By Korsi DZOKOTO

The Summary of Macroeconomic and Financial Data published by the Bank of Ghana provides a comprehensive overview of key economic indicators shaping the economy. These indicators play a crucial role in informing policymakers, businesses, and individuals about the current state of the economy and its future outlook. In this summary, we will delve into the trends and implications of inflation, real sector indicators, interest rates, and foreign exchange rates.

INFLATION OVERVIEW

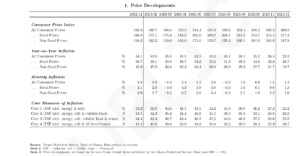

The macroeconomic and financial data provides insights into price developments, inflation rates, and core measures of inflation for the period between December 2022 and December 2023.

- Price Developments:

- The Consumer Price Index (CPI) for all consumer prices has shown a steady increase: “Consumer Price Index All Consumer Prices: 162.8 (Dec 2022) to 200.5 (Dec 2023).”

- Both food and non-food prices have contributed to the rise in the CPI: “Food Prices: 168.8 (Dec 2022) to 217.2 (Dec 2023)” and “Non-Food Prices: 158.2 (Dec 2022) to 187.8 (Dec 2023).”

- Year-on-Year Inflation rates have been high but have shown a gradual decline: “All Consumer Prices %: 54.1 (Dec 2022) to 23.2 (Dec 2023).”

- Monthly Inflation rates have fluctuated but generally remained positive: “All Consumer Prices %: 3.8 (Dec 2022) to 1.2 (Dec 2023).”

- Implications for Businesses and Individuals:

- Businesses: Rising prices can increase production and operating costs, requiring careful cost management and potentially adjusted pricing strategies. Supply chain management and market positioning strategies may need to be adapted to mitigate risks and maintain competitiveness.

- Individuals: High inflation can erode purchasing power, necessitating wise budgeting and investment planning. Debt management strategies should also be considered to avoid financial strain.

- Managing Inflationary Trends:

- Monitor Economic Indicators: Regularly monitor CPI, inflation rates, and core inflation measures.

- Adaptation and Flexibility: Remain adaptable to changing market conditions by revisiting pricing strategies, renegotiating contracts, and optimizing operations.

- Diversification: Protect finances from inflation by diversifying income sources and investing in assets that historically perform well during inflationary periods.

- Financial Planning: Set realistic financial goals, maintain emergency funds, and seek professional advice when necessary.

By understanding and proactively managing inflationary trends, businesses and individuals can navigate economic uncertainties more effectively and make informed decisions to safeguard their financial well-being.

REAL SECTOR INDICATORS OVERVIEW

The real sector indicators offer valuable insights into the economy’s performance, particularly regarding growth in the real sector and confidence levels among consumers and businesses. Let’s explore the implications for businesses, individuals, and strategies for managing these indicators:

- CIEA (Year 2001 = 100):

- The Nominal Index shows an upward trend, indicating overall growth in economic activities: “Nominal Index: 2975.9 (Sep 2022) to 3649.8 (Nov 2023).”

- The Annual Growth Percentage has been fluctuating but generally positive, indicating periods of growth in economic activities: “Annual Growth %: 18.4 (Sep 2022) to 15.2 (Nov 2023).”

Implications:

- Businesses: A rising Nominal Index suggests increasing economic activities, creating opportunities for expansion. However, fluctuating Annual Growth Percentage indicates market volatility, requiring agility from businesses.

- Individuals: Increasing economic activities can lead to job creation and income growth if the drivers are jobs oriented. However, individuals should save for future uncertainties due to potential market fluctuations.

Management:

- Businesses should diversify products/services to capitalize on growth opportunities while maintaining flexibility.

- Individuals should save and invest during economic growth to prepare for potential downturns.

- Gross Domestic Product (GDP):

- The Nominal GDP shows an increasing trend, indicating overall economic growth: “Nominal GDP (billion GHC): 152.4 (Sep 2022) to 212.4 (Nov 2023).”

- The Real GDP, adjusted for inflation, also shows an increasing trend, with fluctuations in the Quarterly Year-on-Year Growth: “Real GDP (billion GHC): 43.9 (Sep 2022) to 44.7 (Nov 2023).”

Implications:

- Businesses: A growing GDP suggests a favourable business environment with potential market expansion, requiring strategic alignment for growth. However, with high tax constraints and increase cost of power, this may not be achieved.

- Individuals: Economic growth can lead to increased job opportunities and income growth, benefiting individuals.

Management:

- Businesses should invest in research, expand market reach, and innovate to capitalize on economic growth.

- Individuals should upskill to enhance employability and leverage job opportunities arising from economic growth.

- Bank of Ghana Confidence Surveys:

- The Consumer Confidence Index fluctuates but generally indicates positive consumer sentiment: “Consumer Confidence Index: 79.2 (Jul 2023) to 93.0 (Dec 2023).”

