By Elizabeth PUNSU, Sefwi Asawinso

The Asawinso Rural Bank PLC in the Sefwi Wiawso Municipality in the Western North Region has held its 38th Annual General Meeting of shareholders and posted growth in almost all financial indicators for the 2023 year under review.

The bank recorded a profit before tax of a little over GH₵ 775,791 as against a loss of approximately GH₵2million in 2022 representing an impressive growth of 137%. Shareholders have therefore been assured of prudent management of their investment to grow the Bank’s profitability to increase shareholders’ worth.

The Bank’s Deposit Liability grew by 33.50% in 2023 as against 16.95% in the previous year. In absolute terms, the Bank’s Total Deposit for 2023 and 2022 were GH₵ 55,321,534 and 41,440,861 respectively.

The robust deposit mobilization drive implemented by the Bank seems to have worked effectively, leading to the high deposit growth in the year under review.

The bank recorded at Total Assets which amounted to approximately GH₵ 55.2 million in December 2023, representing an increase of 27.08% from a little over GH₵ 43.4million in 2022.

Of the Total Assets, Earning Assets Constituted about GH₵ 36.3 million or 65.77% in 2023 Compared to approximately GH₵ 23.6 million representing 54.29% growth from in 2022.

Thus, Earning Assets grew by 53.94% in 2023, Compared to 23.91% in 2022. The Bank’s growth in Total Assets was driven by a heathy increase in Deposits and the performance of 2023 strongly suggests the bank is likely to witness a similar trend in 2024.

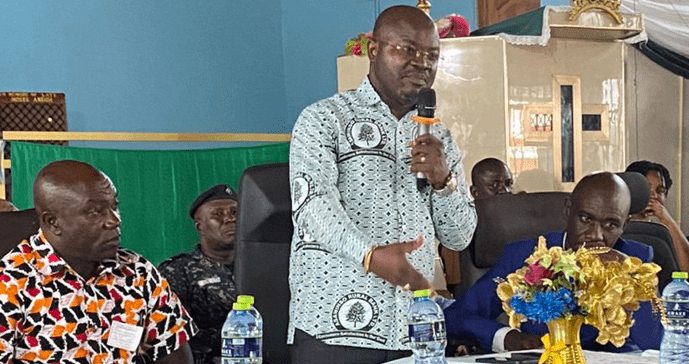

The chairman of the Board of Directors, Pious Vincent Abakah announced these and more at the bank’s 38th AGM of shareholders held last Saturday at Sefwi Asawinso.

Operational Environment

According to him, Ghana’s domestic economic vulnerabilities deepened in 2022/2023. The government had to reach out to the International Monetary Fund (IMF) for an Extended Credit Facility bail-out of USD3.0billion in July 2022, which was subsequently approved by the IMF Board in May 2023.

To ensure debt sustainability and macro-economic stability, the government on 5th December, 2022 activated the Domestic Debt Exchange Programme (DDEP) for all domestic currency bonds issued by the government as part of the conditions of the IMF programme.

This meant that all holders of such bonds, including Asawinso Rural Bank, had to exchange their holdings for new bonds which had elongated maturity profiles and lower coupon rates with the bank’s total holdings of approximately GH₵8.2million affected.

Ghana’s inflation remained high, though headed in the right direction, down to 23% in December 2023 from a record high of 54% in December 2022 and expected to further decline to 20.4% in 2024.

GDP growth was projected to fall to 1.7% in 2023 and to recover to 3% in 2024, in line with global trends. The fiscal deficit is projected to narrow to 8.9% of GDP in 2023 and 9% in 2024 on account of new revenue enhancement measures.

The current account deficit is projected to widen to 3% of GDP in 2023 and to narrow to 2.5% in 2024, following global trends. The country’s economy grew by 3.8% year-on-year in the fourth quarter, bringing full-year growth to 2.9% in 2023. Annual growth was largely driven by services and agriculture, while industry sector saw a small contraction.

In addition to the significant decline in inflation, the cedi recovered from its sharp depreciation (45% against the US Dollar) at end-2022 and has been less volatile, with international reserves increasing.

Operational Performance

In spite of the challenging macroeconomic environment coupled with the unprecedented high inflationary rate that pertained during the reviewed year, the bank managed to pull a satisfactory operational performance in almost all key financial indicators as indicated in the table.

| Items | GH₵’ 2023 | GH₵ ‘2022 | Percentage Change |

| Total Assets | 55,252,636 | 43,479,979 | 27.08 |

| Shareholders’ Fund | (2,748,622) | (2,845,960) | (3.42) |

| Stated Capital | 1,104,429 | 1,096,179 | 0.75 |

| Deposits | 55,321,534 | 41,440,861 | 33.50 |

| Loans & Advances | 11,741,906 | 3,519,997 | 233.58 |

| Investments | 32,598,787 | 28,141,856 | 15.84 |

| Fixed Deposits | 2,387,959 | 1,720,997 | 38.75 |

| Total Operating Income | 2,030,645 | 951, 220 | 113.48 |

| Profit Before Tax | 775,791 | (2,097,192) | 136.99 |

| Profit After Tax | 418,673 | (2,097,192) | 119.96 |

| Proposed Dividend | – | – | – |

Corporate Social Responsibility

The Bank has been providing support to various state institutions and stakeholders within its catchment areas. The Bank has started awarding scholarship to brilliant but needy Shareholders wards.

The Board is therefore encouraging shareholders to take this advantage to buy new shares and increase existing one.

“We are socially responsible and will not renege on supporting projects and engaging in environmentally friendly activities in the years ahead,’ the Board Chairman stressed.

Future Outlook

The Board Chairman further stressed that as directors of the Bank, they would continue to put in pragmatic measures to ensure positive growth and achievement of the Strategic Plan of the Bank. The Board according to him is mindful of the fact that Shareholders have entrusted the Bank in their care and they need to work towards that.

The CEO of the Bank, Kwasi Ameyaw tells Times Business & Financial in an interview that they would intensify loan recovery, embark on intensive deposit mobilization, Strengthen Internal Controls and maintain quality assets to increase profitability.

He therefore anticipates a very good future and know the Bank can achieve the objectives outlined in the Bank’s Strategic Plan.

Pious Vincent Abakah, Board Chairman (standing) addressing shareholders at the meeting