By Ebenezer Chike Adjei NJOKU

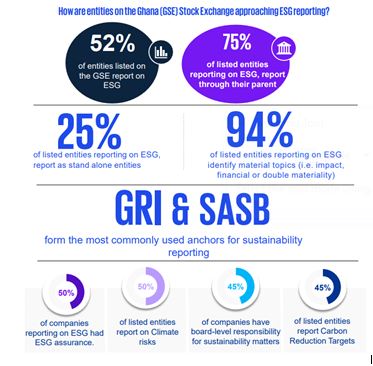

Sixteen out of 31 companies listed on the Ghana Stock Exchange (GSE), representing 52 percent, are actively engaging in environmental, social and governance (ESG) reporting, a new KPMG survey has revealed.

This development marks a notable advancement in the domestic corporate sector, demonstrating a heightened focus on sustainability and transparency – particularly over the past five years.

However, the report titled ‘ESG Reporting in Ghana: Are Listed Companies Meeting Expectations?’ also highlights persistent gaps in ESG compliance and materiality – environmental and financial – assessments, with 48 percent of listed entities still not disclosing any sustainability-related information whatsoever.

“The insights gathered from this survey offer a nuanced view into the evolving ESG and sustainability reporting landscape among listed entities.

“A significant portion of companies listed on the GSE are now actively reporting on their ESG practices, a testament to the growing emphasis on transparency, accountability and sustainable business practices,” the exchange’s Managing Director, Abena Amoah, said of the survey which was based entirely on publicly available information – primarily annual financial reports and sustainability reports from 2022 to 2023.

“This shift reflects the increasing expectations of stakeholders – from investors to regulators – and highlights the need for businesses to integrate ESG considerations into their strategic decision-making,” she added.

The survey found that among companies reporting on ESG, 75 percent rely on parent or group companies to report while 25 percent disclose independently.

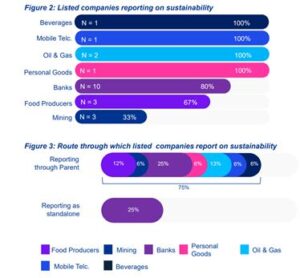

Certain industries – such as beverages, mobile telecommunications and oil & gas, demonstrate full compliance in ESG reporting.

In contrast, sectors like forestry, life insurance and technology hardware have no representation in the ESG reporting sphere.

“While our findings indicate that many listed companies are taking steps toward ESG compliance, there remains a significant opportunity for others,” said KPMG Partner and Head of Advisory, Andy Akoto.

For the 48 percent of companies which are not reporting “in spite of the push for more business disclosures”, KPMG cautioned that lack of ESG reporting from these businesses could obstruct investor decision-making.

Without insight into ESG, it said, investors may struggle to make informed choices on their investments through sustainability performance metrics. This situation, it added, underscores the necessity for stronger regulatory measures to promote ESG reporting for listed companies.

Mr. Akoto expressed the readiness of his outfit to help bridge the gap, saying: “We stand ready to support… ensuring they not only comply with regulations but also create long-term value”.

This development comes as the Accra bourse launched its ESG Disclosures Guidance Manual in November 2022, based largely on the Global Reporting Initiative (GRI).

This saw GSE join more than 60 stock exchanges across the globe which guide ESG reporting, according to the United Nations Sustainable Stock Exchanges (SSE) – a body of which GSE is a member.

Subsequently, GSE announced that it has developed a nuanced ESG reporting framework that categorises companies into three groups based on market capitalisation.

This tiered approach acknowledges the varying capacities of listed companies to adopt ESG reporting practices. Top-tier companies, many of which are multinationals, were found to already be reporting on ESG matters.

Banks lead

The banking industry was unsurprisingly in the lead, with 80 percent of the listed banks reporting on ESG. Banks are also leaders in standalone ESG reporting, a trend influenced by implementation of the Sustainable Banking Principles by the Bank of Ghana (BoG) in 2019.

In June this year, the BoG, revealed that banks in the country had achieved a 62.5 percent compliance rate with the Ghana Sustainable Banking Principles by end-2023.

The banking sector stands out in governance, with 70 percent of listed banks integrating ESG matters into board-level responsibilities. This is higher than the average of 45 percent across all sectors.

Global standards

The survey also touched on the importance of adhering to global frameworks such as the GRI and Sustainability Accounting Standards Board (SASB). 61 percent of companies reporting on ESG align with these standards, either exclusively or in combination.

Meanwhile, 30 percent of listed companies have also developed internal ESG reporting frameworks tailored to industry-specific challenges.

Assurance, climate action

The survey also found that 50 percent of reporting companies have undergone external assurance for their ESG disclosures, with ISAE 3000 serving as the primary standard. Assurance adoption is most prevalent in industries such as beverages, oil and gas, and personal goods, which face greater environmental scrutiny.

Nearly half (45 percent) of GSE-listed companies reporting on ESG include carbon reduction targets in their disclosures. The report describes this as “a positive development, as it demonstrates a growing commitment to sustainability and a recognition of environmental responsibility’s importance among listed companies”.

GSE’s Deputy MD, Frank Berle, expressed hope that the remaining listed companies will participate in sustainability reporting. He emphasised its growing necessity as a global corporate practice due to its significant influence on social, environmental and financial performance.

“This follows continuous engagements with our listed members, stakeholders and the issuance of International Financial Reporting Standards on Sustainability,” he told the B&FT.

He is optimistic that the development will result in a significant shift toward transparent corporate reporting, potentially attracting international sustainable investment and setting a regional benchmark for corporate accountability.

At the second day of trading’s close in the final week of November 2024, the GSE had a market capitalisation of GH¢108 billion with the GSE Composite Index up 49.43 percent compared to beginning of the year.