- The Business Confidence Index also fluctuates but suggests positive business sentiment: “Business Confidence Index: 75.7 (Jul 2023) to 90.9 (Dec 2023).”

Implications:

- Businesses: Positive confidence indices can lead to increased spending and investment, necessitating strategic alignment with consumer and business sentiment.

- Individuals: Positive confidence indices can result in job stability and potentially higher wages, impacting individuals’ financial planning.

Management:

- Businesses should focus on customer satisfaction, product quality, and effective communication to maintain and improve consumer confidence.

- Individuals should stay informed about economic conditions and consumer confidence levels for informed financial decisions.

INTEREST RATES OVERVIEW

Interest rates play a crucial role in the economy, impacting borrowing, saving, and investment decisions. The data above shows various interest rates and their trends over time, providing insights into monetary policy and credit market conditions.

- Monetary Policy Rate:

- The Monetary Policy Rate (MPR) is the rate at which the central bank lends to commercial banks. It influences other interest rates in the economy.

- MPR has remained at 30.00% from August 2023 to December 2023.

Implications:

- Businesses: A high MPR can increase borrowing costs for businesses, affecting investment decisions and profitability. At 30%, meaning businesses would have to borrow at same rate or above as cost of capital, plus cost of labour and cost operation, that is stifling for business.

- Individuals: High MPR can lead to higher borrowing costs for individuals, impacting consumption and investment decisions.

Management:

- Businesses can consider alternative sources of funding or negotiate for favourable terms with financial institutions.

- Individuals can explore saving and investment options that offer higher returns to offset the impact of high borrowing costs.

- Interbank Weighted Average:

- Interbank rates reflect the cost at which banks lend to each other.

- The Interbank Weighted Average has increased steadily from 25.51% in December 2022 to 30.19% in December 2023.

Implications:

- Businesses: Higher interbank rates can increase the cost of funds for banks, which may translate to higher lending rates for businesses.

- Individuals: Increased interbank rates can lead to higher borrowing costs for individuals, affecting affordability of loans.

Management:

- Businesses can explore hedging strategies or negotiate for better loan terms.

- Individuals can consider refinancing existing loans to take advantage of lower rates.

- Treasury Instruments:

- Treasury bills are short-term government securities used to raise funds.

- The interest rates on 91-Day, 182-Day, and 364-Day Bills have shown varying trends but generally increased over the period.

Implications:

- Businesses: Rising treasury bill rates can signal tightening monetary policy, impacting borrowing costs and investment decisions.

- Individuals: Higher treasury bill rates can offer attractive returns for savers but may increase borrowing costs.

Management:

- Businesses can explore other financing options or adjust investment strategies.

- Individuals can consider investing in treasury bills as part of a diversified portfolio.

- Deposit Rates:

- Deposit rates influence saving and spending behaviour.

- Rates for demand deposits and savings deposits have remained stable, while time deposit rates have decreased over time.

Implications:

- Businesses: Stable deposit rates may indicate a stable funding environment for banks, which can affect lending rates.

- Individuals: Lower time deposit rates can reduce returns on savings, impacting financial planning.

Management:

- Businesses can assess funding sources and adjust pricing strategies accordingly.

- Individuals can explore alternative savings or investment options to maximize returns.

- Credit Market:

- The Average Lending Rate and Ghana Reference Rate have shown varying trends, with fluctuations over time.

Implications:

- Businesses: Fluctuating lending rates can impact the cost of credit for businesses, influencing investment decisions.

- Individuals: Changes in lending rates can affect the affordability of loans for individuals, impacting consumption and investment decisions.

Management:

- Businesses can monitor credit market trends and adjust financing strategies accordingly.

- Individuals can consider loan options with favourable terms or explore other financing options.

FOREIGN EXCHANGE RATES OVERVIEW

Foreign exchange rates play a pivotal role in global trade and investment, influencing businesses and individuals alike. The BoG data provided offers insights into currency movements, exchange rate trends, and their implications for various stakeholders.

- Domestic Currency Movements:

- USD/GHC: The exchange rate between the US dollar (USD) and the Ghanaian cedi (GHC) has experienced fluctuations, with the GHC depreciating against the USD over time.

- GBP/GHC: Similarly, the exchange rate between the British pound (GBP) and the GHC has shown depreciation trends, indicating a weaker GHC relative to the GBP.

- EUR/GHC: The exchange rate between the euro (EUR) and the GHC has also displayed depreciation, reflecting a decline in the value of the GHC against the euro.

Implications:

- Businesses: Depreciation of the domestic currency can increase import costs for businesses, affecting profitability and pricing strategies.

- Individuals: Depreciating currency may lead to higher prices of imported goods, impacting individuals’ purchasing power and cost of living.

Management:

- Businesses can hedge against currency risks through forward contracts or diversify sourcing strategies to mitigate the impact of currency depreciation.

