By Joshua Worlasi AMLANU & Ebenezer Chike Adjei NJOKU

Synergy between the current administration’s 24-hour economy programme and its predecessor’s industrial policy could catalyse significant growth in the country’s manufacturing sector, according to a leading investment manager.

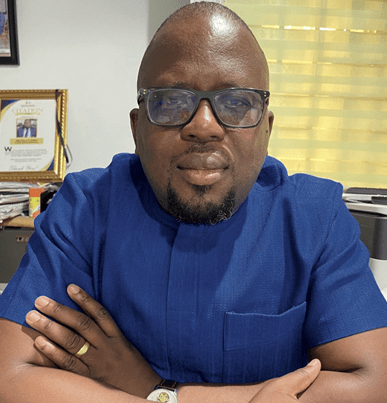

Dela Agbo, chief executive of EcoCapital Investment, suggests the combination supported by targetted fiscal incentives for publicly listed entities could drive transformation in both the real economy and capital markets, particularly equities in the manufacturing segment.

“If factories under the One District, One Factory initiative are incentivised to operate 24 hours a day, it will significantly boost productivity. When these two policies are integrated successfully, it can create a win-win situation for businesses and the economy,” Mr. Agbo said in an interview with B&FT.

While he acknowledged the cautious approach investors are likely to take due to uncertainties, he remained optimistic about potential impact of these policies on the stock market.

“Successful execution of these initiatives could translate into a positive outcome for the Ghana Stock Exchange, especially following its performance last year,” he stated – referencing the 56.17 percent gain that made Accra bourse best performing on the continent in 2024.

Last year, GSE witnessed significant sectoral divergence with the consumer goods sector emerging as market leader, posting an average return of 77.1 percent.

This was particularly driven by Unilever Ghana which spearheaded the rally with a 140.4 percent gain – translating to a GH¢11.39 capital appreciation as shares surged from GH¢8.11 to GH¢19.50 between the beginning and end of 2024. Guinness Ghana Breweries recorded a 61.8 percent increase, adding GH¢2.10 to reach GH¢ 5.50. Fan Milk showed more modest growth of 13.9 percent, gaining GH¢0.45 to reach GH¢3.70.

However, Dannex Ayrton Starwin declined five percent by losing GH¢0.02 to GH¢0.38 while Intravenous Infusions remained unchanged at GH¢0.05.

In the banking sector, Ecobank Transnational led with a 106.7 percent gain (GH¢0.16 increase to GH¢0.31), followed by GCB Bank’s 87.4 percent rise (GH¢2.97 gain to GH¢6.37).

Access Bank gained 52.9 percent (GH¢1.80 increase to GH¢ 5.20), while Standard Chartered Bank appreciated 31.1 percent (GH¢5.45 gain to GH¢23). Republic Bank posted a 37.5 percent return (GH¢0.18 gain to GH¢0.66) and Ecobank Ghana added 18.2 percent (GH¢1 increase to GH¢6.5).

On the lower end, Trust Bank Gambia barely moved with a 1.2 percent gain (GH¢0.01 to GH¢0.83), while Societe Generale declined 4.5 percent (GH¢0.07 loss to GH¢1.50). Cal Bank suffered the sector’s biggest decline of 27.1 percent (GH¢0.13 loss to GH¢0.35).

SIC Insurance saw its share price rise by 12.5 percent (GH¢0.03 gain to GH¢0.27).

Enterprise Group’s 17.2 percent decline (GH¢0.41 loss to GH¢1.98) however dragged the insurance sector’s average down.

The mining sector averaged 29.5 percent returns. NewGold led with a 78.7 percent gain (GH¢172 increase to GH¢ 390.5) while Atlantic Lithium rose 39.1 percent (GH¢1.72 gain to GH¢6.12). AngloGold Ashanti and its Depository Shares remained flat at GH¢37 and GH¢0.41 respectively.

In energy, TotalEnergies Marketing Ghana gained 45.8 percent (GH¢4.12 increase to GH¢13.12) while Ghana Oil Company added a modest 1.3 percent (GH¢0.02 gain to GH¢1.52).

Benso Oil Palm Plantation, the sole agricultural stock, posted a 14.8 percent gain (GH¢3.26 increase to GH¢25.26).

Perennial market leader and ICT giant MTN recorded a 78.6 percent gain (GH¢1.10 increase to GH¢2.50).

Meridian Marshalls Holding Company declined 9.1 percent (GH¢0.01 loss to GH¢0.10).

Analysts have said that the sectoral performances, in part, reflect the broader economic dynamics at play – with the consumer sector’s outperformance pointing to strong domestic demand.

The proposed abolition of certain taxes, such as the e-levy and COVID-19 levy, has sparked concerns about government’s ability to meet revenue targets.

Mr. Agbo highlighted the importance of expanding the tax base to address these gaps.

“Rather than relying on a small group of taxpayers, government needs to find ways of expanding the tax net. This will help offset any revenue loss from abolishing these taxes,” he noted.

The investment professional also called for reforms in the country’s tax system to encourage compliance and improve tax collection. Drawing from international examples, he suggested that introducing tax refunds could incentivise tax filing.

“In the U.S., the possibility of receiving a refund encourages people to file their taxes. If Ghana introduced similar measures, it would increase tax compliance and help broaden the tax base,” he explained.

The cedi’s stability is another critical factor in driving economic growth. Mr. Agbo noted that businesses, especially small and medium-sized enterprises (SMEs), are highly sensitive to fluctuations in exchange rates.

“When the exchange rate is unstable, it’s harder for SMEs to plan and grow. A stable currency will help businesses thrive, which in turn creates more opportunities for investors,” he said.

He further pointed out the challenges posed by high import duties, which can erode business profits and hinder growth.

“If businesses are spending too much on import duties, it affects their bottom line. This is something that government must address in order to make the business environment more conducive for growth,” he stated.

Despite these challenges, Mr. Agbo remains confident that the economy can thrive if the right policies are put in place. He believes that with the right mix of tax reforms, exchange rate stabilisation and business incentives, Ghana can achieve significant economic growth.

“Even in an election year, the Ghana Stock Exchange has proven its resilience. By implementing stable and supportive policies, Ghana can continue to attract investment and achieve sustainable growth,” he asserted.