By Ebenezer Chike Adjei NJOKU

The Chamber of Cement Manufacturers, Ghana (COCMAG) has stated that it has no reservations about providing transparency in the price build-up of cement.

Speaking during a consultative stakeholders forum on cement pricing and matters arising for growth of the economy’s construction sector, organised by the Ghana Chamber of Construction Industry, Chairman of COCMAG, Frédéric Albrecht, stated that preliminary conversations around a standardised framework have taken place and he is optimistic that it will be put in place shortly to address lingering concerns.

“We are dedicated to transparency in our cost structures and remain open to constructive dialogue with all stakeholders. Our aim is to work together on addressing economic and regulatory challenges facing the cement industry,” he said.

The opacity in price build-up and uniformity of prices across the industry have led to price-fixing suggestions. However, the Chamber noted that the apparent uniformity in prices results from similarity in production inputs and identical external factors affecting all manufacturers.

“The similar cement prices are because everyone uses similar materials and faces the same external factors, not because of price-fixing,” Mr. Albrecht explained.

External factors contributing to the current pricing structure include significant cedi depreciation against the US dollar, high taxes and levies on imported clinker, and other production costs.

Over the past two years, the cedi’s value has halved – doubling production costs for crucial inputs priced in dollars. Additionally, taxes, levies, fees and charges from various government agencies account for about 30 percent of cement’s consumer price.

Imported clinker, a vital component in cement production, is subject to no fewer than 22 distinct taxes and fees before reaching production facilities. While recognising government’s revenue requirements, the industry has emphasised a necessity for transparency in any measures aimed at reducing consumer costs.

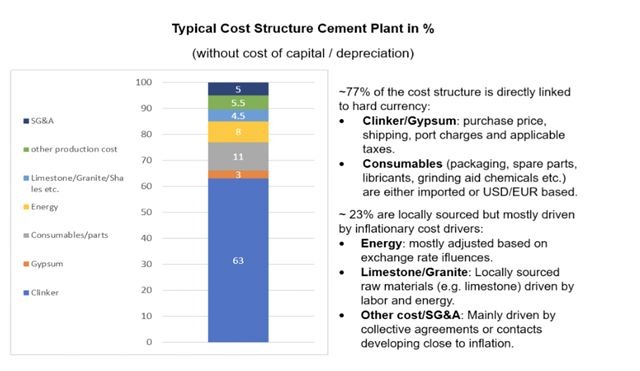

The broader macroeconomic context has further complicated the situation for cement producers. The currency depreciation has severely impacted production costs as 77 percent of inputs, including clinker and gypsum, are directly priced in dollars.

Despite these pressures, the cement industry asserts that it has exhibited remarkable restraint in pricing. Retail cement prices have increased by 48 percent, considerably lagging behind the 103.7 percent rise in the exchange rate. In dollar terms, the price of a bag of cement has decreased by 27 percent over the past two years, from US$8.40 to US$6.12.

Despite these challenges, Ghana’s cement prices remain among the lowest in West Africa.

These sentiments come as there is heightened consternation over Ministry of Trade’s proposed regulation of prices.

Legitimacy

On his part, George Dawson-Amoah, CEO-COCMAG, raised concerns over constitutionality of the L.I. and criticised the lack of proper stakeholder consultation.

The primary issue, according to him, lies in the L.I. ‘s misalignment with its parent Act – specifically the Ghana Standards Authority Act, 2022 (Act 1078), section 80 which addresses sales advertising, not pricing.

“This misalignment is very surprising and significant. It is unconstitutional because drafters of the L.I. did not consider this very concern, which has only recently come to light,” he stated.

He further explained that through recent scrutiny, it became evident that the L.I. is not properly anchored to the relevant legal framework.

“We have been delving into what the L.I. is all about, and we have been going through a window of truth. Establishing an L.I. must be aimed at the parent act… How do you base this L.I. in that section? It is amazing and unconstitutional as it stands,” he explained.

While acknowledging the Chamber’s interactions with the Ministry of Trade and Industry on various issues, Mr. Dawson-Amoah emphasised that there had been no discussions regarding this specific L.I. on pricing.

“We are not saying that we have never had any discussions or meetings with the Ministry of Trade and Industry. We have had several meetings with them. But the issue here, let us narrow it down to the point that there has not been any discussion whatsoever in respect of this particular L.I. on pricing,” he clarified.

Nonetheless, the Chamber will continue to advocate for transparent and inclusive legislative processes to ensure industry stakeholders are adequately consulted and that legislative instruments are constitutionally sound, he added.

Consultation

CEO-Ghana Chamber of Construction Industry (GhCCI), Emmanuel Cherry, said while he did not doubt the noble intentions of the L.I.’s proponents, lack of broad consultation was their biggest flaw.

“The proponents of this L.I. have tried their best in the national interest, but the methodology is where the problem lies,” Mr. Cherry stated.

“If the approach was carefully considered, I do not think we would be having these ups and downs today,” he added.

Mr. Cherry highlighted the GhCCI’s broad representation, which includes professionals, artisans, trade associations and academics within the construction industry.

Despite this, he noted that key stakeholders – particularly developers and consumers – were not adequately consulted during the drafting process.

“The proponents of this bill, who did they consult? In the drafting and composition of the committee, I do not see us, the developers, or the consumers who represent our interest,” he said.

A significant issue raised was deviation from the Ghana Standard Authority’s mandate, which does not include cement pricing.

“One of the concerns being raised by the manufacturers is the standard authority’s remit seems to have a little deviation,” Mr. Cherry explained. “Their mandate does not include cement pricing, and that’s where the issues are.”

The meeting, which intentionally excluded the Ministry of Trade and Industry and Ghana Standard Authority to focus on specific discussions, was seen as a necessary step in addressing the industry’s concerns methodically.

Mr. Cherry stressed a need to protect the construction industry while acknowledging government’s regulatory efforts.

“Inasmuch as government is trying to regulate the price or find a way to regulate the price within the market, we must also not forget the bottlenecks and challenges causing these price fluctuations,” Mr. Cherry noted.

He outlined a plan for phased engagement with various stakeholders, including the Ministry of Trade and Industry, Ghana Standard Authority and parliament.

Advocating for a holistic approach to the built environment, Mr. Cherry emphasised that cement is just one component. “Other materials should also be considered in the regulatory framework,” he said.