By Samuel Kweku KUMAH and Frank Atsu EDEM

When you think of Ghana, the lush landscapes, rich & vibrant culture, and bustling open markets often come to mind. Yet, beneath the surface lies a complex web of poverty that goes beyond mere financial inadequacies. A compendium of silent struggles, where the pages are filled with deprivation, written in the ink of unfulfilled basic needs. This is what experts call multidimensional poverty, a term that encapsulates various deprivations in health, education, and living standards.

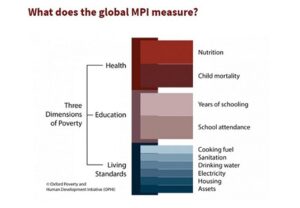

The Multidimensional Poverty Index (MPI) measures multidimensional poverty using household survey data, where health and education indicators are weighted 1/6 each, and standard of living indicators 1/18 each. A deprivation score of 1/3 or higher classifies a household as multidimensionally poor, while scores equal to 1/5 but less than 1/3 indicates vulnerability to multidimensional poverty, and scores of 1/2 or more signify severe multidimensional poverty.

The MPI, ranging from 0 to 1, reflects both the incidence and intensity of poverty, complementing the US$2.15 a day poverty rate by detailing the composition of poverty. While the nation has made strides in many areas, the MPI reveals a more nuanced picture of hardship that demands a collective effort to address. Astonishingly, the banking sector, long regarded as the unyielding fortress of finance, stands poised to become the unexpected hero in this epic battle against multidimensional poverty.

In Ghana, 24.6 percent of the population (8,089 thousand people in 2021) is multidimensionally poor, while an additional 20.1 percent (6,598 thousand people in 2021) are classified as vulnerable to multidimensional poverty (UNDP, 2023). In comparison, Cameroon and Kenya have MPI values of 0.232 and 0.171, respectively (UNDP, 2023).

In the Northern Region, the incidence of multidimensional poverty soars to a staggering 80.8 percent, with severe deficiencies in health insurance, nutrition, and educational attainment. The Upper East and Upper West regions also have high incidences of multidimensional poverty, at 68.0 percent and 65.5 percent respectively.

Even in more affluent regions like Greater Accra, around 22.5 percent of the population faces significant deprivations. The intensity of poverty or the average proportion of deprivations poor people suffer, stands at 51.7 percent nationally, meaning the average poor person in Ghana is deprived in over half of the critical indicators (GSS,2020).

The causes of this high MPI score are manifold and deeply intertwined with the fabric of daily life in Ghana. At the forefront is the poor access to healthcare, a glaring issue that is especially pronounced in rural areas where medical facilities, largely Community-Based Health Planning and Services (CHPS) compounds are scarce and often under-resourced. This lack of access leaves a significant portion of the population without essential medical coverage, exacerbating health-related deprivations and leading to preventable illnesses and deaths.

Educational disparities add another layer of complexity to the poverty landscape. In numerous regions, school attendance and attainment lag significantly, depriving children of the education necessary to break the cycle of poverty. According to the Ghana Statistical Service (GSS), approximately 23.5 percent of the population experiences school lag, meaning that children are two or more years behind their appropriate grade level (GSS, 2020). This educational gap not only limits their future opportunities but also perpetuates a cycle of poverty that is hard to escape.

The repercussions of these educational disparities are far-reaching. Data from the Multidimensional Poverty Ghana Report indicates that lack of educational attainment is one of the significant contributors to multidimensional poverty, with a substantial portion of the population being deprived in this area (GSS, 2020). In rural areas, the situation is particularly dire, with 64.6 percent of the rural population being multidimensionally poor, compared to 27.0 percent in urban areas. This disparity underscores the critical need for targeted educational interventions in rural communities (GSS, 2020).

Furthermore, the link between education and health is evident. Children who are out of school are more likely to suffer from health issues, as they miss out on school-based health programmes and vaccinations. This correlation between education and health exacerbates the cycle of poverty. The Annual Household Income and Expenditure Survey (AHIES) revealed that educational attainment significantly impacts income levels, with higher levels of education correlating with higher income and better health outcomes (AHIES, 2023).

