined to 25.7 percent in January 2025 compared to 26.4 percent in December 2024. Also, inflation for imported items went up in January, recording 18.4 percent compared to 17.9 percent in December 2024.

Regional disparities in inflation are evident in the data, with Upper West Region experiencing the highest rate at 34.3 percent while Volta Region recorded the lowest at 17.1 percent. This highlights varying economic conditions across the country, with some areas feeling the impact of price increases more severely than others.

A breakdown by category reveals that inflation was driven primarily by rising costs in food and non-alcoholic beverages, housing and utilities, transportation and clothing.

Several products recorded price increases above the overall inflation rate, particularly essential food items, utilities and transportation costs. The rising prices of vegetables, cereals and dairy products significantly contributed to food inflation. Fuel price fluctuations also played a role in transport sector inflation.

Alcoholic beverages, tobacco and narcotics recorded inflation of 27.2 percent. Food and non-alcoholic beverages also recorded 28.3 percent, while housing, water, electricity, gas and other foods had 24.6 percent. These divisions recorded higher inflation compared to the national inflation rate.

Despite a slight reduction in the inflation rate from the previous month, concerns remain over persistent high prices in essential commodities.

Monetary policy decision

To stabilise inflation and address these structural issues, the Bank of Ghana’s Monetary Policy Committee (MPC) opted to maintain the policy rate at 27 percent.

The Bank of Ghana (BoG) has revised its target for achieving single-digit inflation, now projecting the milestone for the second quarter of 2026 instead of the previously announced first quarter.

This was revealed during a press briefing by former BoG Governor , Dr. Ernest Addison, following the Monetary Policy Committee’s (MPC) 122nd meeting.

The Bank’s mandate is to maintain inflation over the medium-term within a band of 8± 2 percent.

Dr. Addison attributed the revised timeline to prevailing economic conditions and structural challenges. He noted that achieving the new target will depend on continued fiscal consolidation and adherence to the International Monetary Fund (IMF) programme guidelines.

“Our forecasters are saying that instead of reaching the single digit by first quarter of 2026, we will do that in the second quarter. Of course, all of that is predicated on the economic policy agenda, which is yet to be crafted,” he stated.