By Joshua Worlasi AMLANU & Ebenezer Chike Adjei NJOKU [email protected] / [email protected]

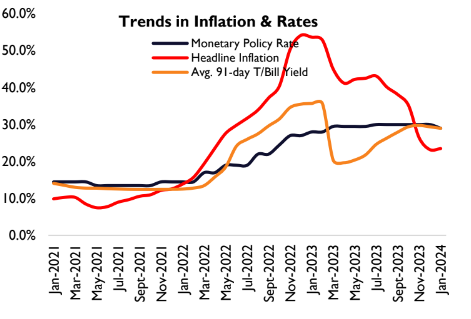

Inflation data for January 2024 has sparked divergent views among analysts, casting doubts over further rate cuts by the Bank of Ghana and its attendant impact on the broader cost of commercial borrowing.

While GCB Capital and Constant Capital predict further inflation hikes, Apakan offers a more optimistic outlook, suggesting a potential near-term decline.

Headline inflation unexpectedly rose to 23.5 percent in January, reversing a five-month downtrend. This was driven primarily by surging non-food inflation, which outweighed a continued decline in food prices.

Offering thoughts on the direction of the metric over the next two months, analysts at GCB Capital predict that inflation could climb higher to 26 percent in March before returning to a disinflationary path, highlighting risks from potential currency depreciation and second-round effects.

“Despite the surprise inflation print in January 2024, we reaffirm our inflation outlook. The suspension of the proposed VAT on household electricity consumption eliminates the immediate risk to inflation. However, inflation could climb higher in March 2024 to within 26 percent largely on account of unfavourable base drift before returning to the path of disinflation from April 2024, all things being equal. Thus, we expect headline inflation to print sub-20 percent from May 2024,” it remarked in a note.

Constant Capital concurs, predicting a similar peak of 26 percent in February due to emerging foreign exchange pressures.

In contrast, Apakan paints a brighter picture. Their analysis emphasises the cedi’s relative stability and subsiding seasonal pressures, leading them to forecast a slight dip in inflation for February.

“The balance of inflationary risks tilts favourably for the coming month,” their report declared.

Rate cuts

All three analysts agree on the central bank’s challenging position. GCB Capital expects the bank to hold off on rate cuts until May, while Constant Capital suggests a potential pause. Apakan, on the other hand, believes cuts remain on the table; but with caution due to January’s inflation surge.

“While the unexpected 100bps cut in the MPR in January 2024 was not entirely surprising, with the direction of inflation pointing lower despite the simmering upside risks, we expect the monetary policy stance to remain cautious and appropriately tight… we expect the Monetary Policy Committee to defer its next rate cut to the May 2024 monetary policy window, by which time inflation would have firmly returned to the path of disinflation,” GCB Capital noted.

Source: Apakan Research, Ghana Statistical Service (GSS), Bank of Ghana (BoG)

It also maintained its in-house forecast of at least three and at most four interest rate cuts in 2024 to between 24 percent and 26 percent by the end of 2024 as the central bank balances the risks to inflation and growth.

“Despite the interruption in the disinflation process at the latest reading, we maintain an outlook of a general downtrend for 2024. This trajectory could provide the central bank with the opportunity to gradually unwind its tight monetary policy wall built up over the past year while supporting economic recovery and re-anchoring inflation expectations. However, the latest inflation reading may prompt the central bank to pause its incipient easing orientation, during the upcoming March 2024 meetings,” Constant Capital said.

Constant Capital further believes that inflation could rise in February 2024 due to pressure on foreign exchange rates. This is despite receiving US$600million from the IMF in January as the value of the US dollar has fallen 2.3 percent so far this year. Although this is more stable than last year, companies and importers buying foreign goods could put more pressure on foreign exchange rates in the future.

Debt market

Investors and businesses are closely monitoring the inflation situation, as it directly impacts investment decisions and economic activity. Stable and predictable inflation is essential for sustained economic growth and development.

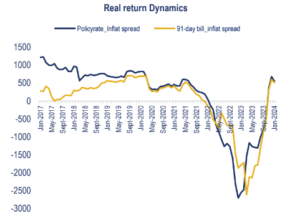

The Treasury has enjoyed a strong start to 2024; on average, investors accepted a 1.4 percent lower return despite strong demand for short-term debt instruments. This is expected to continue due to anticipated inflation reduction and improving economic indicators. However, full recovery for the bond market may be slow.

Though T-bill yields will likely keep falling, the pace will be gradual. This, coupled with inflation staying outside the target band until 2025, could stall secondary market activity throughout the year. The key obstacle is the distorted yield curve, where longer-term bonds lack the usual higher yields compared to shorter-term ones, discouraging investment.

For the bond market to fully recover, T-bill yields need to fall significantly, eventually restoring the natural slope of the yield curve. While this will take time, commercial lending rates, which have consistently stayed below both policy and T-bill rates, are expected to remain stable, offering some stability in the financial landscape.