Head of Client Coverage at Stanbic Investment Management Services (SIMS), Desmond Bredu, has highlighted the need for investors to assess their risk appetites before making investment decisions. He made this statement in an interview on TV3’s morning show, New Day.

Speaking on the topic, ‘Smart Money Moves; Understanding Savings and Investments’, Desmond Bredu explained the importance of aligning your risk appetite with your investment goals.

He said, “Every investment comes with a level of risk. If anyone promises you an investment with zero risks and guaranteed returns you need to be skeptical. Instead of running away from investments to avoid risks, it is important to know your risk appetite level. Some people are naturally risk takers and others are risk averse. If you know yourself and which category you fall in then you can align your investment goals properly. Young people are encouraged to be risk-takers because they have more time to make up for whatever may be lost if things go wrong. All other things being equal, the higher the risk, the higher the expected return.”

He added that, “Investing is a good way to grow your money and manage your wealth. It is important however to make sure you understand the risk involved before you go ahead and invest.

There are two main types of risks, systematic and unsystematic risk. Systematic risks such as Inflation affect everyone while unsystematic risks such as credit risk are company sector or asset specific and do not affect everyone in the market.

If you are interested in any investment but do not fully understand the risks kindly contact an expert to assist you. When you fully understand and believe you can tolerate the risk then you can go ahead and invest.”

Mr. Bredu also shared how lifestyle inflation can affect one’s ability to save and invest. He shared, “When you earn 500 cedis you may think it will be easier to save more than if you earn 1000 cedis.

The truth is that as your income changes your lifestyle also changes. This is when lifestyle inflation comes into play and you have to be more conscious about your savings. You need to be disciplined and cut out certain expenses.

If you go out four times a month you can reduce it to twice a month to save some money. A mistake some people make is that they save after spending. It is better to take out your savings first and then you can use what is left as your expenditure.”

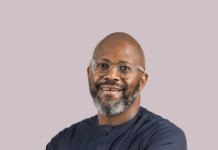

Desmond Bredu, Head, Client Coverage – Stanbic Investment Management Services (SIMS)