By Kizito CUDJOE

Resource-rich Ghana has once again made headlines by joining the ranks of African nations producing green minerals. This time, the focus is on lithium, a highly sought-after transition mineral. The country’s entry into lithium production is seen as significant, considering the growing global demand for this crucial transition metal. Lithium is a key component in the manufacturing of batteries, particularly those used in electric vehicles and renewable energy storage systems. The shift towards green technologies has increased focus on minerals like lithium.

While Ghana is already known for its resource-rich profile in gold, cocoa, and oil, diversifying into lithium production reflects the country’s recognition of the importance of minerals in the emerging green economy. Notably, this development came barely 12 years after the country’s commercial oil discovery and production. Therefore, the move toward lithium production can potentially boost Ghana’s economy, create job opportunities, and contribute to the global supply of essential minerals for sustainable technologies.

However, ever since the declaration of the first mining lease for lithium with Barari DV Ghana Limited (a subsidiary of Atlantic Lithium Limited), following the commercial discovery at Ewoyaa in the Mfantseman Municipality of the Central region, a multitude of opinions has surfaced regarding the agreement.

These discussions have revolved around the potential benefits for the country, coupled with concerns that the deal may carry a perceived ‘colonial nature.’ Some also highlight the economic disadvantages the country had going into the deal.

Barari DV Ghana Limited, according to the Minerals Commission of Ghana, has been engaged in the exploration of lithium resources within the Ewoyaa enclave since 2012. Subsequently, according to the Commission, the company has invested approximately US$58 million in this undertaking.

According to Atlantic Lithium, the Ewoyaa inaugural lithium mine boasts a spodumene pegmatite resource of 35.3 million metric tons at 1.25 percent Lithium Oxide (Li₂O). Atlantic Lithium says the initiative is financially supported through a co-development agreement with Piedmont Lithium, a company listed on NASDAQ and ASX. “The project enjoys governmental backing, excellent local infrastructure, and strategic proximity to potential off takers, reinforcing its economic viability. Atlantic Lithium has secured a total tenure of 1,283 square kilometers spanning Ghana and Côte d’Ivoire.”

Lease Agreement:

The agreement awards Barari DV the inaugural mining lease for lithium extraction at Ewoyaa. It covers a 15-year period and incorporates new and enhanced terms to ensure the country optimally benefits from this mineral. This includes increased royalty rate, state and local participation, and value addition to the mineral mined. The lease agreement follows the completion of prospecting and feasibility studies by the company, as well as a series of negotiations between the state and Barari DV.

The lease covers an area of approximately 42.63 square kilometers. It grants the company exclusive rights to work and produce lithium and associated minerals in the area under the country’s mining laws.

Announcement of the inaugural lease agreement

During a ceremony to announce the lease agreement, the Minister of Lands and Natural Resources, Samuel Abu Jinapor, said, “The government took a decision not to treat these new minerals the way we have done with other minerals over the years.”

“Accordingly, on 13th July 2022, on behalf of the President of the Republic, Nana Addo Dankwa Akufo-Addo, I presented a policy statement on the development and management of our green minerals to Parliament, which was anchored on ensuring that the exploitation of these green minerals inures to the benefit of Ghanaians, the true owners of these minerals, through effective and efficient exploitation; local content and local participation; and value addition.”

Following this, he said the Cabinet then approved policy proposals for exploiting and managing our green minerals. Among the approved policies are; an increased royalty rate for green minerals, an increase in state and Ghanaian participation in all green mineral operations to a minimum of 30 percent; an enhanced local content and local participation, including listing on the Ghana Stock Exchange (GSE); and value addition and beneficiation.

He said it was based on these policies that the government entered into negotiations with Atlantic Lithium. The Minister maintained that the deal differs from “our standard Mining Lease, in that it incorporates the agreed terms we have concluded with the company, based on the policy approved by Cabinet.”

The provisions in the lease agreement announced by the Minister include an increase in royalties rate from the standard 5 percent to 10 percent and an increase in the State’s free carried interest from 10 percent to 13 percent.

“The government will, therefore, hold 13 percent shares in the company, which it will not pay for but would be entitled to dividends and other rights,” Mr. Jinapor explained. Furthermore, he said there is an additional government participation through the acquisition of shares. “Thus, in addition to the 13 percent shares, the government, through the Minerals Income Investment Fund (MIIF), will acquire an additional 6 percent shares in the mining company and 3.06 percent shares in the holding company, listed on the Australian and London Stocks Exchange. This will bring the Government’s interest in the company to 19 percent in the local company and 3.06 percent in the foreign holding company.”

Also, he noted that the government and MIIF will have representations on the Board of both the local company and the foreign company to protect the government’s interest; “To ensure that other interested Ghanaians benefit from this mining operation, the company will list on the Ghana Stock Exchange, and their shares will be made available to Ghanaian entities and individuals, including SSNIT, pension funds, and other high-income individuals,” he stated.

