By Dela Herman AGBO

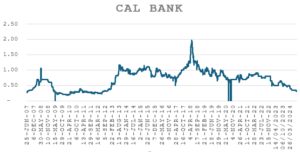

CAL Bank PLC, a prominent player on the Ghana Stock Exchange (GSE), has faced a challenging 2024. The bank’s stock, which started the year at GHS 0.48, has seen a significant decline, dropping to GHS 0.31 as of August 28, 2024.

This represents a Year-to-Date (YTD) performance of -35.4%, raising concerns among investors and market analysts alike. Despite this downturn, a detailed analysis reveals both the challenges and potential opportunities that lie ahead for the bank.

Current Performance and Financial Metrics

CAL Bank’s current financial metrics offer insight into its stock performance. The Price-to-Book (P/B) ratio stands at 0.77, indicating that the stock is currently undervalued. This suggests that investors might be pricing in future growth or higher returns on equity.

However, the trailing Price-to-Earnings (P/E) ratio of 1.06 and a forward P/E ratio of 1.16 reveal a different story, highlighting the market’s cautious stance on the bank’s earnings potential.

When compared to its peers, CAL Bank’s metrics show areas of concern. GCB Bank, for instance, has a lower P/B ratio, which may indicate that it is undervalued relative to its assets. Ecobank Ghana and Access Bank Ghana also exhibit lower P/B ratios and higher P/E ratios, reflecting stronger market confidence in their profitability and growth prospects.

Challenges Facing CAL Bank

The substantial decline in CAL Bank’s stock price can be attributed to several factors. The broader economic environment in Ghana has been challenging, with inflation, exchange rate volatility, and political uncertainty impacting the financial sector. The government’s debt exchange program has also placed pressure on many banks, including CAL Bank, by affecting their balance sheets and profitability.

Bank-specific challenges further compound these issues. CAL Bank has struggled with asset quality, particularly with non-performing loans (NPLs), which can erode profitability and investor confidence. Additionally, higher operating costs relative to income have raised concerns about the bank’s operational efficiency. Capital adequacy is another area of focus, as maintaining adequate capital buffers in a volatile economic environment is critical to sustaining long-term performance.

Market sentiment has also played a significant role in the stock’s decline. Negative investor perceptions, whether due to broader economic concerns or specific issues related to CAL Bank, have likely contributed to the downward pressure on the stock price.

Future Prospects and Strategic Considerations

Despite these challenges, CAL Bank is not without opportunities for recovery and growth. The post-election stabilization of Ghana’s economy could create a more favorable environment for the banking sector. Improved macroeconomic conditions, such as reduced inflation and stabilized exchange rates, could positively impact CAL Bank’s financial performance.

Operational improvements are crucial for the bank’s recovery. By enhancing operational efficiency, reducing NPLs, and improving asset quality, CAL Bank could potentially reverse its current downward trend. Additionally, the bank’s focus on digital transformation and fintech innovations could drive growth in its customer base and revenue streams, positioning it well for future growth.

Looking ahead to the end of 2024, there is potential for CAL Bank’s stock to stabilize and recover. If the bank can address its operational challenges and the broader economic environment improves, the stock could rise to between GHS 0.37 and GHS 0.40 by December. However, this projection is contingent on the absence of significant negative shocks to the economy or the banking sector.

Investment Recommendations

For investors, the outlook for CAL Bank is mixed and depends heavily on individual risk tolerance and investment horizons. For those with a high-risk tolerance and a long-term perspective, buying at the current price could be a strategic move, especially if they believe in the potential for economic recovery and operational improvements at the bank.

Holding the stock might be advisable for investors who are already invested in CAL Bank and are willing to wait for clearer signs of recovery. However, for risk-averse investors or those needing liquidity in the short term, selling might be the prudent choice, given the current negative performance and uncertain outlook.

CAL Bank PLC’s stock performance in 2024 reflects the significant challenges facing both the bank and the broader Ghanaian economy. While the road to recovery may be fraught with obstacles, the bank’s strategic focus on operational improvements and digital transformation could pave the way for a turnaround. Investors must carefully weigh their options, considering their risk tolerance and investment goals, before making decisions regarding CAL Bank’s stock.

For a deeper understanding and detailed information on this subject, you can refer to your investment advisor or kindly contact EcoCapital Investment Management Ltd for a comprehensive guide on building and managing your investment portfolio.

Dela is the Chief Executive Officer,EcoCapital Investment Management Ltd