The nation’s banking sector is making progress toward gender equality but there is still a significant climb to reach the summit, a recent PwC report titled ‘Changing Currency’ has said.

The report, with the tagline ‘examining trends and challenges of female participation in Ghana’s banking sector sheds light on this ongoing journey, the challenges and opportunities for women in leadership positions.

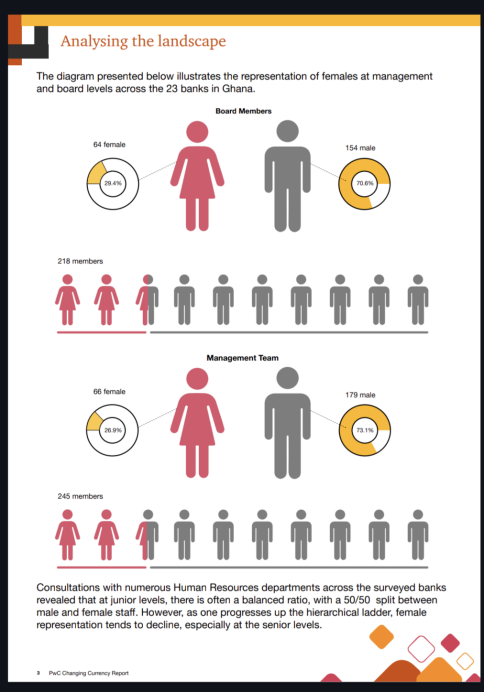

It revealed that while women constitute nearly half the workforce at junior levels, their representation significantly dips at the top. In the 23 banks surveyed, only 29.4 percent of board members are women – 64 out of 218 – and that number dips to 26.9 percent – 66 out of 245 – for management teams.

“There is a pressing need to redefine this narrative, fostering an industry where diversity thrives and opportunities are accessible to all,” the report emphasises.

The report’s findings echo a reality observed globally. A 2017 International Monetary Fund (IMF) study revealed that women hold less than two percent of bank CEO positions worldwide and occupy roughly 20 percent of board seats.

This under-representation is not for lack of interest. The report highlights a growing surge of women seeking to contribute their skills and expertise to the banking sector.

A key driver is the evolving perception of the industry, which is increasingly seen as offering dynamic opportunities across various roles.

However, PwC identifies several factors that continue to hinder women’s advancement. One major hurdle is the perception that diversity and inclusion are secondary concerns for many banks.

The report quotes a female executive who expresses this sentiment: “Many female executives believe that banks regard diversity and inclusion as secondary considerations, overlooking the pivotal role it plays in driving progress and strengthening organisational resilience”.

Societal norms and a lack of female role models are also cited as significant barriers. PwC explains that “predetermined roles assigned to women” can make it difficult for them to assert themselves confidently in their careers. Additionally, “family objections and societal criticisms often deter women from pushing forward with their ambitions and capabilities”.

PwC recommends that regulatory bodies take the lead by establishing mandated diversity targets and enforcing stricter diversity reporting requirements. This could involve implementing quotas for boards and executive positions, similar to those enforced in some European countries.

The report also stresses the importance of collaboration among stakeholders. It highlights the need for regulators and private sector organisations to work together with advocacy groups and industry associations to develop effective initiatives. These initiatives should address societal norms and promote the development of female role models who can inspire future generations.

Another key recommendation is the establishment of clear reporting standards for gender-related data. This would allow regulators to monitor progress, identify areas for improvement, and create benchmarks across the industry.

The report further underscores the importance of providing training and resources to equip banks with the tools they need to comply with diversity and inclusion reporting requirements.

This could involve workshops, webinars or online resources focused on the importance of diversity and inclusion, along with guidance on data collection and reporting methodologies.