By Joshua Worlasi AMLANU

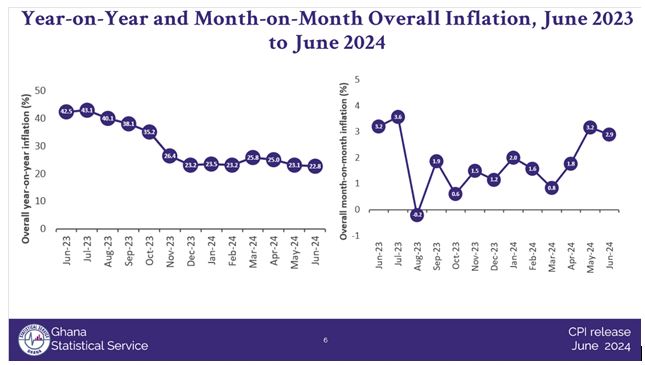

Consumer inflation declined to 22.8 percent in June 2024, down from 23.1 percent in May, according to the latest Consumer Price Index (CPI) report released by the Ghana Statistical Service.

This marks the lowest year-on-year inflation rate the country has seen in 28 months, offering a glimmer of hope for the nation’s economic landscape.

The month-on-month inflation rate between May and June 2024 stood at 2.9 percent, showing a slight improvement from the 3.2 percent recorded in the previous month. However, the report reveals a complex picture of the country’s economic situation, with varying trends across different sectors and regions.

Food inflation saw a marginal increase year-on-year, rising from 22.6 percent in May to 24.0 percent in June 2024. This uptick was particularly pronounced in the month-on-month figures, with food inflation jumping from 2.7 percent in May to 5.1 percent in June.

The volatility in food prices remains a concern, with items such as vegetables, tubers, plantain, cooking banana and pulses contributing significantly to the food inflation rate.

In contrast, non-food inflation showed a marked improvement, decreasing from 23.6 percent in May to 21.6 percent in June 2024. The month-on-month figures for non-food inflation saw a sharp decline from 3.6 percent to 0.9 percent over the same period.

This reduction in non-food inflation played a crucial role in the inflation rate’s overall dip, driven by a decrease in the prices of items such as housing, water, electricity, gas and other fuels which had previously seen consistent increases over the past four months.

Regional disparities in inflation rates remain significant across Ghana. The Upper East Region recorded the highest inflation rate at 35.2 percent while Oti Region experienced the lowest at 10.3 percent. Food inflation showed even more stark contrasts, with the Bono East Region recording a rate of 39.2 percent – more than 2.5 times higher than the lowest food inflation rate of 15.6 percent observed in the Oti Region.

Offering some insights into the inflation trend’s potential trajectory, GCB Capital in an earlier note to investors predicted the disinflation trend will continue… albeit at a moderated pace.

They cite several factors that could influence inflation in the coming months, including the lagged impact of cedi depreciation, a recent transport fare hike and implementation of Q2 2024 utility tariff adjustments in second-half of the year.

GCB Capital also points to positive factors that could sustain the disinflationary trend, such as the upcoming main crop harvest season which is expected to ease pressures on food prices.

Additionally, they note that the UN-backed cease-fire talks between Israel and Hamas show promise for restoring peace; which, combined with the US Federal Reserve’s likely pushback on an immediate interest rate pivot, could improve the outlook for crude oil supply and potentially stabilise fuel prices.

Completion of the second review of Ghana’s programme with the International Monetary Fund (IMF) and release of US$360million catalytic funding as well as funding from the World Bank’s DPO, among others, are also seen as positive factors that could improve the country’s foreign exchange reserve cushion and trigger a marginal correction in the exchange rate.

Apakan Securities offered a more cautious outlook, predicting a further drop in the annual inflation rate going forward in H2 2024 but warning that the balance of risks tilts to the upside. While they acknowledge the Consumer Price Index base’s potential to support the disinflation process in the short-term, they highlight several risk factors that could cap the disinflation process.

These include persistent pressures on the local currency – which has depreciated by 20% year-to-date, elevated transport fares and ex-pump prices, and recent increases in electricity tariffs implemented by the utility regulator. Apakan Securities warns that these developments could create second-round effects on related items in the inflation basket, potentially limiting further declines in the inflation rate.