The Ghana Cocoa Board (COCOBOD) has defended its decision to move away from syndicated external borrowing, the reasons for which have sparked a heated debate.

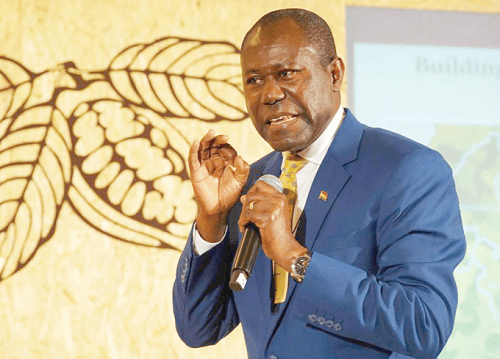

In a statement issued yesterday, COCOBOD Chief Executive Joseph Boahene Aidoo rejected claims made by the Minority in parliament which argued that the cocoa regulator had failed to get assurances for funding and has subsequently moved to alter the narrative.

COCOBOD had earlier announced a shift in its financing strategy. After 32 years of relying on offshore syndicated loans to finance its operations, COCOBOD stated that it had decided to end this practice, describing it as a strategic policy shift aimed at creating more value for farmers and enhancing the sustainability of Ghana’s cocoa industry.

Mr. Aidoo described this move as a “historic moment for the cocoa industry”, emphasising that COCOBOD has learned valuable lessons over the years and is now ready to finance its cocoa crop locally.

“This marks a transformative change,” Mr. Aidoo stated, explaining that COCOBOD is confident in its ability to self-finance its operations as the new cocoa season begins in September.

Mr. Aidoo noted that this approach enables COCOBOD to meet its financial obligations more efficiently, as the revenue generated from cocoa sales will directly support the organisation’s operations.

The announcement comes at a crucial time for Ghana’s cocoa sector, which contributes approximately 30 percent of the country’s export earnings. COCOBOD’s decision to explore non-syndicated funding sources marks a significant departure from its long-standing financial strategy – raising eyebrows among industry observers and political opponents alike.

“This is not about face-saving,” insisted the COCOBOD Chief Executive in a statement released yesterday.

“It is about diversifying our funding sources and retaining more value within the Ghanaian economy.”

The board maintains that contrary to allegations of being “chased away” from international markets, it has received term sheets from syndicated banks in response to its Request for Proposals.

COCOBOD’s financial performance has become a focal point of the controversy. The board reported a profit of GH¢2.3billion for the 2022/2023 crop season, a figure audited by Ernst & Young. This stands in stark contrast to the Minority’s claim of a GH¢4.2billion loss, highlighting the contentious nature of debate surrounding the cocoa sector’s financial health.

Amid the financial discussions, COCOBOD highlighted its production achievements; indicating a record-breaking cocoa production of 1.045 million metric tonnes during the 2020/2021 crop season. However, recent harvests have faced challenges, which COCOBOD attributes to adverse weather conditions and the persistent threat of Cocoa Swollen Shoot Virus Disease (CSSVD).

To address these challenges, COCOBOD has implemented an extensive rehabilitation programme. As of August 2024, 74,813 farms spanning 67,385.43 hectares have been rehabilitated – benefitting 56,105 farmers. Of these, 44,480 farms covering 40,150.40 hectares are already yielding crops.

COCOBOD’s statement also highlighted ongoing modernisation efforts: including the digitisation of cocoa farmer households and farms, implementation of a national cocoa traceability system and introducing motorised pruner-slasher machines.