By Juliet ETEFE ([email protected])

The 2024 UK-Ghana Chamber of Commerce (UKGCC) Business Environment and Competitiveness Survey (BECS) has revealed a mixed outlook among some businesses in Ghana regarding their preparedness for the African Continental Free Trade Area (AfCFTA).

“Businesses have mixed feelings about their preparedness for the AfCFTA. While many respondents recognise the significant opportunities AfCFTA presents – such as access to a larger market and the potential for increased exports – concerns remain about the level of readiness, especially among small and medium-sized enterprises (SMEs),” the report said.

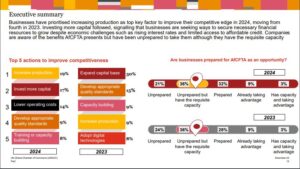

According to the survey which engaged 725 respondents from diverse sectors, 21 percent of businesses indicated they are unprepared, lacking in the capacity needed; 36 percent indicated they are unprepared, but have the requisite capacity; while 32 percent claimed to be prepared and have the capacity but have not deployed it yet.

However, nine percent said they were already taking advantage of the AfCFTA, while still building capacity alongside; and three percent has requisite capacity and is also already taking advantage of AfCFTA.

AfCFTA, heralded as a transformative initiative for economic integration across Africa, seeks to offer businesses access to a vast market of over 1.3 billion people.

Optimism

The report noted that respondents are optimistic about the role of AfCFTA in fostering a more competitive business environment by reducing trade barriers and facilitating the movement of goods and services across borders.

For businesses in the manufacturing and agriculture sectors, the prospect of accessing regional supply chains and new consumer bases is seen as a game-changer.

While many see the agreement as a gateway to a larger market and increased export opportunities, significant challenges persist.

Challenges

Despite the optimism, some businesses reported limited understanding of the agreement’s requirements – and these knowledge gaps hinder their ability to fully exploit the trade agreement’s benefits.

The report also emphasised access to financing as a critical challenge, with SMEs citing lack of affordable credit as a major constraint to scaling operations and expanding into regional markets.

Also, high operational costs – including energy, transportation and raw materials – further compound the difficulties faced by smaller businesses attempting to compete on a continental scale.

Regulatory and infrastructural barriers

Findings further point to regulatory and infrastructural challenges as key impediments to AfCFTA-readiness, as respondents expressed concerns about bureaucratic delays, inconsistent policies and a lack of transparency in regulatory frameworks.

Infrastructural gaps, particularly in transport and logistics, were also highlighted as critical barriers.

Recommendations for improvement

The report has it that: “Factors that are influencing expansion decisions to take advantage of AfCFTA include lower operating cost, expanding market, lower taxes, low corruption, transparency and closeness to customers”.

As such, “To fully benefit from AfCFTA, businesses are calling for more government support in safety and security of investment, low corruption, transparency, tax cuts, effective regulatory reform and quick approvals and effective bureaucracy that facilitates seamless intra-African trade”.

Capacity building

A recurring theme in the survey is the need for targetted capacity-building initiatives to support businesses in navigating AfCFTA requirements.

Respondents also called for government and private sector collaboration to provide training on export procedures, compliance with trade standards and accessing market intelligence.

Tailored support for SMEs, including access to affordable financing and advisory services, could significantly enhance their ability to leverage AfCFTA opportunities.

SMEs, in particular, represent a vital engine for growth; but they will require improved access to financing, technology and favourable government policies to thrive.

Generally, “The survey found that cost of capital continues to be a major hurdle, particularly for small and medium-sized enterprises (SMEs), which account for a substantial portion of the private sector. Higher interest rates, combined with stringent lending conditions from banks, have made it difficult for businesses to secure funding.

“Many respondents called for government intervention to ease these financial pressures, suggesting a need for targetted tax incentives and flexible financing mechanisms to support business growth. Without improved access to affordable financing, many SMEs are at risk of stagnation – which could impede broader economic growth.”

About the survey

Being the 6th edition, the BECS generally offers insights into Ghana’s business environment – drawing responses from various sectors.

The survey, which involved member-companies of the UK–Ghana Chamber of Commerce and other businesses, had 725 respondents; reflecting a 4% increase from the 696 participants in the 2023 survey. Most respondents reported turnovers up to US$0.499million, with service-based businesses being the most common.

Of the responding businesses, 98% were fully locally-owned. Investor countries represented via the 2% of business respondents included South Africa, the UK, the USA, China and France. Lebanon, Holland, Canada, India, Switzerland and Spain were also represented in the survey. Most responses came from small companies with fewer than 50 employees.