Housing and basic sanitation are further critical issues that compound the everyday struggles of countless Ghanaians. Inadequate housing conditions, particularly in northern and rural communities, mean that many families live in structures that are not fit for human habitation, lacking basic amenities such as clean water and proper sewage systems.

The GSS reports that 44.1 percent of the population does not have access to adequate sanitation facilities, a deficiency that poses severe health risks and undermines overall well-being (GSS, 2020). This lack of proper sanitation is linked to higher incidences of waterborne diseases, which further strain the already limited healthcare resources in these communities.

Additionally, 27.5 percent of Ghanaians live in substandard housing, where overcrowding and poor construction quality are commonplace (GSS, 2020). These inadequate living conditions exacerbate health problems and reduce the overall quality of life. For instance, overcrowded homes increase the spread of communicable diseases, including respiratory infections and tuberculosis. Moreover, poorly constructed houses are vulnerable to natural disasters such as floods and storms, which can lead to displacement and further economic hardship for already impoverished families.

The disparities in housing and sanitation are stark between urban and rural areas. In rural areas, the incidence of multidimensional poverty is 64.6 percent, compared to 27.0 percent in urban areas, highlighting the urgent need for improved infrastructure in rural regions (GSS, 2020). The lack of access to clean water exacerbates these challenges. According to the World Health Organisation (WHO), inadequate water supply and sanitation are directly linked to malnutrition, as poor hygiene practices increase the incidence of diarrhoea and other gastrointestinal diseases, which can impair nutrient absorption and weaken immunity (WHO, 2023).

According to the Africa Housing Finance Yearbook (2023), the housing deficit in Ghana is also a significant barrier to reducing poverty. Ghana has a housing deficit of 1.8 million units despite several public and private sector-driven initiatives cumulatively reducing the deficit by a third (33 percent), with the majority of this deficit affecting low-income households (CAHF, 2023). This shortfall underscores the need for affordable housing solutions. Financial institutions can support this through the provision of low-interest loans for housing development and renovations, particularly targeting rural and underserved areas.

In this multifaceted fight against poverty, banks have a crucial role to play through what we would like to term GFC; Green Banking Solutions Development, Financial Inclusion Efforts, Collaboration amongst industry players.

The focus on Green Banking Solutions will have a profound impact on improving Ghana’s MPI. The World Bank Group’s Country Climate and Development Report (CCDR) for Ghana estimates that at least one million more people could fall into poverty due to climate shocks. Income could reduce by up to 40 percent for poor households by 2050. Access to affordable and reliable electricity will enhance living standards by enabling better healthcare, education, and economic activities.

For example, schools with reliable electricity can extend study hours, improve computer literacy, and provide a conducive learning environment, leading to better educational outcomes. Health facilities can operate essential medical equipment and preserve medications effectively, improving health outcomes. Businesses, particularly in agriculture and small-scale industries, can increase productivity and reduce operational costs, fostering economic growth and job creation.

Banks can fund these loan facilities by tapping into international green grants and funds such as the Green Climate Fund, the Global Environment Facility, and other sustainable finance initiatives. These initiatives are aligned with Sustainable Development Goals, focusing on Gender Equity, Affordable and Clean Energy, and Industry, Innovation and Technology.

By leveraging these funds, banks in Ghana can significantly reduce the financial burden on communities, making green energy solutions affordable and accessible. This shift not only addresses energy poverty but also improves health outcomes, educational performance, and economic productivity, thereby reducing the MPI significantly.

Further in the conversation around green products, the introduction of green bonds and the Securities and Exchange Commission’s (SEC) new regulation in Ghana opens significant opportunities for investment into renewable energy. Green bonds, which are earmarked to raise money for climate and environmental projects, offer a tool for mobilising capital towards sustainable development.

