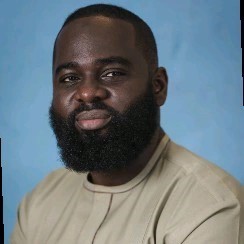

By Umar FAROUK

In the modern era of digital technology, the corporate board plays a crucial role in formulating policies that align with the organization’s objectives and driving forward-thinking ideas to achieve long-term business viability or sustainability. As a supervisory body, the board ensures accountability, transparency, fairness, and responsible management by engaging with stakeholders. However, technology systems and data-driven economy are increasingly shaping boardroom discussions, and strategic decisions are often viewed through technological lenses. Therefore, boardroom leadership must be prepared to navigate the dynamics of the digital age and meet shareholders’ expectations of long-term business performance.

Risk and Finance Committee

In a merger and acquisition transaction, an advanced model may be used to analyze the impact of financial decisions and handle complex financial data. The Monte Carlo Simulation method can be used to forecast investment portfolios or financial derivatives. This ensures the integrity of financial reporting and risk management processes and gives the committee control to oversee current and future risk assessments of the investment variables, informing the firm’s strategic position on the transaction.

Audit and Finance Committee

Providing investors with comprehensive reports on asset valuation, liabilities, and risk management procedures would offer them a transparent overview of organizational performance and enhance their confidence in their potential investment. In the era of digitalization, advanced models such as Machine Learning can be of great assistance in financial accounting processes to improve internal/operational auditing and forensics. To uncover fraud in forensics and fraud investigation exercises, there would be the need to establish electronic evidence. More so, during boardroom discussions on investment valuation or transactions, data visualisation such as Power BI and Tableau tools can enhance the presentation. This effective communication medium will go a long way to improve smooth transition, build trust, and also mitigate uncertainty.

Human Resource Committee

The board of leadership will be considering the compatibility between the separate organizations in an M&A transaction. Experts will evaluate the technological systems and business models of each firm, which will play a central role in the valuation process. The strategic alignment of the firms involved will depend on the nature of the business, the enhanced technology, and the expertise available to leverage opportunities in a competitive business environment. The board’s new directorship or composition could be influenced by technological systems expertise and experience while developing a strategic human capital plan to equip its members with the relevant know-how.

Risk and Compliance Committee

Consequentially, today’s boardroom meeting will feature discussions on the impact and benefits of digital transaction media and ledgers, such as Cryptocurrency and Blockchain, on ensuring the security of financial data. As more businesses move to online transactions, it is crucial to implement strategic measures to tackle challenges and leverage opportunities. This will help mitigate risks and optimize opportunities while the board implements a cyber-security governance framework. Compliance with global financial regulations, such as anti-money laundering laws, will require automated systems to facilitate compliance procedures without compromising data security. When expanding in an evolving market, the company may need to adopt effective marketing strategies that make the right impact on a digital market with diverse cultures and audiences. Web analytics can be used to gather data that helps analyze users’ experience of a website, which is the first point of contact in a digital market. To optimize online products through digital platforms, the board would have to consider these technologies in its budget statement while discussing strategic metrics.

Conclusion

In summary, one of the biggest challenges that an organization may face in the Digital Age is managing the process of change, which is often met with resistance. Before an organization can transition into the digital space, the board must formulate strategic policies from various competing alternatives. This may be met with resistance from stakeholders at all levels of the organizational structure. Therefore, in situations where change is met with opposition or is perceived as detrimental to the company’s progress, using statistical models with historical data can help facilitate discussions and provide evidence for initiating the change. This way, the board can convincingly align its shared vision and lead the organization towards transformation and success.

The writer is a Corporate Governance & Data Analyst