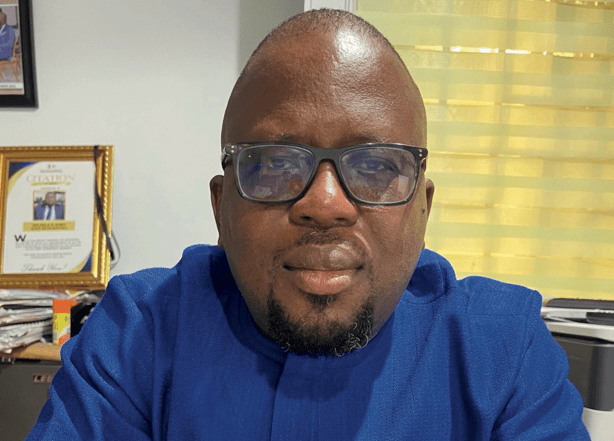

By Dela Herman AGBO

Financial freedom remains a desired goal for many individuals, symbolizing the ability to live without being constrained by financial stress. However, achieving this state can be difficult, with many encountering pitfalls that derail their progress.

This article outlines key financial mistakes people often make and provides strategies to avoid them, emphasizing how EcoCapital Investment Management Ltd can support individuals on their path to financial independence.

Living beyond your means

One of the most common financial errors individuals make is living beyond their means. This often results from spending more than one earns, frequently relying on credit cards or loans to cover shortfalls. Over time, such behavior leads to debt accumulation and high interest payments, which can be difficult to escape.

To avoid this trap, individuals should establish a budget and stick to it. Tracking income and expenses can provide a clear picture of where money is going and help in prioritizing savings and investments over unnecessary spending.

Understanding the difference between needs and wants is crucial in maintaining a sustainable financial lifestyle. By making informed decisions that align with long-term financial objectives, individuals can avoid falling into the debt cycle.

Neglecting to build an emergency fund

A lack of an emergency fund is another prevalent mistake that leaves many vulnerable when unexpected expenses arise. Whether it’s a medical emergency, car repairs, or job loss, not having a financial cushion can force individuals to turn to debt, further complicating their financial situation.

A recommended approach is to build an emergency fund that covers three to six months’ worth of living expenses. This fund should be kept in an easily accessible savings account and reserved strictly for emergencies. This step provides peace of mind and allows individuals to handle financial setbacks without compromising their long-term goals.

Inadequate investment planning

A considerable number of people either avoid investing altogether or invest without a clear plan, leading to poor financial outcomes. Many are deterred from investing due to fear of loss or lack of knowledge, while others may take on excessive risk in pursuit of quick returns.

To mitigate these issues, it is essential to become educated about investment options and seek professional advice. A diversified investment portfolio, tailored to an individual’s risk tolerance and financial objectives, can yield sustainable returns.

Regularly reviewing and adjusting investment strategies ensures alignment with evolving financial goals. With the right guidance, investing can be both rewarding and relatively low risk, and this is where expert support from financial institutions like EcoCapital becomes invaluable.

Over-reliance on debt

Another common issue is the over-reliance on debt, often to finance a particular lifestyle or large purchases. This can become burdensome, especially with high-interest debts such as credit card balances, which can quickly spiral out of control.

It is crucial to limit debt usage to essential purchases and focus on paying down high-interest debt as swiftly as possible. Agbo suggests that “exploring debt consolidation or refinancing options can reduce interest rates and ease the financial burden, allowing individuals to regain control of their finances.”

Lack of comprehensive financial planning

Approaching personal finances without a clear plan is another frequent misstep. Without defined goals, individuals are more likely to make impulsive financial decisions that are misaligned with their long-term objectives. Financial instability often follows.

Creating a comprehensive financial plan, which includes short- and long-term goals, a budget, and an investment strategy, can provide much-needed structure. Regularly reviewing and updating this plan ensures it remains relevant as circumstances and goals change over time. Financial planning should be viewed as a dynamic process that evolves along with your personal and financial situation.

Ignoring retirement planning

A significant error many individuals make is failing to plan adequately for retirement. Underestimating the amount needed to maintain a comfortable lifestyle post-retirement can result in financial hardship during what should be one’s golden years.

To counter this, it is advisable to start saving for retirement as early as possible. Employer-sponsored retirement plans, along with third-tier pension schemes and provident funds, can offer considerable benefits. Individuals should calculate how much they will need to retire comfortably and adjust their savings rates accordingly. It is better to have more funds for your retirement than not enough, ensuring you can maintain your lifestyle after retiring.

Not seeking professional financial advice

Many individuals attempt to manage their finances independently, often leading to costly mistakes due to a lack of expertise. Without professional guidance, critical aspects of financial planning can be overlooked.

Working with financial professionals allows individuals to access personalized advice tailored to their unique circumstances. A financial advisor can assist with developing a plan, selecting the appropriate investments, and navigating complex financial decisions. Expert guidance can make all the difference in avoiding costly mistakes and ensuring financial success.

Conclusion

Achieving financial freedom is possible with a proactive and informed approach to financial management. By avoiding common mistakes and seeking expert guidance, individuals can navigate the complexities of personal finance and achieve long-term stability.

EcoCapital Investment Management Ltd offers tailored solutions designed to help clients establish and reach their financial goals, providing the necessary support to ensure financial success.

For those starting their financial journey or looking to enhance their current strategies, partnering with experienced professionals like EcoCapital can be a crucial step toward achieving financial freedom.

Dela is the Chief Executive Officer, EcoCapital Investment Management Ltd.