The SEC of Ghana’s new green bond guidelines aim to facilitate the issuance and utilisation of these bonds, providing a regulatory framework that ensures transparency, accountability, and environmental integrity. Proper utilisation of green bond flows can lead to increased access to clean energy, reducing the gap in access to affordable energy for homes, schools, and hospitals. Investment in renewable energy projects such as solar and wind can provide off-grid solutions for rural areas, enhancing energy security and resilience.

Financial inclusion efforts in Ghana can also contribute to changing the narrative around multi-dimensional poverty for Ghana. Encompassing access to bank accounts, remittances, financial literacy, and concessionary credit for MSMEs, financial inclusion plays a crucial role in providing economic stability and opportunity. In rural areas, where traditional banking services are limited, access to financial services is crucial for empowering individuals and communities.

The GSS reports that only about 23 percent of adults in rural areas have access to a formal bank account, impeding their ability to save securely, invest in education and health, and manage financial risks. Enhancing rural access to banking services through mobile banking, community banking, and microfinance institutions can bridge this gap, enabling more people to participate in the formal economy and improve their financial stability.

Remittances also play a vital role in reducing multidimensional poverty in Ghana. According to the World Bank Migration and Development Report for 2024, remittances to Ghana amounted to approximately US$4.6 billion in 2023, constituting a significant portion of the national GDP.

These funds are often used to support household consumption, education, healthcare, and small businesses. By facilitating easier and more affordable remittance services for the unbanked within rural areas, financial institutions can ensure that more of these funds reach their intended recipients. This can be achieved through the development of user friendly and secure digital remittance platforms, which can lower transaction costs and increase the efficiency of remittance flows.

Financial literacy is another critical component of financial inclusion that can help reduce poverty. A study by the International Finance Corporation (IFC) found that only 39 percent of Ghanaians have a basic understanding of financial concepts. Financial literacy programmes can empower individuals with the knowledge and skills needed to make informed financial decisions, manage their resources effectively, and utilise financial services to their benefit.

These programmes should target both urban and rural populations and can be delivered through various channels, including schools, community centres, and digital platforms. Improving financial literacy can enhance the effectiveness of financial inclusion initiatives and ensure that individuals are better equipped to leverage financial services for their development.

Concessionary credit for Micro, Small and Medium Enterprises (MSMEs) is also essential for promoting economic growth and reducing poverty. MSMEs constitute about 90 per cent of businesses, 80 per cent of workforce, and 70 per cent of the country’s Gross Domestic Product (GDP), according to the Ministry of Trade and Industry(GNA, 2024).

However, access to affordable credit remains a significant challenge for many of these businesses. Financial institutions can address this issue by offering concessionary credit facilities with lower interest rates and flexible repayment terms. Programmes such as the Ghana Incentive-Based Risk Sharing System for Agricultural Lending (GIRSAL) have demonstrated the potential impact of targeted credit facilities on enhancing agricultural productivity and supporting small businesses.

Deliberately providing a solution such as this can foster entrepreneurship, create jobs, and drive economic development, thereby contributing to improving income levels of households which in turn improve access to other facilities including healthcare and education hence reducing the number of multidimensionally poor Ghanaians.

The Inclusive Banking Department of Fidelity Bank Ghana Ltd, in collaboration with the International Fund for Agricultural Development, initiated an innovative financial literacy scheme to leverage remittances for driving financial inclusion, particularly in rural Ghana. This project, implemented in the Western and Central regions, has successfully mobilised above GH¢60 million in savings deposits through the establishment of 6,697 smart accounts.

Furthermore, 12,232 rural beneficiaries have gained from Instant Voice Response (IVR) services, which provide essential financial literacy education and highlight the benefits of savings. These collaborative efforts can create a comprehensive and inclusive financial ecosystem, driving sustainable development and significantly reducing multidimensional poverty in Ghana.