- Individuals can consider allocating assets to currencies or investments that are less impacted by domestic currency depreciation.

- Real Effective Exchange Rate (REER):

- The REER index reflects the value of a country’s currency relative to a basket of other currencies, adjusted for inflation.

- The REER index has shown fluctuations over time, indicating changes in the competitiveness of the domestic currency in international markets.

Implications:

- Businesses: Changes in REER can affect the competitiveness of domestic goods and services in international markets. A higher REER may make exports less competitive, while a lower REER may benefit exporters.

- Individuals: REER fluctuations can influence the cost of imported goods and services, impacting individuals’ purchasing power and inflation rates.

Management:

- Businesses can monitor REER trends to assess the competitiveness of their products in international markets and adjust export strategies accordingly.

- Individuals can consider the impact of REER fluctuations on inflation and adjust spending and investment decisions accordingly.

- International Currency Movements:

- GBP/USD, EUR/USD, GBP/EUR: Exchange rates between major international currencies have shown fluctuations, impacting global trade and investment flows.

- US Dollar Index (USDX): Reflects the value of the US dollar against a basket of major currencies.

- Emerging Market Currency Index (EMCI): Reflects the value of emerging market currencies against the US dollar.

Implications:

- Businesses: Fluctuations in international currency movements can impact the cost of imports and exports, affecting profitability and market competitiveness.

- Individuals: Changes in major currency exchange rates can impact the cost of international travel, imported goods, and investment returns.

Management:

- Businesses engaged in international trade can use currency hedging strategies to manage exchange rate risks and stabilize cash flows.

- Individuals can diversify currency exposure in investment portfolios or use currency exchange services to mitigate the impact of currency fluctuations.

COMMODITY PRICES OVERVIEW

The Bank of Ghana provides data on key commodity prices, including cocoa, gold, and Brent crude oil, which are crucial for understanding economic trends and their implications for businesses and individuals.

- Cocoa Price:

- International cocoa prices per tonne have surged, with a year-to-date change percentage peaking at 66.8% in December 2023.

- The realized price of cocoa per tonne has also risen, albeit with fluctuations, indicating market volatility.

Implications:

- Businesses: Increasing cocoa prices can raise production costs for businesses in the chocolate and confectionery industries, impacting profit margins.

- Individuals: Higher cocoa prices may lead to elevated prices for chocolate and other cocoa-based products, affecting consumer spending.

Management:

- Businesses can hedge against cocoa price fluctuations through futures contracts or diversify sourcing strategies.

- Individuals can consider adjusting consumption patterns or exploring alternative products if cocoa-based items become cost-prohibitive.

- Gold Price:

- The international price of gold per fine ounce has exhibited an overall upward trend, with a year-to-date change percentage of 13.3% in December 2023.

- The realized price of gold per fine ounce has also increased, albeit with some volatility, reflecting market dynamics.

Implications:

- Businesses: Rising gold prices can elevate costs for businesses in the jewellery and electronics sectors, impacting profit margins.

- Individuals: Higher gold prices can affect the value of jewellery and gold investments, influencing personal finances and investment decisions.

Management:

- Businesses can hedge against gold price volatility through futures contracts or adjust pricing strategies to mitigate profitability risks.

- Individuals can consider diversifying investment portfolios to reduce exposure to gold price fluctuations.

- Brent Crude Oil Price:

- The international price of Brent crude oil per barrel has shown fluctuations, with a year-to-date change percentage of -5.0% in December 2023.

- The realized price of Brent crude oil per barrel has also fluctuated, indicating market volatility in the oil sector.

Implications:

- Businesses: Fluctuating oil prices can impact production costs for businesses in various industries, particularly those reliant on oil for energy or transportation.

- Individuals: Changes in oil prices can affect gasoline prices, impacting transportation costs and inflation.

Management:

- Businesses can hedge against oil price volatility through futures contracts or invest in alternative energy sources.

- Individuals can consider carpooling, using public transportation, or investing in fuel-efficient vehicles to mitigate the impact of rising oil prices.

Conclusion

In conclusion, the Summary of Macroeconomic and Financial Data highlights the complex interplay of factors shaping Ghana’s economic landscape. While inflation remains a concern, real sector indicators show signs of resilience and growth. Interest rates, though fluctuating, play a crucial role in balancing economic stability.

Foreign exchange rates, while volatile, reflect the country’s position in the global economy amidst prevailing uncertainties, the Bank of Ghana’s data underscores the imperative of implementing stricter fiscal discipline. The discernible trends in fiscal, debt, and macroeconomic indicators highlight the necessity for proactive measures to address potential vulnerabilities.

However, the IMF backstop is poised to offer a vital anchor, providing ample restraint to fortify the macroeconomic gains achieved thus far. By leveraging this support effectively, coupled with sustained efforts towards fiscal prudence, Ghana can navigate through uncertainties with resilience, fostering stability and sustainable growth in the long term.