The Amantin and Kasei Community Bank, headquartered at Amantin in the Bono East Region, made impressive strides in key performance metrics during the 2023-year review.

The bank reported a remarkable increase in its total advances to businesses and individuals, soaring by an impressive 46.85%. The figure shows a shift from a little over GH¢17.25 million in 2022 to approximately GH¢25.34 million in 2023.

Additionally, total deposits also saw a growth, rising from GH¢69.40 million to GH¢81.52 million—an appreciable change of 17.47%. This performance underscores the bank’s pivotal role in supporting economic activities and enhancing liquidity within the market.

The bank’s short-term investments portfolio experienced a robust expansion in the year under review, totaling GH¢37.63 million. This marks a substantial increase from GH¢26.58 million in the previous year, reflecting an impressive growth rate of 41.56%.

The Amantin-based Community Bank also reported a significant leap in its gross income, soaring to GH¢17.92 million in 2023. This marked an impressive 47.53% increase compared to the previous year’s figure of GH¢12.15 million.

The bank’s strong performance translated into a profit after tax of GH¢1.85 million, reflecting a remarkable growth of 75.98% from 2022’s profit of GH¢1.05 million. This tremendous growth highlights the bank’s firm market position and effective financial strategies in the current competitive landscape.

Moreover, the bank’s assets have seen significant appreciation, increasing from GH¢77.91 million to GH¢93.06 million, further solidifying its healthy growth trajectory.

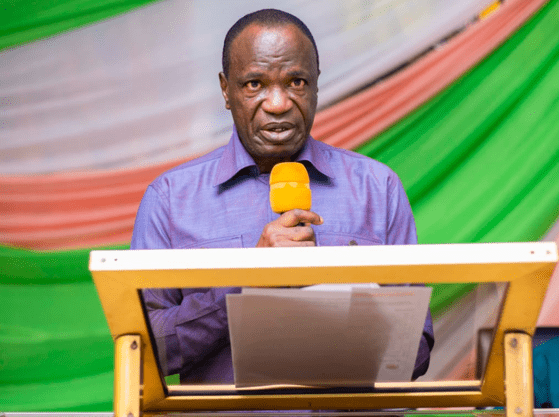

The Board Chairman of the Bank, Richard Owusu Afriyie, who announced these developments during the 19th annual general meeting of shareholders, held at Amantin said, “the bank performed extremely well. The bank’s capital adequacy ratio stood at 16% which is higher than the industry benchmark of 10%.”

Despite a successful financial year, Mr. Afriyie announced that the bank would not distribute dividends from its 2023 profits, adhering to directives set forth by the Bank of Ghana. This decision reflects a focus on long-term sustainability rather than immediate returns for shareholders.

Instead, the board proposed allocating GH¢500,000 from retained earnings to bolster the bank’s stated capital, which stood at GH¢1,545,456. Such a move he indicated, was designed to strengthen the bank’s financial foundation and prepare for future opportunities.

In line with the bank’s corporate social responsibility policy, it invested a total of GH¢48,991.50 in different projects. “The bank committed GH¢31,742.50 into Kasei water project to help ease water shortage in the community; GH¢9,649 was used to fund a set of furniture and a television set for the Atebubu Government Hospital-O.P. D; and GH¢7,600 to purchase 100 bags of cement for infrastructural development at Yeji Senior High School,” the Board Chairman explained.

Looking ahead, Mr. Afriyie outlined a comprehensive five-year strategic plan, with 2024 as the base year. This plan aims to provide a clear roadmap for the bank’s operations, focusing on enhancing resilience against potential economic shocks while driving efficiency and growth.