By Joshua Worlasi AMLANU & Ebenezer Chike Adjei NJOKU

The stock market’s rally is expected to maintain its momentum through the end of 2024, with Databank, a leading brokerage firm, significantly revising its initial projections.

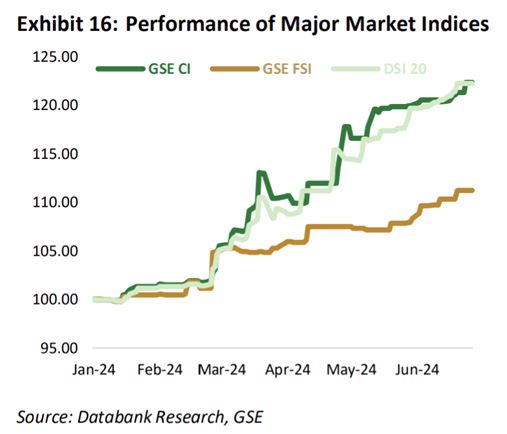

The Ghana Stock Exchange Composite Index (GSE-CI) – primary measure of the equities market’s performance – is now forecast to close at 4,380 points (between 35 and 45 percent growth), more than doubling the firm’s beginning-of-year estimates.

“From a technical analysis standpoint, we expect the GSE-CI to close at 4,380 points, reflecting 40% (±500bps),” the firm said in its quarterly report.

GSE’s performance has already surpassed earlier forecasts, with the index closing the year’s second quarter at 3,829.61points.

The performance has been fuelled by ongoing investor interest in stocks, especially in the fast-moving consumer goods (FMCG), telecommunications, oil marketing and financial sectors.

This has been largely due to the enhanced visibility of corporate profits in an improving macroeconomic climate. Furthermore, the fixed-income market remains sluggish after the Domestic Debt Exchange Programme (DDEP); prompting more investors to focus on equities.

Databank Research believes the stabilising macroeconomic environment, bolstered by the successful engagement with the International Monetary Fund (IMF) and debt restructuring, will further drive GSE’s performance.

“The Ghanaian economy is reaping benefits from a well-executed IMF programme, fostering stability and nurturing a positive earnings growth outlook across various sectors,” the report from Databank’s research arm stated.

“This stability is expected to further cement investor confidence in equities.”

Banks on the mend

The banking sector, initially battered by the DDEP, is showing strong signs of recovery. First-quarter results for 2024 revealed a 53 percent year-on-year growth in net profits, primarily driven by a 31 percent increase in interest income.

However, the sector faces challenges with a sharp rise in non-performing loans – averaging 24.5 percent in the first quarter of 2024, up from 14.9 percent in the same period last year.

Despite these headwinds, many bank stocks are trading below their book values and historical averages – presenting what Databank describes as “a compelling buying opportunity for investors”.

Real sector

The non-banking sector is also contributing significantly to the market’s buoyancy.

Benso Oil Palm Plantation (BOPP) has emerged as a standout performer, with its stock reaching an all-time high of GH¢23 per share. The company is benefitting from global production challenges in major palm oil-producing countries and rising crude palm oil prices.

“BOPP’s position is further strengthened by favourable rainfall patterns in its operational area,” the Databank report highlights.

“These factors, combined with the company’s sound management practices, are expected to drive continued growth and generous dividend yields,’ it added.

In the oil marketing sector, TotalEnergies is poised for significant earnings growth, buoyed by a rebound in local demand and rising Brent crude oil prices following OPEC’s production cuts.

The fast-moving consumer goods (FMCG) sector, led by Unilever, FanMilk and GGBL, is expected to maintain its position as a major driver of market returns. Databank anticipates that a gradual slowdown in inflation, coupled with increased government spending ahead of elections, will likely benefit consumer demand in this sector.

Telecommunications giant MTN is also on a growth trajectory, supported by ongoing network infrastructure upgrades and an upward revision in mobile money (MoMo) charges. The company saw its revenue in first half of the year reach GH¢8.1billion.

MTN’s dominant market share positions it to capitalise on this trend.

While the overall outlook is optimistic, Databank cautions investors about potential risks. “We remain vigilant about possible profit-taking and increased volatility as we approach the election period,” the report states.

The firm also notes concerns about sluggish growth in private sector lending due to high non-performing loan rates in the banking sector.

At close of the first trading week in August 2024, GSE’s market capitalisation was GH¢94.54billion.