Finally, collaboration amongst banks is another key approach to reducing multidimensional poverty in Ghana. One of the significant benefits of collaboration between financial institutions is the ability to pool resources and share risks. This collective approach enables banks to undertake larger and more impactful community development projects than they could individually.

By combining financial resources, banks can support initiatives that require substantial capital investments, such as large-scale infrastructure projects, which are essential for sustainable development. Additionally, sharing risks among multiple institutions reduces the financial burden on any single bank, making it more feasible to engage in high-impact projects with long-term benefits.

Globally, financial collaborations have proven effective in enhancing livelihoods and reducing poverty. For instance, the African Development Bank’s partnership with the European Investment Bank has funded numerous infrastructure projects across Africa, improving connectivity and creating economic opportunities. Similarly, the Grameen Bank’s microfinance model in Bangladesh has empowered millions of people to escape poverty through small loans. These examples underscore how strategic collaborations can drive significant social and economic improvements.

In Ghana, collaborative efforts among banks can be directed towards impactful large-scale projects, such as building schools and providing educational resources to underserved communities. Improved educational infrastructure enhances literacy rates and provides better job opportunities, directly impacting poverty reduction. By pooling financial resources, banks can build and upgrade educational facilities in deprived areas. This includes constructing new schools, renovating existing ones, and equipping them with essential facilities such as libraries, science laboratories, and computer rooms.

The Orange Impact Initiative, backed by Fidelity Bank Ghana Ltd and voluntary staff contributions demonstrates the bank’s dedication to social upliftment and educational empowerment by addressing educational infrastructure needs across Ghana. In 2023, significant achievements included constructing a 6-unit solar-equipped classroom block at Duose DA Wa in the Upper West Region, benefiting 245 students.

Fidelity Bank Ghana Ltd has gone on to complete 5 other schools in 4 other regions in Ghana benefitting thousands of underprivileged children of school going age. If banks within the banking sector in Ghana can collaborate on a project such as this, we will be able to effectively improve the learning environment of a larger number of children of school-going age in every corner of this country. This can be replicated in many other sectors including health and support for persons with disabilities.

Effective collaboration between financial institutions can significantly amplify the impact of development projects. Joint initiatives can fund larger and more complex projects that a single institution might find challenging.

For instance, a consortium of banks in Ghana could finance the afore-mentioned initiatives. Such collaborations can also attract additional funding from international donors and development agencies, further expanding the scope and impact of poverty reduction initiatives. International funds often seek stable and large-scale projects with substantial backing, and collaborative efforts among local banks. This collective effort can significantly lower the MPI by addressing multiple dimensions of poverty simultaneously.

In Ghana, where the weight of multidimensional poverty presses down on many, the banking sector holds the keys to transformation. By weaving a tapestry of Green Banking Solutions, fostering robust collaborations, and championing comprehensive financial inclusion programmes, banks can elevate lives, nurture dreams, and open doors to boundless opportunities.

This is not merely about financial transactions but also about building bridges to better healthcare, enhanced education, and vibrant economic landscapes. It is a call to action, a testament to the power of united efforts, and a vision of a Ghana where every citizen can rise with dignity and hope.

>>>Samuel Kweku Kumah is a sustainability professional with expertise in research, impact management, and sustainability reporting. Currently serving as the Research and Impact Management Officer in the Partnerships, Sustainability, and CSR department at Fidelity Bank Ghana, Samuel has demonstrated a robust capacity for implementing and reporting sustainability research and impact strategies that align with global standards.

Frank Atsu Edem is Client Service Advisor at Fidelity Bank Ghana and a dedicated and passionate banker with a strong commitment to shaping a sustainable future. Holding a Bachelor of Arts degree in Economics and a Master’s in Development Finance, he has been instrumental in supporting on various projects, particularly in research and impact management, sustainable finance, and sustainable operations. His work is driven by a deep passion for achieving the Sustainable Development Goals, with a special focus on reducing poverty and inequality among Ghanaians. Edem is committed to making decisions today that will ensure a brighter and more equitable future for the next generation.