By Elizabeth PUNSU

Kwaebibirem Rural Bank PLC at Asuom in the Eastern Region has posted impressive growth in all indicators in 2023 year under review.

The bank recorded a profit before tax of approximately GH₵4.1 as compared to the previous year’s profit of about GH₵3.45million representing a growth rate of 20 percent. Total assets of the bank grew from GH₵57.1 million in 2022 to GH₵76 million, representing a growth rate of 33 percent.

The rise in profit is attributed to improved revenues generated from operations and prudent management of recurrent expenditures both on the part of the Board, Management and the entire Staff.

In view of this remarkable results, the Directors have recommended the payment of total dividend of GH¢793,066.48 representing GH¢0.02p dividend per share as at December 31, 2023.

The Directors of the Bank have obtained exceptional approval from the Bank of Ghana to pay dividends to the shareholders for the financial year of 2023. Kwaebibirem Rural Bank PLC is among the few Banks approved by the BoG to pay dividend.

Meanwhile shareholders of the Bank have expressed their gratefulness and satisfaction with current operational performance of the Bank and have urged the board to do well to maintain and reward the current management team especially the CEO, Prince Obiri Yeboah whose tenure is witnessing all these positive signs of growth.

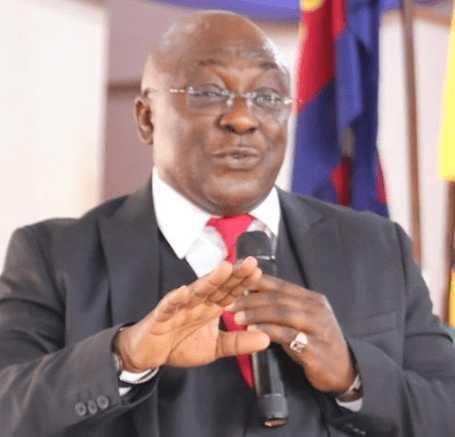

The Chairman of the Board of Directors, Carlos Kingsley Ahenkora, announced these and more at the Bank’s 37th Annual General Meeting (AGM) of shareholders which also marked the climax of 40th anniversary celebration of the Bank.

Economic environment

According to him, following the economic crises experienced in the year 2022, the economy witnessed some improvements in its economic recovery throughout the year 2023. Inflation reduced from 54.1 percent to 23.20 percent by December, 2023, reflecting a more improved condition as compared to the previous year.

He added that apart from the general challenges mentioned, the banking sector in the country showed stripes of positivity by recording 224.6 percent growth in profit to GH₵8.3 billion in 2023, which the bank shares in this great achievement, a sign that the economy is bouncing back from the shocks of the Domestic Debt Exchange Programme (DDEP) by the government.

In spite of the unstable macroeconomic environment in which the bank operated during the reviewed year, the bank managed to pull an impressive operational performance in all the financial indicators as shown in the table.

| Indicator | 2023

GH¢ |

2022

GH¢ |

% Change

|

| Total Deposit | 61,947,740.00 | 48,585,493.00 | 27.50 |

| Investment | 47,742,105.00 | 34,591,714.00 | 38.02 |

| Advances | 17,379,597.00 | 13,279,784.00 | 30.87 |

| Shareholders’ Fund | 7,107,047.00 | 4,404,570.00 | 61.36 |

| Profit Before Tax | 4,128,799.00 | 3,447,455.00 | 19.76 |

| Total Assets | 75,949,969.00 | 57,112,851.00 | 32.98 |

Corporate Social Responsibility

Mr. Ahenkora, further indicated that so far in the year 2023 under review, the bank spent about GH₵ 50,000.00 as it continues to offer support to the public institutions in its operational territories with their CSR activities in the area of security and education among others.

He said the bank also spent about GH₵98,170 as donations to schools and other institutions in the form of building materials, computers, educational event sponsorships and other kind gestures.

Future outlook

Due to the bank’s performance for the past three years, the board and management will embark on branch expansion and introduce new products and services, in the last quarter of 2024;

The Board Chair mentioned that in line with the bank’s four-year strategic plan which expires next year, it will seek to open two new branches at Akokoaso and Akroso. He added that feasibility studies have been completed and the necessary documentations are ongoing with the appropriate bodies.

The board also intends to open two mobilization centers; one at Adankrono and the other at Abaam, this will bring banking services to the door steps of customers and potential customers’ while expanding deposit mobilization drive in these communities and their environs.

The Board and Management also intend to roll out Point of Sale Devices (POS) for sales executives. These devices will help in deposit mobilization drive and fast truck their operation on the field.