By Isaac K. FRIMPONG

Retirement age, a pivotal stage marking the withdrawal of statutory workers from active work, holds a unique significance in Ghana, much like in many countries globally. This is where retirees are expected to start enjoying pensions and other retirement benefits. In Ghana, the retirement age is 60 years (both male and female) and is enshrined in law, primarily applicable to a select few in the formal economy—those in the civil service and registered corporate organisations governed by employer-employee contracts. The setting of the retirement age often depends on the country’s life expectancy and workers’ health, the cost of ageing, dependency ratios, and other factors. This article seeks to add its voice to the debate on when to increase Ghana’s retirement age.

The Ghanaian Retirement Landscape

When a worker reaches the age of 60, it is worth noting that the individual does not necessarily need to stop working. But marks the point at which they are eligible for retirement benefits. In Ghana, the pension age, the juncture at which individuals become eligible for pension payments, mirrors the retirement age, where individuals start receiving pension payments. There are provisions for early voluntary retirement options, allowing individuals to receive pension benefits at the age of 55 or earlier. This flexibility accommodates those who may choose to retire early or may need to retire due to health concerns.

Life expectancy, a crucial metric reflecting a population’s health, has witnessed a significant upswing in Ghana over the past century—from 28 years in 1921 to 64 years in 2021. However, this longevity has implications for the pension system, as individuals may only enjoy a brief span of pension income, potentially just four years post-retirement if they reach the age of 60.

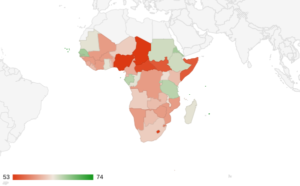

Life Expectancy Across sub-Saharan Africa 2021

Source: World Bank Data 2023

Despite the positive trajectory in life expectancy, Ghana grapples with a high age dependency ratio. As defined by the Ghana Statistical Service, it is the ratio of the population aged 0-14 years and 65 years (likely dependent population) and above to the working population of 15 – 64 years. The ratio depicts the relationship between the dependent population and the working-age population of the country. The age dependency ratio is 66, implying that for every 100 persons in the working age bracket (15-64 years), there are 66 persons in the dependent age bracket (children 0-14 years old and the elderly 65+ years old) who depend on them for sustenance. Although Ghana’s population age structure is transitioning from one dominated by children (0-14 years) to one dominated by young people (15-35 years),. This is expected to have a positive impact on the age dependency ratio by bringing it down. One can attribute it to several factors, but this is not the aim of this article.

Addressing the Minority: The Basic National Social Security Scheme (BNSSS)

It is crucial to note that any contemplation of increasing the retirement age and/or pension age pertains primarily to those working who are formally employed (with employment contracts). Thus, privileged few groups of people are covered by the Basic National Social Security Scheme (BNSSS), also known as tier-1 as well as the work-based pension scheme – tier 2.

As per the 2020 National Pension Regulations Authority (NPRA) report, the BNSSS boasts 1.6 million active contributors, including 227,407 pensioners. The NPRA’s 2021 report further indicates that there are over 1.7 million active contributors, including 225,768 pensioners. The scheme’s ratio of pensioners to contributors for 2020 and 2021 is approximately 14 percent and 13 percent, respectively, indicating that a considerable workforce supports a relatively smaller group of pensioners.

While some countries have raised their state pension age, Ghana’s unique context demands careful consideration. For instance, based on the estimation from model life tables, population’s total life expectancy in 2010 was 61 years, and in 2021 it has increased to 64.

In the same vein, life expectancy at age 60 has risen steadily. Data from the World Health Organisation shows that from the year 2000 to 2009, the increase was minimal: 16 years to 16.2 years. In the decade from 2010 to 2019, the figure is 17.2 years. These figures are national, and what is the life expectancy of contributors and pensioners in the scheme?

To Hike or Not to Hike the Retirement and/or Pension Age?

The pivotal question emerges: should the retirement age be increased, considering the nuanced analysis provided? Exploring the age variation among the over 1.7 million contributors, understanding the total contributions of active members, and evaluating disbursements to beneficiaries and return on assets become imperative. These answers can significantly shape the debate on whether a retirement age hike is warranted to bolster the pension scheme or if a younger workforce is the need of the hour for the formal economy.

Conclusion

In navigating this complex terrain, Ghana faces a crucial juncture, requiring a delicate balance between the welfare of retirees, the economic realities of the workforce, and the overarching goals of the national pension system. The discourse must be informed by a comprehensive understanding of demographic trends, financial implications, and the broader socio-economic landscape

The writer is a Researcher: Pensions, Informal labour market, Social Policy in Africa, and Ageing studies