The Central Securities Depository (CSD) of Ghana marked its 20th anniversary with a celebration that highlighted its evolution and future aspirations.

The event, which took place in Accra, saw Dr. Maxwell Opoku Afari, Board Chairman of CSD and First Deputy Governor of the Bank of Ghana, address the audience on the institution’s achievements and its plans for the years ahead.

Reflecting on the journey of the CSD, Dr. Afari described its establishment two decades ago as a strategic move to create a secure and efficient depository system. He noted that the depository’s role in safeguarding and settling securities has been pivotal in the growth of Ghana’s capital markets.

“From our beginnings as a department within the Bank of Ghana, to our current status as an independent, thriving institution, our journey has been one of evolution, adaptation, and resilience,” he stated.

Dr. Afari emphasized the support of key stakeholders in the success of the CSD, mentioning the critical roles played by the Bank of Ghana, the Ghana Stock Exchange, and the CSD’s management team. According to him, this collaborative effort has allowed the CSD to navigate a dynamic and complex financial landscape.

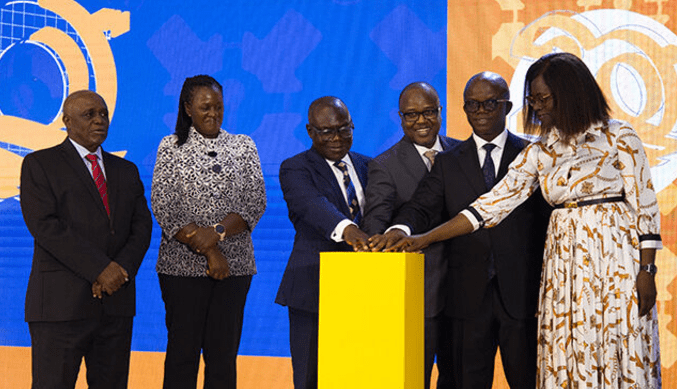

He announced the launch of a new logo for the CSD, describing it as a modern representation of the institution’s commitment to innovation and protecting investments in the financial markets.

“This new logo symbolizes our dedication to protecting investments and fostering trust and innovation in Ghana’s financial markets,” he said.

The theme of the celebration, “Reflecting on Two Decades of Depository Services in Ghana: Evolution, Innovation and Beyond,” was chosen to highlight the CSD’s adaptability and growth over the years.

Dr. Afari remarked that the CSD’s transformation from a foundational department within the Bank of Ghana to an independent institution reflects its steady pursuit of excellence. He noted that adopting advanced technologies and enhancing service offerings have been crucial in meeting the demands of a changing market.

“Through the years, the CSD has continuously innovated, adopting advanced technology and enhancing service offerings to address emerging market needs,” he noted.

Highlighting the organization’s vision for the future, Dr. Afari spoke about plans to embrace technological advancements to strengthen the CSD’s infrastructure further. He emphasized that the focus will be on expanding service capabilities and positioning Ghana more prominently in the global market.

“As we look beyond, we remain dedicated to leading Ghana’s financial sector into new realms of opportunity and resilience,” he remarked, outlining a commitment to build a more inclusive and resilient financial system.

Dr. Afari also acknowledged the contributions of the Board of Directors, past and present CEOs, and the entire CSD staff in guiding the institution towards financial stability and strong performance.

He credited their strategic oversight for enabling the CSD to achieve sustainable growth, stating, “Through sound governance and forward-looking thinking, the Board has worked diligently to create a financially stable company, enabling the CSD to achieve sustainable growth and deliver value for our stakeholders.”

In his remarks, Dr. Afari also touched on the CSD’s role in supporting a diverse range of asset classes, including government securities, corporate bonds, equities, and money market instruments.

He highlighted the institution’s recent involvement in the Ghana Domestic Debt Exchange Programme (GDEP), noting that this showcased the CSD’s adherence to international best practices and its capability to serve regional markets.

“The CSD played a key role in the just-ended GDEP, once again showcasing our international best practices and standards,” he said.

Furthermore, he outlined the CSD’s comprehensive suite of services, which include secure custody, efficient settlement, and effective asset servicing for various asset classes.

He noted that the depository’s settlement services, encompassing both primary and secondary market transactions, facilitate seamless operations for the Government of Ghana, the Bank of Ghana, and private sector participants.

He underscored the importance of these services in enhancing transparency and stability in the financial sector.

“Our settlement services, which include both primary and secondary market settlements, facilitate seamless transactions for the Government of Ghana, the Bank of Ghana, and private sector participants,” he explained.