In addition to all taxes, royalties, and levies, including a one percent Growth and Sustainability Levy, he added that the Barari DV Ghana Limited would also pay one percent of its revenue into a Community Development Fund to be utilized to develop communities impacted by their operations.

It was also stated that the company had committed to completing a feasibility study for the establishment of a chemical plant within four months of the signing of the lease. To this, the Minister said, “Our commitment is to ensure that, as much as possible, we add value to these minerals before exporting them. We do not intend to export lithium in its raw state.” According to Mr. Jinapor, if the company cannot set up a chemical plant in the country, they have agreed to supply its mined minerals to any chemical plant established there. This will ensure that we do not export lithium to its raw state. He noted that all by-products from the operation, such as feldspar and kaolin, would have to be sold locally to feed the local ceramic and other industries.

Reactions following the lease agreement

Since this announcement, various figures and entities, including think tanks and academia, have expressed criticism of the decision.

For instance, the Institute of Energy Security (IES) and the African Center for Energy Policy (ACEP), in a study, emphasized that Ghana has adhered to an open-door, direct negotiation policy for allocating mineral rights in the mining sector for the past century. While legally sound, this approach, they said, lacks competitive bidding and the systematic selection of companies for mineral prospecting and production.

The study also highlighted that Ghana appears to have yet to learn from its extensive experience in gold mining, spanning well over a century. The country continues to export raw gold without significant value addition.

In light of this, the think tanks called for a shift in the mineral exploitation and exportation paradigm, advocating for a focus on processing and adding value to minerals to enhance the nation’s industrial capacity and increase its stake in mineral exploitation. They added, “That is the best way to develop the country’s industrial capacity and increase the nation’s stake in mineral exploitation.”

Furthermore, the study revealed that much of the data on the lithium discovery, including geological estimates, was determined by the exploratory company using baseline data from the Geological Survey Department.

The think tanks pointed out that this puts the state at a disadvantage during negotiations, as it cannot challenge the geological data provided by the licensed company. They, therefore, recommended that the state invest in comprehensive data gathering for potential mineral locations across the country.

Regarding the Minerals Income Investment Fund’s (MIIF) interest in investing approximately US$30 million in the Ewoyaa Lithium project held by the Atlantic Lithium Company Limited, the think tanks acknowledged the positive aspect of such investment, as it allows the state to have a stake and promotes local content considerations.

However, they, among others, stressed the importance of the government conducting thorough due diligence to ensure a risk-free transaction that aligns with the best interests of the state.

Also, the Institute of Economic Affairs (IEA) led by one of its distinguished scholars, the former Chief Justice, Sophia Akuffo, raised critical concerns over the deal.

The key concerns raised by the IEA emphasized the necessity for parliamentary ratification, citing Article 268 of the 1992 Constitution, and challenged claims made by the Minister that the terms of the agreement are favorable to Ghana.

The Institute argued that these terms resemble previous colonial-type agreements, which have yielded limited benefits to the average Ghanaian.

Drawing parallels with successful lithium producers such as Mexico, Bolivia, Chile, and Argentina, the IEA, among others, proposed a comprehensive alternative model. This involves the establishment of a Ghana Lithium Company (GLC) responsible for the entire value chain, emphasizing the creation of a local refinery before excavation begins.

The Ranking Member of the Mines and Energy Committee and Member of Parliament (MP) for the Yapei Kusawgu Constituency, John Abdulai Jinapor, has subsequently also said the minority is ready to scrutinize the agreement when it is brought before the House to ensure that it is in the best interest of Ghanaians.

“I want to make it clear, succinct, and explicit that the agreement between the government of Ghana and Barari DV Ghana Limited should be laid before parliament without delay. Let me assure the people of Ghana that the Minority will not let you down.”

He said they would scrutinize the agreement and not allow it to be rushed through. “We will seek the guidance and involvement of civil society. We will speak to important personalities, including Former Chief Justice Sophia Akufo, who has been vocal on this lithium agreement.”

“Let me re-emphasize that we demand the Akufo-Addo government tables or lays this agreement before parliament without delay. Let me also caution Barari that any attempt to commence mining without parliamentary approval will be illegal.”

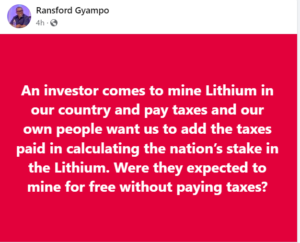

Also, a senior political science lecturer at the University of Ghana, Prof Ransford Edward Van Gyampo, has called on Ghanaians to reject the lithium deal outrightly.

It is the position of the lecturer that the deal constitutes robbery and wants Parliament to reject the agreement, adding that the agreement gives Ghana “about 13 percent of our lithium proceeds and 87 percent to foreigners.”

He is also quoted to have said, on the Key Points on TV3 on Saturday, Dec. 9, 2023, that “We don’t trust Parliament, people are hungry and so they will succeed in buying everybody. The history of this Parliament is one that barks but does not act. I do not trust Parliament.”

