By Joshua Worlasi AMLANU & Ebenezer Chike Adjei Njoku

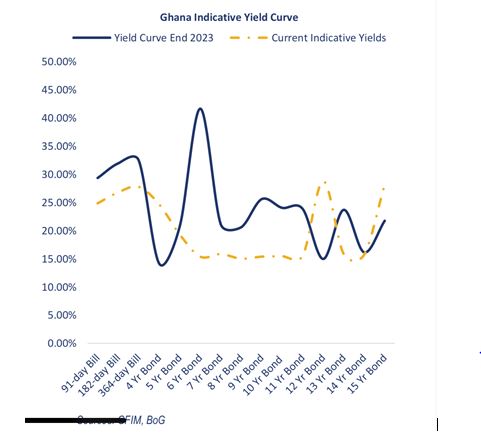

Yields on the Treasury market have continued an upward trajectory as government faces increasing challenges in raising its auction targets.

The latest auction saw yields on the 91-day bill increase by 9 basis points (bps) to 25.01 percent, while the 182-day and 364-day bills also rose slightly by 1bp each – settling at 26.82 percent and 28.08 percent respectively.

This marks a reversal from end of first-half 2024 when rates were in decline; with the 91-day bill at 24.87 percent, 182-day bill at 26.80 percent and 364-day bill at 27.79 percent. The rising rates signal higher borrowing costs for government, which has struggled to meet its weekly auction targets.

In the most recent auction, the Treasury recorded a 25 percent undersubscription – raising GH¢4.39billion from a target of GH¢5.88billion and marking the steepest shortfall in eight weeks. Government’s financing conditions remain tight, resulting in rising rates across the yield curve.

Apakan Securities highlighted the ongoing trend of auction shortfalls, stating that while the GH¢4.39 billion raised was enough to cover upcoming maturities of GH¢4.35 billion, it fell short of government’s needs. “The proceeds were below the target, but adequate to pay off the maturing amount of GH¢4.35billion due today across all the bills,” the firm noted, indicating a maturity cover of 1.01x.

Analysts remain sceptical about government’s ability to meet its future borrowing requirements. This week, the Treasury aims to raise GH¢7.44billion – the highest weekly target ever set – through the issuance of 91-day, 182-day and 364-day bills. This ambitious target comes at a time when market confidence is wavering and investors remain cautious.

The next auction is scheduled for Friday, September 27, 2024, but expectations are low.

“We expect the Treasury to miss its auction target while yields remain on the upside this week,” Apakan Securities predicted, citing government’s persistent struggle to attract sufficient bids.

The market’s caution is further heightened by the Bank of Ghana’s approaching Monetary Policy Committee (MPC) meeting this week. The MPC is expected to announce its policy rate decision on Friday, September 27, 2024.

While headline inflation has eased slightly, dropping by 50bps to 20.40 percent in August, analysts are divided on whether the MPC will cut its policy rate.

Apakan Securities anticipates a marginal cut in the policy rate, as inflation appears to be stabilising. However, Databank takes a more conservative stance; expecting the MPC to maintain its tight monetary policy in line with the IMF programme.

Databank warned that “election-induced spending” could exacerbate inflationary pressures, and any rate cuts should be made cautiously to avoid further depreciation of the cedi.

Databank’s review of the primary market also underscored government’s ongoing struggle to meet its auction targets.

Both Apakan Securities and Databank expect market activity to remain subdued as government continues to grapple with its domestic debt obligations. With external debt restructuring ongoing and set to conclude by end-September, market participants are adopting a wait-and-see approach.