The recent acquisition of One Airport Square (OAS) by The Sentinel Commercial Real Estate Investment Trust (REIT) is set to be a major catalyst for the growth of Ghana’s REIT market, according to industry experts.

REITs pool investor capital to buy income-producing properties like apartments, offices or warehouses. This allows individuals to invest in real estate without directly managing it, offering benefits like diversification, steady income through dividends, easy buying or selling, professional management and inflation protection. However, consider the market, interest rate, liquidity and management risks before investing.

This landmark deal marks the first acquisition by the Sentinel REIT, the country’s first licenced REIT under the current Securities and Exchange Commission (SEC) guidelines.

The nine-storey OAS, boasting a prime location, state-of-the-art facilities and a diverse tenant base, aligns perfectly with Sentinel REIT’s strategy of investing in high-quality, income-producing assets with strong growth potential.

This successful acquisition, backed by a combination of equity and debt financing from prominent local and international institutions, demonstrates the growing confidence in Ghana’s REIT market.

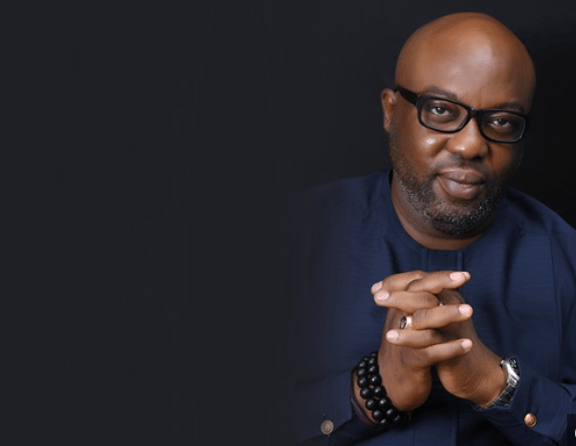

“The Sentinel REIT’s acquisition of OAS is a significant milestone for the Ghanaian real estate industry. This deal showcases the potential of REITs to unlock value in our commercial real estate sector and provide attractive investment opportunities for a wider range of investors,” said Kisseih Antonio, CEO-Sentinel Asset Management Limited, promoters and managers of the Sentinel REIT.

Industry analysts believe that this transaction will pave the way for further REIT listings in Ghana, attracting both domestic and international capital. The stable and consistent income generation offered by REITs, coupled with their hedge against currency depreciation, makes them ideal investment vehicles for risk-averse investors seeking portfolio diversification.

The Sentinel REIT’s success is expected to inspire other developers and asset managers to consider the REIT structure for their commercial real estate holdings. This, in turn, will lead to a wider variety of REIT offerings catering to different investor preferences and risk profiles.

Growth of the REIT market is expected to have a positive impact on the overall economy. Increased investment in commercial real estate will not only create jobs and boost economic activity, but also contribute to the development of modern infrastructure and amenities.

This comes as Ghana witnessed a 33 percent reduction in its housing deficit – from 2.8 million units in 2010 to 1.8 million in 2021, according to the latest census data. Despite this progress, providing affordable housing options for urban dwellers remains a major challenge for government.

The reduction is attributed to a combination of factors, including a real estate boom that saw a 72.8 percent increase in residential structures within the period and concerted efforts by various organisations to increase the national housing stock. Government has also committed to completing existing housing projects and undertaking new ones across the country.

However, affordability remains a stumbling block. Weakened consumer sentiment due to rising fuel prices, transportation fares and inflation are pushing up housing costs, making it difficult for many Ghanaians to access financing. Additionally, a majority of housing stock comes from the informal economy, lacking formal property rights and hindering investment opportunities.

The rental market, particularly in urban areas like Greater Accra – where nearly half of households rent their units – faces challenges due to land tenure insecurity, high transaction costs, and convoluted property rights.

Despite these hurdles, efforts are underway to address the issue. Government secured a US$75million loan from the African Development Bank to improve the financing and development climate for affordable housing. Additionally, green building requirements are being implemented – and organisations like IFC and Ghana Venture Capital Trust are providing green housing finance and microfinance.