- with GH¢2.8bn Qwikloan disbursements

- sets sights on further expansion with 3Q24 GH¢100m bond issuance

Letshego, a financial services provider specialising in micro loans, has announced strong financial results for the first half of 2024, demonstrating resilience in the face of challenging macroeconomic conditions.

The company reported a 223 percent increase in profits before tax compared to the same period last year, as the metric grew from GH¢18.34 million to GH¢59.3 million.

Simultaneously, total assets expanded by 47 percent to GH¢1.71 billion, primarily driven by a 36 percent growth in net loans and advances, which totaled GH¢1.1 billion.

Customer deposits experienced a notable surge of 325 percent, from GH¢ 69 million to GH¢294 million, reflecting increased market confidence.

The company’s cost-to-income ratio improved to 51 percent, marking an 18 percent reduction from the previous period and indicating enhanced operational efficiency.

Nii Amankrah Tetteh, Chief Executive Officer of Letshego Ghana, during a Facts Behind the Figures session hosted by the Ghana Stock Exchange, stated: “The first half-year results demonstrate the resilience and adaptability of our business model.

Despite the challenging macroeconomic environment, we have delivered strong financial results while advancing our strategic initiatives.” This builds on the lender’s performance in 2023, when it recorded a post-tax profit of GH¢66 million, from GH¢37 million at the end of 2023.

Qwikloan

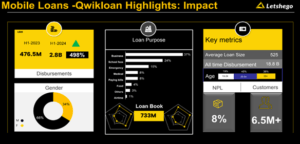

A key driver of this performance was the company’s Qwikloan product, which recorded a 498 percent increase in disbursements, reaching GH¢2.8 billion in the first half of 2024, up from GH¢476.5 million in the corresponding period of 2023.

This included 114 year-on-year growth in customers in the peri-urban markets, as well as a five percent increase in lending to women and women-owned businesses, which constituted 34 percent of disbursements.

“Qwikloan is not only generating shareholder value but also making a significant socio-economic impact. It plays a crucial role in supporting small-scale entrepreneurship and addressing critical financial needs, especially for women and young people across Ghana,” Mr. Tetteh said of the product’s impact, as 66 percent of loans were disbursed to people 34 years old or younger.

Poelo Mkpayah, Chief Financial Officer, disclosed that the product, which makes up 60 percent of Letshego Ghana’s portfolio mix, has served over 6.5 million customers to date.

Analysis of customer purpose for accessing Qwikloan indicates that 37 percent of borrowers directed funds toward business activities, 24 percent toward school fees, 15 percent, and 8 percent toward “emergency situations” and medical expenses, respectively. The product has cumulatively disbursed GH¢18.8 billion to date.

Looking ahead

Letshego Ghana plans to issue a second GH¢100 million bond under its expanded GH¢500 million medium-term note programme by the close of the third quarter (Q3) of the year. This follows the successful issuance of its first GH¢100 million bond in April 2024, which was oversubscribed by more than 40 percents.

As of June 2024, the outstanding value of Letshego’s bond programme stands at GH¢230 million. With GH¢75.9 million scheduled for redemption in Q3 2024, the company retains GH¢270 million for future issuances under the note programme.

Mr. Tetteh, elaborating on the company’s future strategy, said, “We remain committed to driving innovation and delivering value to our stakeholders. The forthcoming bond issuance will provide capital to underwrite new and existing products, support balance sheet growth, and fund working capital and liquidity management activities.”