By Mary Anane AWUKU

As we delve into one of the most significant challenges businesses face today, financial management it’s essential to recognize that effective money management is not always straightforward. Over the years, I have observed many entrepreneurs fall into the pitfalls of financial mismanagement, so I feel compelled to address this topic with such urgency.

Money management encompasses the systematic handling of finances within a business, focusing specifically on three critical aspects: revenue, expenses, and profit. These components are vital indicators of an organization’s financial health. Let’s explore each of these fundamentals in more detail. Revenue represents the income generated from the business’s core activities, whether through the sale of products or the provision of services. It is the lifeblood of any enterprise, illustrating the financial inflow that sustains operations and growth.

Expenses refer to the costs incurred while running the business. This category includes many expenditures, from production costs to operational overhead and logistics required to deliver the final product or service to consumers. Profit is the ultimate measure of financial performance, calculated as the difference between total revenue and expenses. It reflects the effectiveness of an organization in generating income while managing its costs, serving as a crucial metric for sustainability and growth.

After subtracting all expenses from the revenue generated, the remaining amount constitutes your profit. However, many organizations, especially in their early stages, face challenges in refraining from prematurely accessing company funds for personal gains.

Continuous reinvestment

In the initial phase of a business, ongoing investment is often necessary. Given that revenue may be limited in the early stages due to a small client base, additional capital may be required to cover essential costs such as employee salaries, rent, and other operational expenses. As you work to expand your client base and increase revenue, it is crucial to remain attuned to your business’s financial needs.

Even after achieving profitability, the prudent course of action for business owners is to reinvest earnings back into the organization. This strategy fosters growth and stability, allowing the business to enhance its offerings, expand its market reach, or innovate its product line. It is essential to adopt a disciplined approach during this phase. Only withdraw profits once you are confident that accessing a portion of them will not adversely affect the organization’s financial health. `

Yes, I now put myself on a salary, and beyond that salary, all my expenses remain separate. I don’t take money from the company for personal use no exceptions.

Personal ATM on Company’s Account?

I’m very disciplined with my business finances. I don’t even keep the check books; an accounting department handles them. For business accounts, you shouldn’t be in possession of a business account ATM since you might be tempted to make personal redrawers.

You must be very disciplined, or you’ll misuse company funds. If you want your business to grow, you must separate your interests and expenses from company profits. Some employers believe that because they built the organization and invested their money, they have the right to take out whatever they want, whenever they want. ut a business is a separate entity. You’ll gradually be able to realize some profit and recover what you’ve invested, little by little, and that’s good enough.

However, when the organization can’t pay you back, you must exercise discipline. When I reached a point where I needed help with my finances, I brought in external expertise. Many people don’t have a solid financial background to manage an organization’s finances effectively as employers or heads of organizations.

Get a professional!

When you need help, seek it. Get professional advice on managing expenses, keeping financial records, and preparing budgets so you know exactly what’s coming in, what’s going out, and what’s left for the organization. Always ensure you have a good financial advisor to guide you, providing you with the reassurance and guidance you need.

Get multiple invoices for purchases

One strategy I use to save company funds is obtaining multiple invoices when purchasing. This helps you assess whether you’re overspending. The key is to be very intentional about saving as much as possible for the company. If you spend recklessly, you might end up collapsing your organization.

Be intentional about saving for the organization.

3 key things entrepreneurs can learn and implement in managing finance:

- Separate personal and business finances: Discipline is critical when managing company funds. Entrepreneurs must resist the urge to mix personal expenses with business accounts. Please keep personal withdrawals within reasonable limits and ensure they don’t affect the company’s operations. If you learn to do this, your business will surely do well, making you feel responsible and in control of your business’s financial health.

- Reinvest in the early stages: Don’t spend all your money; this temptation is very high initially. At the beginning of a business, focus on reinvesting profits to grow the venture rather than drawing them out. Maintain financial discipline until the company reaches a stable point where it can sustain its income without compromising its health. This forward-thinking approach will keep you optimistic about your business’s future.

- Seek professional financial advice: Recognize when you need financial help. A financial advisor or accountant can help you track expenses, generate financial reports, and create adequate budgets. This guidance ensures better economic management and sustainable growth for your business.

I’m positive that if you follow through on using these strategies, they will help your business maintain a healthy financial structure, enabling your company to grow.

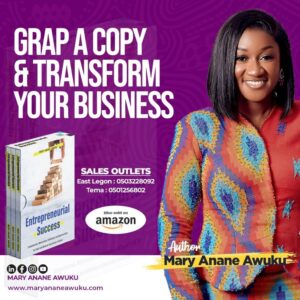

>>>the writer is a serial entrepreneur, an industrial and organizational psychologist, a business and personal development coach, a researcher in the field of entrepreneurial psychology, and the author of the book – Entrepreneurial Success. This book is enriched with research findings in competencies, motivations, challenges, and opportunities for small and medium enterprises in Ghana.

She is the Founder and CEO of a multi-national facility management company and the managing director of the fastest-growing international school in Ghana. She holds several certificates, having participated in a series of international business-related programmes from prestigious universities around the globe. Her extensive expertise equips her to provide valuable insights, strategies, and support for individuals and businesses seeking success and development. To explore more about Mary, visit http:www.maryananeawuku or find her book on Amazon