By Alhassan BUNYAMINU (Dr) and Adibura Baba SEIDU (Dr)

In recent years, the discourse surrounding economic development in Ghana has predominantly focused on regulatory frameworks and fiscal policies as the primary drivers of growth and stability. While undoubtedly crucial, these discussions often overlook a fundamental aspect of economic vitality: the freedom of business.

This study aims at redirecting attention towards an often-underestimated factor in Ghana’s economic landscape – business freedom – and its intricate relationship with tax performance. Business freedom, characterized by the ease of starting, operating, and closing a business, is a multifaceted concept that extends beyond regulatory compliance. It encompasses the efficiency of administrative processes, protection of property rights, and the prevalence of corruption, among other factors.

Ghana’s regulatory environment has undergone significant reforms in recent years, aiming to streamline procedures and attract investment. However, the impact of these reforms on actual business freedom and, consequently, tax performance remains a subject worthy of deeper exploration.

Research indicates a strong correlation between business freedom and tax compliance. When entrepreneurs face fewer bureaucratic hurdles and legal ambiguities, they are more inclined to formalize their businesses, contributing to increased tax revenues. Conversely, burdensome regulations and administrative inefficiencies not only deter entrepreneurs from entering the formal sector but also incentivize tax evasion and informal economic activities.

In light of these observations, it is imperative for policymakers and stakeholders to adopt a holistic approach to economic development that goes beyond mere regulation. Enhancing business freedom entails addressing structural inefficiencies, improving access to finance, bolstering institutions, and fostering a culture of transparency and accountability.

Furthermore, the relationship between business freedom and tax performance underscores the importance of tailored policy interventions. Rather than relying solely on punitive measures to enforce tax compliance, policymakers should prioritize initiatives that empower businesses, promote voluntary tax compliance, and create an enabling environment for entrepreneurship.

Moreover, addressing the underlying factors that impede business freedom requires a concerted effort from both the public and private sectors. Collaboration between government agencies, business associations, civil society organizations, and international partners is essential to enact meaningful reforms and ensure their effective implementation.

As Ghana strives to achieve its economic development objectives and foster inclusive growth, it must recognize the symbiotic relationship between business freedom and tax performance. By embracing policies that enhance business freedom, Ghana can unlock the full potential of its entrepreneurial spirit, promote sustainable economic growth, and build a more prosperous future for all its citizens.

The Landscape of Business Freedom in Ghana

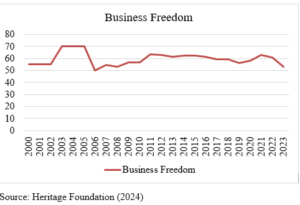

Despite improvements, Ghana’s overall business freedom score according to the Heritage Foundation’s Index of Economic Freedom remains below the world average, indicating room for further progress. The pattern of business freedom in Ghana, as reflected in the data from the Heritage Foundation, exhibits fluctuations over the years.

From 2000 to 2005, the level of business freedom remained relatively stable, hovering around the range of 55 to 70. However, there was a notable dip in 2006, where the score dropped to 50, indicating a decline in the ease of doing business. Subsequently, there were fluctuations in the following years, with some years experiencing slight improvements while others witnessed declines. For instance, there was a slight increase in business freedom in 2007 and 2009, but a decrease in 2008.

A significant improvement was observed in 2011, with the business freedom score reaching 63.4, indicating a more conducive environment for entrepreneurship. However, this upward trend was not sustained, as the score fluctuated in the subsequent years, with occasional decreases observed. In 2017 and 2018, there was a notable decline in business freedom, with scores dropping to 59.6 and 59.5, respectively.

This could suggest challenges or regulatory changes that impacted the ease of doing business during those periods. In more recent years, there has been some variability in the business freedom scores. While there was an improvement in 2021, with the score reaching 62.9, there was a significant decline in 2023, where the score dropped to 53.3, indicating potential challenges or changes in the business environment.

Overall, the pattern of business freedom in Ghana, as depicted by the Heritage Foundation data, highlights the dynamic nature of the business environment, with fluctuations observed over the years. These fluctuations may be influenced by various factors, including regulatory changes, economic policies, and external economic conditions.

The Impactful Outlook of Business Freedom on Tax Performance

In the realm of economic development, Ghana stands as a beacon of progress in the African continent. With a burgeoning economy and a commitment to reform, the nation has made significant strides in recent years. However, amidst discussions of regulatory frameworks and fiscal policies, one crucial aspect often overlooked is the impact of business freedom on tax performance. Business freedom, defined as the ease of starting, operating, and closing a business, plays a pivotal role in shaping the economic landscape of any nation. In the context of Ghana, where entrepreneurship thrives and small and medium enterprises (SMEs) are the backbone of the economy, understanding the relationship between business freedom and tax performance is paramount. Recent studies have shed light on the intricate connection between these two factors. A more favorable business environment, characterized by streamlined regulations, efficient administrative processes, and protection of property rights, not only fosters entrepreneurship but also encourages businesses to operate within the formal sector. This, in turn, leads to increased tax compliance and revenue generation for the government. Conversely, burdensome regulations, bureaucratic hurdles, and institutional inefficiencies hinder business growth and discourage formalization. In such environments, entrepreneurs are compelled to navigate complex regulatory frameworks or resort to informal economic activities to avoid the pitfalls of the formal sector. This not only stifles economic productivity but also undermines tax collection efforts, leading to revenue leakage and fiscal deficits. Looking beyond Ghana’s borders, we can find examples of countries that have embraced business freedom and seen remarkable improvements in tax performance. Singapore, a beacon of economic freedom, boasts a tax-to-GDP ratio exceeding 20%. This is achieved through a competitive tax regime, streamlined regulations, and a commitment to fostering innovation and entrepreneurship. Rwanda, another African success story, has implemented significant reforms to simplify its tax code and reduce bureaucratic hurdles. This has resulted in a surge in tax collection and fueled the country’s impressive economic growth.

Resolve the Challenges

To address these challenges and harness the full potential of business freedom for enhanced tax performance, policymakers in Ghana must undertake comprehensive reforms. This entails streamlining administrative procedures, reducing regulatory burdens, and enhancing the efficiency and transparency of government institutions.

Furthermore, fostering a culture of compliance through education, awareness campaigns, and incentives can incentivize businesses to voluntarily adhere to tax obligations. Moreover, initiatives aimed at improving access to finance, providing technical assistance to SMEs, and strengthening property rights protection can empower entrepreneurs and facilitate their transition into the formal economy.

It is also essential for Ghana to leverage technology and digital platforms to modernize tax administration and enhance compliance mechanisms. By embracing digital solutions such as electronic filing systems, online payment platforms, and data analytics tools, the government can streamline tax processes, reduce compliance costs, and minimize opportunities for corruption and tax evasion.

Moreover, collaboration between government agencies, private sector stakeholders, and international partners is critical to implementing effective reforms and achieving sustainable results. By working together towards a common goal, Ghana can create an enabling environment for businesses to thrive, boost tax revenues, and foster inclusive economic growth.

Conclusion

In conclusion, the nexus between business freedom and tax performance is undeniable. As Ghana continues its journey towards economic development and prosperity, it must prioritize policies that promote entrepreneurship, facilitate formalization, and enhance tax compliance. By embracing business freedom as a catalyst for growth, Ghana can unlock its full potential and pave the way for a brighter future for all its citizens. Beyond regulation lies a realm of opportunity – one where the freedom to do business serves as a facilitator for economic progress. Let us embark on this journey with a renewed commitment to advancing business freedom and unlocking the untapped potential of Ghana’s economy.