Fiaseman Rural Bank, with its headquarters at Bogoso in the Western Region, is one of the most competent financial intermediation companies in the rural and community banking sector.

As a high performing bank and a leader in the industry, it is expected to show the rest of the industry how to navigate through the turbulent business environment and the policy decisions requisite for restoring macroeconomic stability and sustained strong growth.

The stint of the current CEO

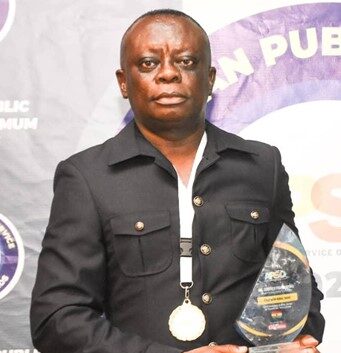

Dr. Godfred Frank Opoku is the Chief Executive Officer of Fiaseman Rural Bank Plc. He is an astute banker with over 33 years of experience in banking.

He holds a Master’s Degree in Administration (Accounting option), Bachelor of Commerce, Professional Certificate in Microfinance and Certificate in Microfinance – all from the University of Cape Coast; and a Diploma Certificate in Modern Administration from Cambridge International College, U.K. He also holds a Bachelor of Law Degree (LLB) from the Presbyterian University College, Ghana.

Dr. Opoku brought his rich experience in the industry to bear immediately he took over in October 2021, culminating into the sterling performance with his three-year stint with the bank.

| NO. | INDICATORS | OCT.2021 | OCT.2024 | VARIANCE | % |

| 1 | PROFIT BEFORE TAX | 10,910,984.82 | 57,775,166.46 | 46,864,191.64 | 81 |

| 2 | TOTAL INCOME | 50,122,826.33 | 160,694,225.75 | 110,571,399.42 | 69 |

| 3 | TOTAL ASSETS | 238,033,784.20 | 910,479,181.73 | 672,445,397.53 | 74 |

| 4 | DEPOSITS | 201,519,396.47 | 760,444,713.83 | 558,925,317.36 | 73 |

| 5 | ADVANCES | 102,962,836.01 | 313,179,226.79 | 210,216,390.78 | 67 |

| 6 | SHAREHOLDERS’ FUND | 28,143,535.27 | 105,511,499.30 | 77,367,964.03 | 73 |

| 7 | INVESTMENT | 78,570,030.78 | 392,701,001.75 | 314,130,970.97 | 80 |

Awards and achievements

The bank entered GIPC’s prestigious Club 100 ranking in 2005 and has steadily improved its placement over the years. By the 2019 edition of the Club 100 rankings, Fiaseman Rural Bank Plc placed 31st among the 100 best companies in Ghana. In the last two editions of the award – 20th and 21st editions, Fiaseman placed 45th and 52nd respectively, ranking 2nd best in the rural banking industry on both occasions.

The bank has consistently featured in the strong category of the Efficiency Monitoring Unit (EMU) ranking of rural banks in the country as done by their regulator, the ARB Apex Bank PLC. It was adjudged the overall Best Rural Bank in Ghana by the Association of Rural Banks in their Rural & Community Banks (RCBs) Excellence Awards in 2017 and at the same awards, the bank was adjudged the 2nd runner-up in the loan, leading the rural banking industry to safe harbour financing category.

More recently in August 2022, a Gold Award was conferred on Fiaseman Rural Bank PLC. by Ghana Premier Business & Finance Excellence Awards in recognition of its outstanding contribution to the Economic Development of Ghana in the Rural Banking Category.

In the just-ended Association of Rural/Community Banks Excellence Awards – 2024, Fiaseman won three awards, giving credence to its excellent performance over the period.

Chiefly among the three awards was the Best Rural Bank in Loan Financing. This particular award is a testament to the bank’s continuous support to the growth of the SME sector with innovative loan products such as the Smart Loan.

Corporate social responsibility

Indeed, over the past couple of years the bank has spent some GH₵1million on corporate social responsibility initiatives, with interventions in education, health, water, security and community support

Branch network

The bank’s impact covers a wider geographical area than most other rural banks in the country. Since it was established in November 1983, the bank has extended its operations beyond the Western Region to the Central Region and currently has 14 branches located at Bogoso, Sikafie, Prestea, Bawdie, Ateiku, Tarkwa, Aboso, Tamso, Huni Valley, Wassa, Damang, Asankrangua, Agona Amenfi, Takoradi and Abura in the Central Region.

Investment in Twifo Rural Bank PLC

Instructively, the bank has a 60 percent stake in Twifu Rural Bank Limited located at Twifu Praso in the Central Region of Ghana, making it the first rural bank in the country to have a stake in another Rural Bank.

Fiaseman Rural Bank’s success derives its bouquet of products and service and the ways in which they are delivered; thus, putting it at the cutting edge of the rural banking industry in Ghana.

The latest addition is the Smart Loan, which focuses on the SME sector in the areas of working capital, goods purchases, goods clearing, shop rental and asset financing.

Instructively it can be accessed digitally. Deservedly, superior financial intermediation products and services, delivered in a most customer friendly manner have resulted in exemplary financial performance.

Financial performance

In 2022, Fiaseman Rural Bank PLC made a profit before tax of approximately GH₵14,398,799, the highest in the history of rural banking industry in Ghana. This has grown further in 2023, by 157 percent to GH₵36.976million.

This financial performance continues to improve by the year. In 2023, income generated by the bank reached GH₵134.428million, up 77 percent on the GH₵75.740million earned in the previous year.

Underpinning this is the strength of the bank’s balance sheet. By the end of 2023, total assets had reached GH₵536.656million, up 53 percent on the GH₵351.898.71million achieved a year earlier.

This was financed by the ever-growing confidence in the bank by customers as a safe haven for their savings and investments, with deposits growing by 51 percent during 2023 from GH₵308.273million at the beginning of the year to GH₵465.189million by year’s end.

Prudently, the bank mirrored its asset growth with similar expansion of its loan portfolio, which grew by 106 percent to GH₵229.986million last year, up from GH₵111.579million as at the end of 2022.

Ghana’s financial intermediation industry is inevitably sailing through turbulent waters, as government’s fiscal reforms to ensure debt sustainability take hold led by the recently concluded Domestic Debt Exchange Programme (DDEP).

Due to our outstanding performance so far, the country’s rural banking sector will be looking up to Fiaseman Rural Bank to show it the way to safe harbour; which means this year, the bank has even more responsibilities than ever before.