Minister’s Response to Critics:

However, in a swift rebuttal to critics of the deal, the Minister of Lands has justified why the deal is the best-ever mining deal signed by the country.

Speaking at a press conference in Accra, he stated that it is the first time in the history of “our country that we have successfully negotiated for ten percent royalties for any mineral, which is one of the highest for exploitation of any mineral across the globe” among others.

Also, he noted that “for the first time in the history of our country, a mining lease contains provisions for the establishment of a refinery.”

“The issue of ratification of the mining lease, which has been raised by several people, has never been lost on us. This is expressly provided for in the Mining Lease granted to Barari DV Ltd,” he clarified.

He observed that “By the very terms of the Lease, therefore, ratification by Parliament is a condition precedent”.

Still, he said that before such agreements can be laid before Parliament, they must go through several processes, including securing the Cabinet’s approval. “The processes are ongoing, and once completed, the Agreement would be laid before Parliament for consideration and ratification.”

The Minister justified that the historical lack of resources for exploration compelled the country to depend on private companies to launch exploration for most of our minerals. This entitles them to grant mining leases without going through any tender process.

On the calls for establishing a Ghana Lithium Company to undertake lithium mining and others, he said the government had considered this prior.

However, he contended that “the volumes of the mineral we have, currently, and our quest to ensure optimal benefit from the exploitation of this mineral made that option not feasible for several reasons.”

Lithium lease likely to be presented to parliament by first quarter of 2024

It is expected that the lithium lease will be presented to the Parliament by the first quarter of 2024, according to the Minister of Lands and Natural Resources.

This is expected to be done after the deal has been taken to Cabinet, upon the signing of the lease agreement.

In direct response to the call by the Institute of Economic Affairs (IEA), to subject the deal to a legislative probe, Mr. Jinapor said that the mining lease itself compels ratification by Parliament.

The lands minister said, “The issue of ratification of the mining lease, which has been raised by several people, has never been lost on us. This is expressly provided for in the Mining Lease granted to Barari DV Ltd. Specifically, Clause 1(e) of the Lease.”

“This Mining Lease is subject to ratification by Parliament in accordance with Article 268(1) of the Constitution and section 5 (4) of Act 703. Upon execution of this Mining Lease, the Minister shall cause the Mining Lease to be laid in Parliament for ratification,” he quoted.

“By the very terms of the Lease, therefore, ratification by Parliament is a condition precedent. As the Supreme Court explained in Republic v High Court, (General Jurisdiction 6), Accra; ex parte Attorney-General (Exton Cubic – Interested Party) (Unreported, Civil Motion No. J5/40/2018, dated 31st July 2019), an unratified mining lease confers no enforceable rights, and Government has always been mindful of this decision,” he stated.

However, he indicated that before such agreements can be laid before Parliament, it must go through some processes, including securing Cabinet approval. “The processes are ongoing, and once completed, the Agreement would be laid before Parliament for consideration and ratification,” he added.

Meanwhile, the Ranking Member for Mines and Energy, John Abdulai Jinapor, has expressed the Minority’s readiness to scrutinize the agreement when it is brought before the House, to ensure that it is in the best interest of Ghanaians.

“I want to make it loud and clear, succinct and explicit that the agreement between the government of Ghana and Barari DV Ghana Limited should be laid before parliament without delay. Let me assure the people of Ghana that the Minority will not let you down.”

He said they will scrutinize the agreement, and not allow it to be rushed through. “We will seek the guidance and involvement of civil society. We will speak to important personalities including Former Chief Justice, Justice Sophia Akufo who has been vocal on this lithium agreement.”

“Let me re-emphasize that we demand the Akufo-Addo government tables or lays this agreement before parliament without delay. Let me also caution Barari that any attempt to commence mining without parliamentary approval will be illegal.”

Also, a senior political science lecturer at the University of Ghana, Prof Ransford Edward Van Gyampo, has called on Ghanaians to reject the lithium deal outrightly.

It is the position of the lecturer that the deal constitutes robbery and wants Parliament to reject the agreement, adding that the agreement gives Ghana “about 13 percent of our lithium proceeds and 87 percent to foreigners.”

He is also quoted to have said, on the Key Points on TV3 on Saturday, Dec. 9, 2023, that “We don’t trust Parliament, people are hungry and so they will succeed in buying everybody. The history of this Parliament is one that barks but does not act. I do not trust Parliament.”

Conclusion:

The lithium deal signed by Ghana has sparked intense debate, with critics raising concerns over its terms and potential impact on the country’s economy. While proponents argue that the deal represents a significant step towards economic development and job creation, others fear that Ghana may not fully benefit from its mineral resources.

As the government moves forward with the implementation of the lithium project, it is crucial for stakeholders to engage in constructive dialogue and ensure transparency and accountability in the process. Ultimately, the success of the lithium deal will depend on the extent to which it aligns with the interests of the Ghanaian people and contributes to the sustainable development of the country.