By Ebenezer Chike Adjei NJOKU

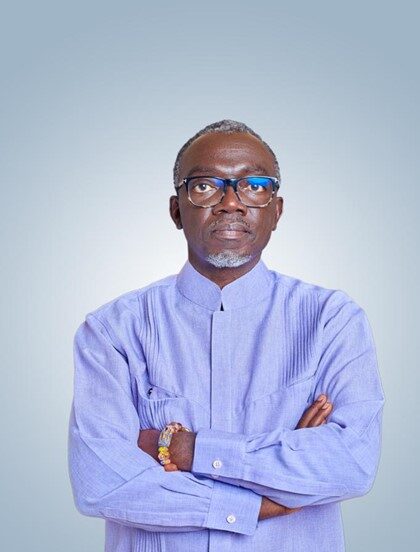

The Minerals Income Investment Fund (MIIF) is on track to increase its Assets Under Management (AUM) to over US$3 billion by December 2026, its Board Chairman, Professor Douglas Boateng has said. This projection comes on the heels of MIIF’s stellar performance in 2023, which saw the fund double its profits and significantly increase its revenue. It comes as MIIF aims to be the most admired and valuable sovereign wealth fund on the continent.

MIIF, established as part of President Nana Addo Dankwa Akufo-Addo’s and government’ vision to maximize Ghana’s mineral wealth, has emerged as a beacon of homegrown success. The fund’s rapid ascent is attributed to good board governance, experienced leadership, and innovative strategies, including expanding its royalties base and strategic investments across the mineral value chain.

Prof. Boateng, expressed confidence in the fund’s trajectory, stating that with sustained performance, it should reach and even significantly surpass the US$3 billion threshold within the next 30 months.

“With the right accountable leadership and experienced supervisory board, there is no limit in the sky for Ghana. MIIF as an entity is 100 percent lead and managed by Ghanaians. This proves that Ghanaians are more than capable to compete with the best in the world” he told the B&FT.

“The performance to date proves that with the right supervision, long term thinking and non interference, what may seem impossible can become possible” the MIIF Board Chair added.

The fund’s financial results for 2023 point to robust and sustainable growth. Net profits surged to GHȼ409 million, a 100 percent increase from GHȼ205 million in 2022. Revenue also saw a significant uptick, rising from GHȼ323 million to GHȼ456 million over the same period.

Edward Nana Yaw Koranteng, CEO of MIIF, attributed this growth to several factors, including the expansion of the royalties net and strategic investments. “The growth trajectory of the Fund is attributed to the hard work of the entire team at MIIF grounded in the vision of the president of the Republic of Ghana, Nana Addo Dankwa Akufo Addo to ensure that Ghana garners more value from its minerals,” Mr. Koranteng explained.

One of MIIF’s key strategies has been diversifying its mineral base beyond gold. The fund has successfully incorporated royalties from previously non-paying sectors such as medium-scale gold, sand winning, and salt. This expansion, coupled with increased royalties from quarries, limestone, and silver, has significantly broadened MIIF’s revenue streams.

The fund’s investments have been equally strategic. MIIF has invested over US$40 million in the Chirano and Bibiani gold mines, increasing Ghanaian interest to approximately 45 percent. It has also taken a significant stake in Atlantic Lithium, positioning Ghana to benefit from the growing demand for battery minerals.

Perhaps the most ambitious is MIIF’s Small-Scale Mining Incubation Program (SSMIP), which aims to formalize and support the small-scale gold mining sector. With an initial investment in excess of US$30 million over two years, the programme could potentially triple the sector’s output, currently valued at around US$2 billion annually.

MIIF’s Gold Trade Desk, operational since August 2023, has already injected over US$700 million into the nation’s economy. This initiative not only provides a stable source of foreign exchange for bulk oil distributors but also complements the Bank of Ghana’s forex support efforts.

“As MIIF sets its sights on becoming a US$6 billion AUM fund within the next decade, its growth strategies and calculating moves are positioning the organisation as the leading benchmark for mineral wealth management in Africa,” Prof. Boateng passionately stated.