By Dela Herman AGBO

The energy sector has long been a barometer of the nation’s economic vitality, with investors closely watching the performance of key players like GOIL Plc and TOTAL. As the country navigates the evolving business landscape, these two fuel giants have emerged as contrasting case studies, offering valuable insights for discerning investors.

GOIL PLC: Stability amid stagnation?

As the partially state-owned oil marketing company, GOIL has long enjoyed a strong foothold in the Ghanaian market. However, the analysis by EcoCapital Investment Management paints a nuanced picture of the firm’s fortunes. While its opening price of GHS 1.50 in January 2024 has remained unchanged as of mid-July, the stagnant year-to-date (YTD) return of 0% suggests that the market views GOIL’s financial performance as stable but lacking in growth momentum.

In my view, this relative stagnation is attributable to the unique challenges that come with GOIL’s partial state ownership. The government’s involvement can often lead to bureaucratic inefficiencies and slower decision-making processes – a reality that has likely hampered GOIL’s ability to adapt to the rapidly changing dynamics of the Ghanaian energy market.

Furthermore, the company’s operational challenges, including issues with consistent fuel supply across its network of stations, have eroded investor confidence. Concerns around profit margins, cost control, and revenue growth have left many questioning GOIL’s long-term growth prospects, despite its strong brand recognition and market position.

TOTAL: Powering ahead with strategic dynamism

In stark contrast to GOIL’s relative stagnation, TOTAL has emerged as the market darling, with its share price soaring by an impressive 37.44 percent YTD. As a global energy conglomerate, TOTAL has leveraged its vast resources, international experience, and commitment to innovation to deliver robust performance.

The key to TOTAL’s success, in my view, lies in its strategic focus and adaptability. Unlike GOIL, which has struggled to keep pace with shifting market conditions, TOTAL has demonstrated a remarkable ability to anticipate and respond to changes, whether it’s regulatory shifts or evolving consumer preferences.

By prioritizing strategic investments, cost management, and innovative marketing, TOTAL has managed to stay ahead of the curve, resonating with investors who are seeking growth and robust returns. Crucially, the company’s global presence and access to best practices have further strengthened its position, allowing it to navigate the Ghanaian market with greater agility and confidence.

Navigating the opportunities and challenges

Gazing into the future, I believe that both GOIL and TOTAL hold significant promise, albeit with distinct challenges and opportunities.

For GOIL, the path forward lies in addressing the inefficiencies stemming from its state ownership. By implementing strategic initiatives to enhance operational efficiency and financial performance, the company can unlock its true growth potential and regain investor confidence. Its strong brand recognition and market position provide a solid foundation for such improvements, but the company must act decisively to capitalize on these advantages.

TOTAL, on the other hand, faces the challenge of maintaining its momentum in the face of a high valuation. While the company’s strategic dynamism and financial health make it an attractive investment option, investors must be mindful that some of the growth potential may already be priced into the current share price. Continuous adaptation and innovation will be critical for TOTAL to sustain its market-leading position.

Balancing risk and reward

Based on our detailed analysis, we have formulated clear investment recommendations for both GOIL and TOTAL.

For GOIL, we advise a “Buy & Hold or cautiously accumulate” strategy. While the company’s stagnant performance may give some investors pause, we believe that the potential upside outweighs the risks, particularly if GOIL can successfully implement operational efficiencies and strategic initiatives to drive growth.

On the other hand, our recommendation for TOTAL is a resounding “Buy.” The company’s robust financial health, effective management, and strategic positioning make it a compelling investment option for those seeking growth and strong returns. However, investors should remain mindful of the potentially high valuation and continuously monitor TOTAL’s ability to adapt to changing market conditions.

As the Ghanaian energy sector continues to evolve, investors would be wise to closely follow the fortunes of GOIL and TOTAL. While GOIL’s stability may appeal to more conservative investors, TOTAL’s dynamic performance and forward-looking strategy seem poised to deliver superior returns in the long run. The future of Ghana’s fuel landscape is being written by these two industry giants, and I believe savvy investors would do well to take note.

For a deeper understanding and detailed information on this subject, you can refer to your investment advisor or kindly contact EcoCapital Investment Management Ltd for a comprehensive guide on building and managing your investment portfolio.

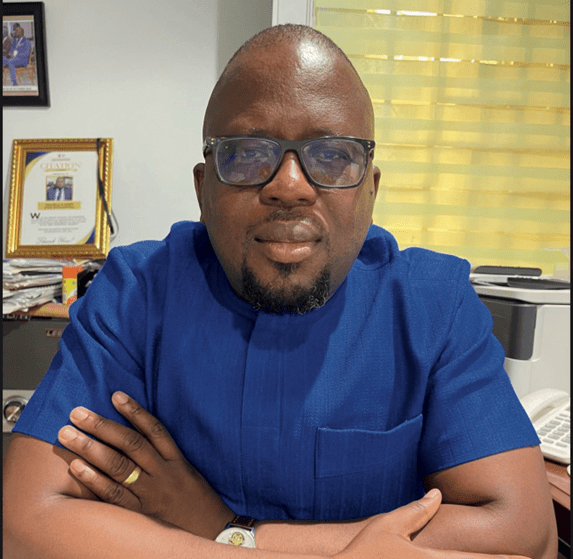

The writer is the Chief Executive Officer, EcoCapital Investment Management Ltd