By Reynell BADOE

Remittances, the financial flows resulting from emigration, have become one of the most significant sources of foreign exchange for developing nations. These inflows, sent by migrants to their families in their home countries, often surpass traditional sources of external financing such as foreign direct investment (FDI).

International remittances provide households in most developing countries with significant and sometimes critical lifeline income that helps to improve their general livelihoods and alleviate the incidence of poverty.

Remittances provide critical foreign exchange earnings, helping to stabilize national economies and mitigate the effects of economic shocks. In some developing economies, remittances make up a considerable portion of the gross domestic product (GDP), in some cases exceeding 10%. Ghana is a net-receive country where personal remittances received as a share of GDP has grown from 5.2% in 2019 to 6.4% in 2023.

There are many reasons why migrants remit money home. These range from a combination of economic, social and emotional factors including self-interest motives and some level of implicit contract sometimes underlying these. The grass, as they say, is greener on the other side, so the expectation is that family members who have had the opportunity to experience the “other side” will fulfil their end of this implicit contract by remitting funds back home.

For migrants, the need to support family and dependants with support for food, housing, education and healthcare is a key reason. Many migrants also use the opportunity to invest in property and businesses back home as the plan may be to return home when they are due for retirement or done with.

Some migrants also remit funds back home for savings, as part of their cultural and social obligations and debt repayment. For households, these funds that come in for family support are essential for reducing poverty, providing for basic needs, and improving living standards. Remittances can alleviate the pressure of unemployment, as the funds allow families to sustain themselves in the absence of adequate local job opportunities.

Additionally, they may contribute to upward pressure on wages by reducing the available labour pool, boosting income levels for workers. The benefits of remittances, however, depend on the specific labour market conditions in the recipient countries, where these transfers can either complement or substitute local income generation.

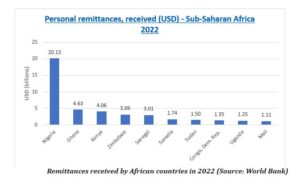

Remittances do not only support individual households but can have a broader impact on the economies of countries receiving them. In many developing countries, the impact of remittances due to migration is immense. According to the World Bank, the top ten recipients of remittances in Sub-Saharan Africa (SSA) in 2022 were: Nigeria, Ghana, Kenya, Zimbabwe, Senegal, Somalia, Sudan, Dem Rep. Congo, Uganda and Mali with the total inflows grossing USD 53.57 billion.

This impressive amount highlights the critical role remittances play in the region’s economic landscape. Ghana, the second largest recipient of personal remittances in SSA, saw inflows of USD4.6 and USD 4.8 billion between 2022 and 2023, placing it second only to Nigeria, which received US$20.13 and USD 20.5 billion respectively.

Ghana’s 2023 remittance figure marks a steady flow of funds that has been crucial in stabilizing the nation’s financial health. The country’s ability to generate a current account surplus in the third quarter of 2023 was in part due to this robust remittance growth.

Remittances to Ghana account for approximately 6% of the nation’s GDP, according to the Bank of Ghana. To put this into perspective, the total remittance inflow in 2023 of US$4.8 billion exceeded the combined value of Official Development Assistance (ODA) and Foreign Direct Investment (FDI) to the country. These flows have proven remarkably resilient, even in times of crisis, such as the COVID-19 pandemic and Ghana’s recent economic difficulties.

Remittances have played a vital role in cushioning the effects of various economic challenges, including food insecurity, drought, supply chain disruptions, floods, and the burden of debt servicing. Global geopolitical tensions, such as the Russian invasion of Ukraine and the Israel-Gaza conflict, have further complicated the economic landscape.

Yet, unlike the more volatile FDI flows, remittances have provided a consistent and reliable source of foreign exchange for Sub-Saharan Africa. In 2023, remittance inflows to the region were nearly 1.5 times larger than FDI, which totalled US$38.6 billion.

Beyond the immediate economic relief, returning migrants often contribute significantly to their home countries’ development. Many come back with valuable skills, knowledge, and technology that can enhance productivity and innovation. These returnees can also stimulate trade and investment, strengthen business networks, and elevate human capital within their communities. The combination of remittances and returning migrants can thus become a powerful driver of economic growth and transformation in developing economies.

The sustained inflow of remittances has been instrumental in boosting Ghana’s socio-economic development. Many Ghanaian families rely on these funds to cover essential expenses such as medical bills, education costs, rent, and general household upkeep. In times of economic uncertainty, remittances act as a buffer, helping to maintain financial stability at both the household and national levels.

As Ghana continues to integrate into the global economy and navigate its economic challenges, the importance of remittances in shaping the country’s economic future and acting as a source of external financing and social support cannot be overstated. These flows not only sustain livelihoods but also contribute to the country’s broader economic growth, reinforcing its role as a critical element in Ghana’s development strategy.

To fully harness the potential of remittances, it is important for the government and private sector to work together to reduce transaction costs, promote financial literacy and encourage productive use of remittance funds which will foster inclusive and sustainable economic growth.