By Seth KRAMPAH

The ARB Apex Bank, together with Chief Executive officers of all rural and community banks in the country, are set for the annual CEOs’ conference scheduled for October 17 at the Volta Serene Hotel, Ho in the Volta Region.

This year’s conference is the twenty third in the series and on the theme: “Repositioning Rural Banking at the Centre of National Financial Inclusion agenda”

The conference, as usual, will bring together chief executive officers of all the 0ne hundred and forty seven rural and community banks in Ghana with the primary focus of discussing the current happenings and some challenges in the rural banking sector, and to proffer solutions for them.

It is expected that organisers of the conference will bring on board a rich pool of consultants, who will be taking the CEOs through carefully selected topics as part of the conference’s major activities.

The topics, as well as the consultants, are always strategically selected to help equip CEOs with contemporary strategies to effectively tackle emerging issues in their daily operational activities in banking.

In the course of the conference, the CEOs will be concentrating their energies on treating topics like: Financial inclusion strategies and the role of key stakeholders in ensuring access to finance by the Ghanaian adult population; How to expand digital financial solution and Increasing Deposit Mobilization and RCBs’ Loan Products and Ensuring Affordable Product Pricing among other timely topics to be presented.

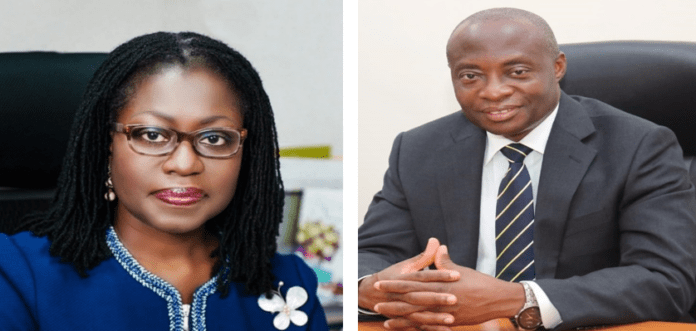

It is also expected that the 2nd Deputy Governor of Bank of Ghana, Mrs. Elsie Addo Awadzi, who is the guest speaker for the second time will make a regulatory pronouncement that may seek to collaborate with the ARB Apex Bank on repositioning the rural banks for effective operational service delivery.

The participants will be looking forward to an update on the banking industry and make time to look at matters arising from the communique issued in the 2023 conference, held at the same venue.

Rural and community banks have a key role in making a positive contribution towards the reduction of poverty. They also act as one of the key channels for distributing funds to businesses in their localities, and encouraging the spread of sound entrepreneurial activity.

It is also believed that rural and community banks can provide an additional channel to deliver essential financial services. They also play a key role in the country’s economic development and ultimately act as a catalyst to stimulate the rural economy by supporting micro and SME businesses based in rural areas.

This initiative can contribute to poverty reduction and help in bridging the gap between urban areas and the rural economy.